UK-based IWSR Drinks Market Analysis thinks alcoholic, flavored seltzers are ‘far from a fad’ based on consumer behavior. The adoption of this new category in the US was quick and relatively seamless, as popular brands like White Claw and Truly have already penetrated the mainstream market.

Total annual sales of hard seltzer in the US are about 82.5m nine-liter cases, and IWSR expects that to triple and reach more 281m cases by 2023. This outpaces the growth and share of vodka in the US.

RTD fans are switching to seltzer

Hard seltzer and its adjacent products have a 2.6% market share of all beverage alcohol in the US, which has increased from 0.85% a year ago. In a six-year period, the product has grown to account for nearly half (43%) of all US mixed drinks.

IWSR includes seltzer-like products in its analysis, which are made from wine and spirits but are similar to the leading malt-based brands, projecting that they will add another 7m cases to the seltzer landscape in the next three years.

Brandy Rand, COO of the Americas at IWSR, said “Hard seltzers are far from a fad, they’re growing at a spectacular rate, and increasingly, hard seltzer producers are pulling consumers from other beverage alcohol categories, not just beer.”

“Combined, hard seltzers and other canned seltzer-like products (vodka soda, as an example) will drive the total ready-to-drink category, making it the fastest-growing beverage alcohol category in the US over the next five years.”

IWSR surveys found that more than half (55%) of US alcohol consumers drink hard seltzers at least once a week. And though the products appeal to the younger generations, the category actually spans all ages and demographics. ‘Refreshment’ is cited as the top hard seltzer attribute that appeals to mass consumers.

Ecommerce sales of hard seltzer are on the rise, expected to jump from a current market share of 0.8% to nearly 2% by 2023. Total alcohol ecommerce is growing at about 15% per year, led by China and followed by France and the US.

Year-round seltzer love

The top brands have built name recognition over several years and command most of the market share, but that hasn’t stopped smaller brands from launching, or seltzer options developed at other alcohol companies.

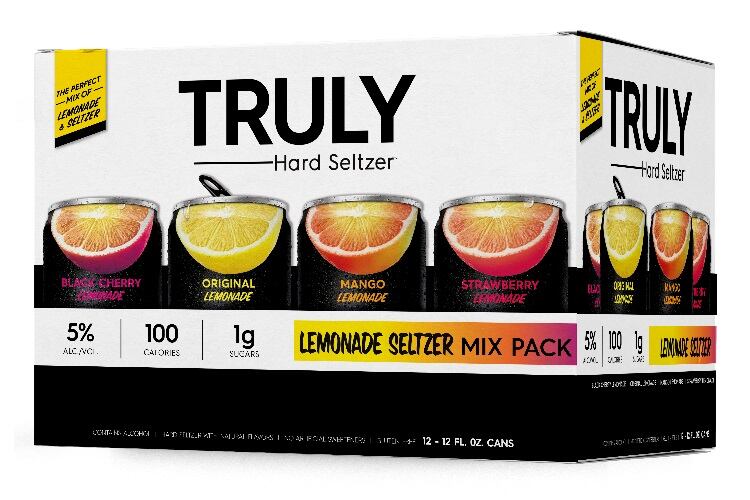

White Claw, Truly, Bon & Viv and Henry’s lead the category as brands original to hard seltzer, followed by PRESS, High Noon, Wild Basin, Sercy Spiked & Sparkling, Nauti, Sauza Agua Fuerte, Arctic Summer and more.

But Bud Light, Natural Light, Corona, Mike’s Hard, Pabst Blue Ribbon and Smirnoff all introduced their own takes on alcoholic fizzy water this year.

Rand told BeverageDaily that those still looking to get into the category are focusing their products on specific attributes, like ABV, calories, sugar or carbohydrate content, or organic, natural, flavors and other ‘better-for-you’ cues.

Despite the constantly growing category, US consumers continue to support new seltzer launches. And they are undeterred by the changing seasons.

“Seltzers are similar to vodka and soda (which is not seasonal), so consumer appetite for seltzers is more based on occasion and need for flavored refreshment, which translates to year-round," said Rand.

Consumers will have even more to choose from soon, added Rand: pointing to several major producers that have new hard seltzer launches on the docket for 2020. MolsonCoors just announced its Vizzy Hard Seltzer that will be superfruit-infused with Vitamin C.

All four flavors of Vizzy will be made with the antioxidant-laden acerola cherry, set to launch at the end of March. It’s being positioned to have a more health and wellness focus than other leading seltzers, and is a major investment by Molson Coors amid significant company restructuring.

Unique global launch positionings

Similar big-brand launches have potential in other countries, but Rand notes that they have to work around market dynamics and product education first. Naming conventions are important in key markets like the UK, Brazil, Japan and South Africa.

“In many markets it’s too soon to tell, given awareness of ‘seltzer’ is very much a US category and does not resonate with other countries, except perhaps for Canada,” Rand said.

“Each country has its nuances in terms of beverage consumption so translating the trend in a way that makes sense for the local market is critical.”

The UK market is under close watch for potential hard seltzer success, but ‘hard’ drinks and seltzer’ aren’t part of the British lexicon. The recent launch of Mike’s Hard in the country has it positioned as Mike’s Alcoholic Sparkling Water for that reason.

“The rise of hard seltzers shows there was a segment of consumers underserved by the current beverage alcohol market who were looking for alternatives that were refreshing and flavorful, but also low-calorie and low-sugar,” Rand said.

“These products also meet the growing consumer demand for convenience, and appeal to people that enjoy popular cocktails like the vodka soda, and wine spritzers. We definitely expect to see more brands taking advantage of this fast-growing trend.”