Millennials, with their adventurous, sweet-toothed tastes, are no doubt a large audience for rosé wine. But wine producers could find a good, dry rosé is well-suited to an older generation.

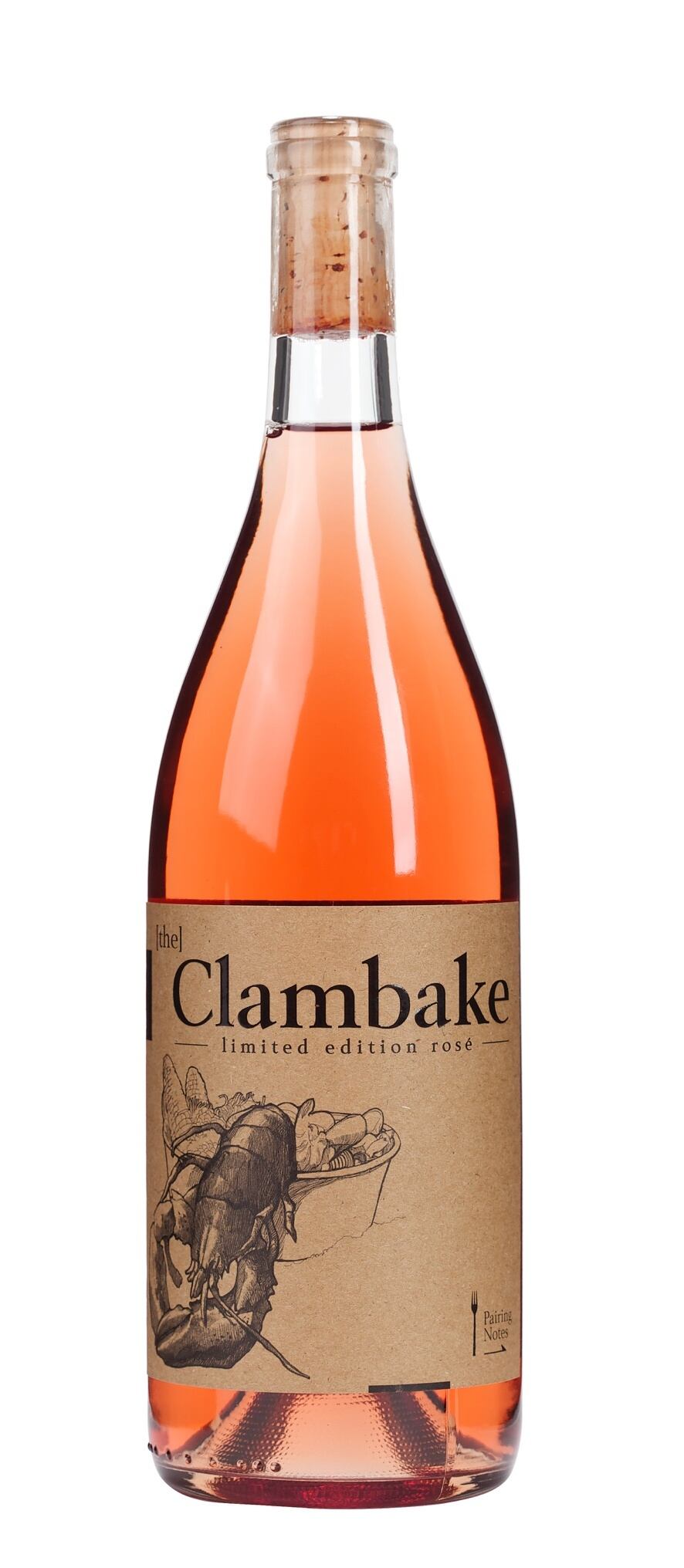

Carefully presenting rosé as a more premium, artisanal product is one way to attract these consumers: although the rosé category must beware the threat posed by cheap brands with ‘gimmicky’ labels.

‘A dry rosé is exactly what women over 65 are looking for’ (they just don’t know it yet)

The US is the second largest market for rosé wine, and the top world market for still wine with some 93m drinkers in the country, according to figures from Wine Intelligence.

Its 2016 report on rosé drinkers in the US shows that ‘heavy’ rosé drinkers – ie, those with a ‘heavy’ share of rosé in their total still wine consumption – was over-represented among Millennials.

