Hard seltzer – quite simply sparkling water spiked with alcohol – has taken the US by storm. The category is currently worth some $550m, with predictions it will grow to $2.5bn by 2021 – implying an impressive annual growth rate of 66%*. It’s been dubbed by the New York Times as the ‘drink of summer 2019’, illustrating the heights of the craze among US consumers.

And now the seltzer storm is coming to the UK: notably with AB InBev’s Mike’s Hard Sparkling Water launch this month; alongside brands such as UK start-ups DRTY Hard Seltzer and Bodega Bay and US seltzers H2Roads Craft Hard Seltzer and Wild Basin. And top-selling US superstar White Claw appears to also be eyeing up the UK market: registering its trademark in the UK last month.

But will seltzers see the same starry success – or have they overstated the size of the prize in the UK? Will seltzers succeed or struggle in this new scene?

Both convergence and divergence: UK and US trends

With UK consumers seeking healthier products, valuing clean-label and yet also still looking for a little luxury, hard seltzer brands believe the UK market is primed for seltzer success.

Matija Pisk was inspired to create his hard seltzer brand DRTY on a trip to the US a little over a year ago. He was introduced to hard seltzer as a low-calorie alternative to beer, and immediately felt this would resonate with UK consumers (the name of the brand is drawn from the idea of a 'clean' drink that is still 'pretty DRTY' in terms of alcohol content).

“The hard seltzer movement has been driven by over-arching consumer trends - consumers are more health conscious than ever before, they count calories, and they look to avoid sugar - that are equally as relevant in the UK as in the US,” he told BeverageDaily.

In a way, hard seltzer is the natural progression of sparkling water, which has seen booming sales on both sides of the Atlantic. “We’ve already witnessed the same in soft drinks with the success of La Croix in the US being replicated with brands such as DASH, Ugly, San Pellegrino (and many more),” said Pisk. “People are becoming more aware of the high sugar content of mixers and fruit ciders, and hard seltzer offers a great alternative.”

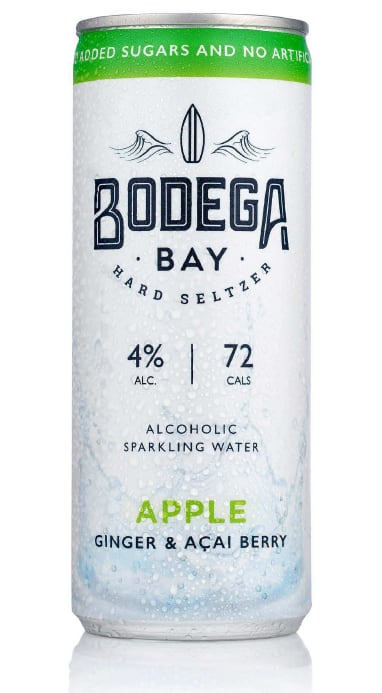

Charlie Markland, founder of Bodega Bay Hard Seltzer, agrees that consumers are looking for drinks with a cleaner, healthier image: competing with existing alcoholic drinks on the UK market (the calorie count of a can of Bodega Bay, for example, comes in considerably below that of a glass of wine, bottle of beer, or G&T).

“The reason to believe Bodega Bay and other Hard Seltzers will topple the sugary fruit cider’s crown and steal from high carb beers is the same here as it is in the States,” he tells us.

“Wellness is the new luxury: the consumer mega trend for leading a more balanced lifestyle has invaded every other industry – be it wearables, activewear fashion, activity-based holidays – and alcohol is the last space to react.”

Bodega Bay, which launched in August and takes its name from the Californian Bay of the same name, therefore sees ‘healthy hedonists’ as its target audience: with drinkers typically aged 21-34 who want to extend the good work done in the gym into their food choices and socialising occasions.

It’s already sponsored fitness event Tough Mudder and had requests from trendy Gen Z venues such as Pergola on the Roof and Boxpark.

All in all, hard seltzer appears to tick all the boxes: “Healthy hedonists are crying out for this delicious and moderate option” says Markland.

Sounds too good to be true? It might well be

But Martin Pasco, Mintel Food & Drink Global Analyst, is a little more cautious: pointing out that seltzers fall into an uneasy gap between key UK trends.

Top of the agenda is the growth of no and low alcohol alternatives – at around 5% ABV seltzers hardly fit the bill here. Nor do they boast the craft or premium credentials so highly valued by millennial consumers.