Mary McAuley is the founder of US craft winery Ripe Life Wines, which has a particular focus on cuisine and food pairing. She does in-store tastings of her wines – including a rosé and a chardonnay – and sees all types of drinkers appreciate rosé.

“Rosé is quite literally reaching everyone: it’s unprecedented,” she told BeverageDaily.

“From wine experts to the least savvy of consumers, the rosé craze is in full effect. All different types of people in all different kinds of shops, from very high-end, thoughtfully-curated boutique stores, to the no-frills, casual stands: everyone is pleasantly trying and buying rosé.”

But she believes that if producers and wine experts focus their attention on older consumers, they will be pleasantly surprised by the response.

Millennials: why all the fuss?

In 2015, Millennials (aged 21-38) drank 159.6m cases of wine in the US, according to the Wine Market Council. Accounting for 42% of all the wine in the US, Millennials consume more than any other generation.

“The last demographic to foster a zeal for rosé is older women, ages 65+,” she said.

“A dry rosé is often exactly what they’re looking for in terms of price, quality, food-pairing ability, and flavor/chemical composition, but I’ve noticed, even more than similarly aged men, they’re mostly set in their ways.

“These females were also the target audience for ‘White Zin’ [White Zinfandel] when they were in their 40s, so they’re scared even by the sight of rosé again.

“But today, 15 to 20 years later, the younger demographic - daughters and granddaughters of these women - are passing glasses of the good stuff to them and broadening their horizons.

“It’s really cute to hear them say “Hmmph. Not bad? Okay… I’ll have that.”

"These women will often taste mine - after much resistance - and say: “I didn’t know it was like this!”

But education and encouragement is crucial if this group is to be reached, adds McAuley.

“I believe, if sommeliers and buyers did a better job tasting this demographic on rosé, we’d definitely see an up-tick in consumption.

"Getting 65+ women to try it is key, they’re not so adventurous with their wine or their dollars."

Reach older consumers with premium messages

Across the pond, Mintel senior drinks analyst Chris Wisson also sees the older demographic as an opportunity for rosé wine in the UK.

Rosé wine has been a huge success story for the UK, attracting new wine consumers and a younger generation of consumers.

But IRI figures show volume and value sales decline in 2015 and 2016.

Speaking to BeverageDaily last month, he explained that rosé wine now faces competition from flavored cider and fruit wines when it comes to the Millennial audience.

And, while rosé’s sweetness may have attracted younger consumers, products with a less sweet taste may see success with older drinkers.

“Rosé brands should look at appealing to older consumers more effectively by communicating premium messages, as only 15% of drinkers currently think that rosé is the most premium type of still wine,” he said.

"Emphasizing production processes (for example, terroir), vintages and aiming for a less sweet taste could help to resonate more effectively with older drinkers,” he added.

The conundrum: how to be approachable, and yet not tacky?

How can rosé brands be approachable to new consumers, and yet avoid the appearance of being a ‘tacky’ or a ‘mass’ beverage?

Like Wisson, McAuley agrees it’s important to explain the provenance of the wine.

“I think it is all about a brand’s packaging and messaging,” she said.

“Ripe Life Wines’ packaging is friendly and approachable, but also classy. We ensure in our messaging that people do not confuse our brand with mass-produced wine. Our back label tells you exactly where we source our fruit and gives you the tasting notes from a sommelier and winemaker, the very people who crafted the product.

“It becomes obvious that we are still a premium label, just with a more down-to-earth label, less esoteric.”

Packaging from premium brands has to counter that of mass produced wines and ‘gimmicky’ labels, she added. The fear is that – if new consumers are not introduced to the right wine for them – they won’t return again.

“There are a lot of loaded opportunists cashing in on the rosé craze and they know or care nothing about quality wine. Unlike any other wine category, rosé can be made ‘on the fly’ at any time by making it from a blend of excess white and red on the bulk market (and they were considered “excess” for a reason…).

“So, these opportunists can easily strike while the iron is hot. These brands are bottling up anything pink that they can get their hands on and throwing it in a package that stands out on the shelf, and I fear we might ruin rosé again—especially if those brands are what people try as their introduction to this new category.”