“It would not be an easy win to translate the success of US hard seltzers to the UK,” Pasco said.

“The trend for moderating alcohol consumption is more advanced in the UK than in the US, where it is only emerging. Mintel data shows 43% of UK 18-34s claim to have moderated their alcohol consumption in the last 12 months.

"This means UK drinkers, who seek to drink less but better-quality alcohol, will actively be looking for either low ABV or very premium full ABV options. Seltzers are typically 5% ABV and do not tick the box on lower alcoholic content.

“Also, they struggle to qualify as genuinely premium in a way that craft beer or premium RTD cocktails from craft spirits brands have potential to.”

Er… what’s a hard seltzer?

Neither the terms ‘hard’ (as an alcoholic descriptor) nor ‘seltzer’ are well-known in the UK. Will hard seltzers fall at this first hurdle?

Mintel’s Pasco agrees this might be the fundamental challenge for the category in the UK: “the segment name acts as a barrier for Brits who are not likely to understand US colloquial terms like ‘hard’ or ‘seltzer’.”

Tackling this challenge head on, Mike’s Hard Sparkling Water has chosen to use the phrase ‘sparkling water’ rather than ‘seltzer’ to help explain the product.

But other seltzer entrepreneurs say consumers are more clued into US trends than we might give them credit for.

“Hard seltzers are like kombucha: our tribe are finding us, and the mainstream will follow on.”

Bodega Bay

Sticking with the hard seltzer terminology from the US, Pisk of DRTY Hard Seltzer says: “Thanks to social media, people are more aware of hard seltzer and White Claw than you might think. The proposition is also compelling - a great tasting 4% ABV product with 0 sugar, 0 carbs and 90 calories per can.”

Charlie Markland of Bodega Bay Hard Seltzer adds that consumers are always on the look-out for new products and so a new, unfamiliar name may not actually be a disadvantage.

“It is a bit like about kombucha - even a year ago, few people would have known what it was,” he said. “But due to the mystic of the name, inquisitive, early adopter type consumers want to know more and take an even greater interest in understanding what it is.

“Hard seltzers are the same: our tribe are finding us, and the mainstream will follow on when they are comfortable.”

A summery drink for winter?

Bodega Bay launched in August; while DRTY and Mike’s Hard Sparkling Water are hitting shelves this month; as are American hard seltzers H2Roads Craft Hard Seltzer and Wild Basin.

Give that seltzer fits in with summer drinking occasions, why is it that seltzers are springing up during these colder months?

There’s definitely a motivation to be one of the first to market: given the size of the prize if the US market is anything to go by.

But the classic G&T was once a refreshing summer tipple, and yet is now a year-round favourite.

“We don’t believe that hard seltzers are confined to one particular consumption moment or season, and we see our product as being relevant for those wanting to enjoy a light alcoholic drink all year round,” Ana De La Guardia, General Manager at Mike’s Hard Sparkling Water, told BeverageDaily.

An alcopop hangover

Easy-to-drink, fruity-flavoured, ready-to-drink formats, and bright coloured bold branding – have we not been here before? Are seltzers not doomed to follow the ill-fated alcopop craze?

“There are some conceptual parallels between the alcopops from a hedonistic 90s UK and modern day US spiked seltzer. Both segments have an accessible taste and both blur the boundaries between alcohol and soft drinks,” agrees Martin Pasco of Mintel.

“However, there are significant differences between the two segments in terms of how they are executed.

“When it comes to product taste, alcopops were way sweeter than the hint of fruit, which sweetens modern day seltzers. Also spiked seltzer dials up ‘better for you’ much more explicitly than alcopops ever aspired to, via ingredients – for example, water content for hydration, natural fruit flavours and juice content.

“Seltzer’s ‘better for you’ positioning is further strengthened via the flagging of descriptors for healthier benefits – such as no artificials, no added sugar and low in ‘carbs’ and calories.”

And seltzers have shifted away from the ‘garish’ branding of alcopops, seeking instead to reflect the cues for hydration, natural fruit flavours and clean label.

“In terms of colour palate, Seltzer packs from the likes of market leader White Claw, tend to use much more muted colours than alcopops did,” observes Pasco.

“Seltzer packs mostly use white backgrounds, with small added touches of colour to signal variant flavour.

“This subtle approach to colour contrasts with the dominance of the garish colours favoured by alcopops. These colours failed to key into naturalness, and together with devices such as cartoon-like graphics and very sweet taste, even implied a younger alcohol novice target audience.

"By contrast, seltzer manages to convey a more adult target.”

“You won’t find a 500ml Hooch can in Harrods!”

In fact, Charlie Markland of Bodega Bay views hard seltzers as the ‘positive evolution’ of the alcopop craze.

“If you stop a consumer in the street and ask them to explain what alcopops are, they will say: ‘they are high in sugar, artificial sweeteners, colours and preservatives; garish and priced towards children’.

Turning those negatives on their head, Bodega Bay contains no added sugar, artificial sweeteners, colours or preservatives; and has even gone to extra lengths to ensure the product is vegan-friendly. Neither is Bodega Bay the product for gritty corner shops: it’s sold in Harrods at £2.95 for a 250ml can (“you won’t find a 500ml Hooch can in Harrods!”).

The proliferation of new brands leaves no doubt there’s a place for hard seltzer in the UK market. But the size of that place is yet to be determined. Will consumers reach out for seltzer - or defend their much-loved G&Ts? Can seltzer stand up against canned cocktails, or steal share from craft beer? Summer 2019 might have been the 'summer of seltzer' in the US: in the UK, the real seltzer test will be summer 2020.

Shaping up the market

Mike’s Hard Sparkling Water

AB InBev’s entry into the category: with each can containing 0g sugar and 99 calories. The 5% ABV seltzer comes in three flavours: lemon, lime and black cherry. “We’ve seen how quickly the alcoholic sparkling water market has grown in the US and we believe now is the time to bring the trend to the UK,” says Ana De La Guardia, General Manager at Mike’s.

DRTY Hard Seltzer

Founded by 26-year-old Matija Pisk, a former Diageo employee, this start-up has launched hard seltzer in two flavours: white citrus and raspberry rosé. The 4% ABV drinks are 0 sugar, contain 0 carbs and are 90 calories per 33cl can. The gluten-free drinks are available in Ocado, Amazon and 31Dover.com.

Bodega Bay Hard Seltzer

Targeting ‘healthy hedonists’, Bodega Bay comes in two flavours: Apple, ginger and acai berry; and elderflower, lemon and mint. The 4% ABV drink is vegan, gluten-free and contains 72 calories per can, with no added sugar.

H2Roads Craft Hard Seltzer

Developed by Connecticut’s Two Roads Brewing Co, the 4.5% drink comes in raspberry, cranberry lime, and grapefruit flavours.

Wild Basin

Created by Colorado headquartered craft brewers, Oskar Blues, Wild Basin is marketed towards lovers of the great outdoors. Flavours include Classic Lime, Black Raspberry, Cucumber Peach, Melon Basil and Lemon Agave Hibiscus (all at 5% ABV).

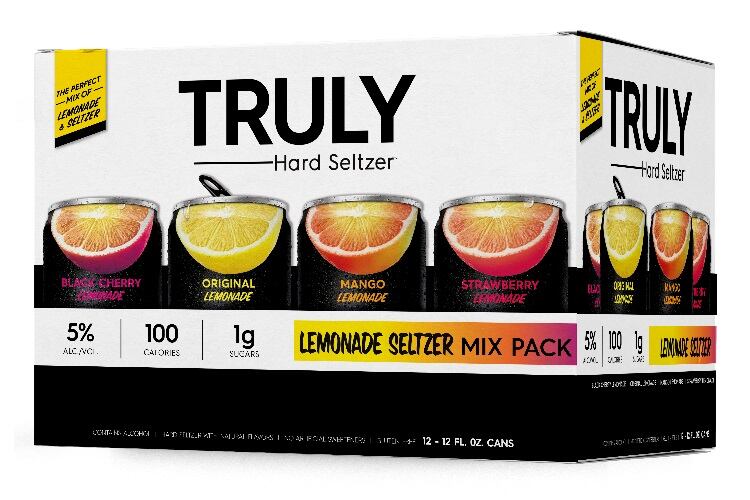

White Claw and Truly

US seltzer superstar White Claw appears to be looking at a UK entry, with owner Mark Anthony Brands applying to register the brand name and logo with the Intellectual Property Office. This raises the question as to whether its fellow big-hitter Truly Hard Seltzer (Boston Beer Company) might also eye up the UK market. BeverageDaily contacted both companies but had not received a reply at the time of publication.

* Source: UBS/businessinsider.com