While most beverage trends start in the US before heading across the Atlantic, it's the UK that's been spearheading innovation in the low and no ABV category.

But consumers worldwide are paying more attention to the amount of alcohol in what they drink, and the no/low ABV category is growing both sides of the Atlantic. And in fact it's the US that’s predicted to generate the most future volume, according to figures from the IWSR.

While the UK has done a good job of raising awareness of the category with new products and innovations, the US will need to build up the sector and educate consumers if it’s to see the same level of success.

Dry January, Sober October...

In the UK, both big multinationals and small craft brands are offering an increasing variety of low and no ABV drinks. Such products now account for 1.3% of the total beverage alcohol market.

“Part of this is due to the success of movements like “Dry January” and brands like Seedlip, both of which started in the UK," explained Brandy Rand, COO of the Americas, at IWSR Drinks Market Analysis.

"IWSR forecasts, however, that the US is expected to generate the most future volume.”

The key drivers of the no/low ABV market in the UK are mirrored in the US – particularly in terms of an increased consciousness in health and wellness – illustrating the opportunities for category growth.

'It’s natural for consumers to compare taste - and value - with alcoholic versions of the same products'

“Consumer demands are similar in the US and the UK,” said Rand. “In the past year, we’ve seen a tremendous amount of innovation in non-alcoholic. Our research shows that this is what consumers want - they feel underserved by limited options available to them.

"Consumers are starting to pay attention to ABV in general, so this is becoming prevalent as part of product packaging and marketing.

“While it’s millennials that are supporting this trend, other demographic segments are also taking part in both short and long-term abstinence from drinking, largely the Dry January and other health and wellness social experiments.

"Looking toward the future, Generation Z dictates the pace in their desire for no-alcohol options.”

While consumers may be driven towards the category by their health and wellness goals, Rand highlights they still have high expectations of products in the category.

“The challenge for most brands in this space is how to develop a non-alcoholic product with flavor that still meets consumer criteria for health and wellness – such as low-calorie or zero sugar. It’s natural for consumers to compare taste - and value - with alcoholic versions of the same products."

The UK: spirits to grow at 82% CAGR

In the UK, 65% of 25-34 year olds are trying to cut back on their alcohol intake, according to an IWSR survey published earlier this year. Its research also shows that 61% of consumers indicate they have not considered drinking low/no alcohol products – showing there’s still much potential remains to convert those drinkers.

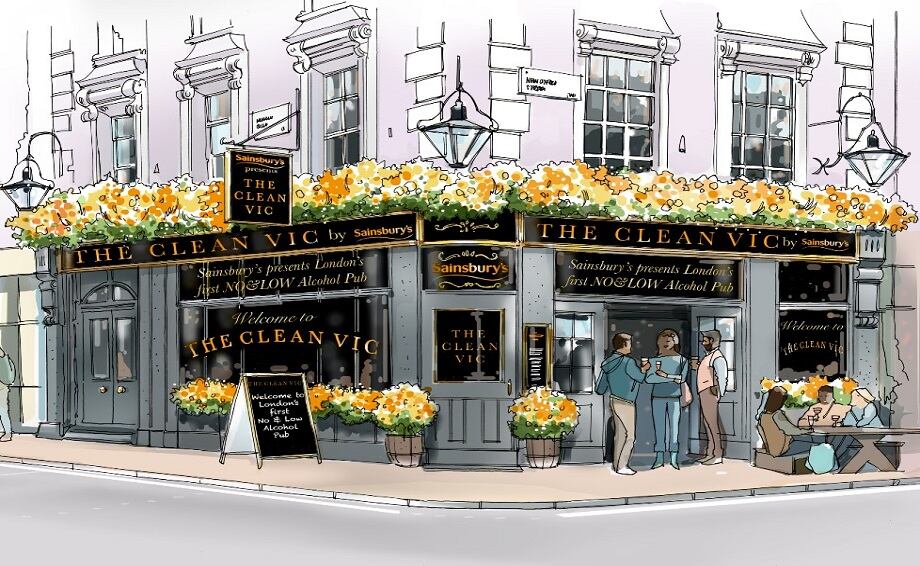

“Demand for alcohol is falling in the UK but continues to be part of the social tapestry in the country," said Rand. "Therefore, no/low alcohol products are a substitute, allowing consumers to not look out of place in social environments.”

The largest sub-category by far is beer: which accounts for almost 85% of the no/low ABV market. Within that, no-alcohol beer has been growing faster than low alcohol beer (31.3% growth for no-alcohol beer vs 14.9% growth for low alcohol).

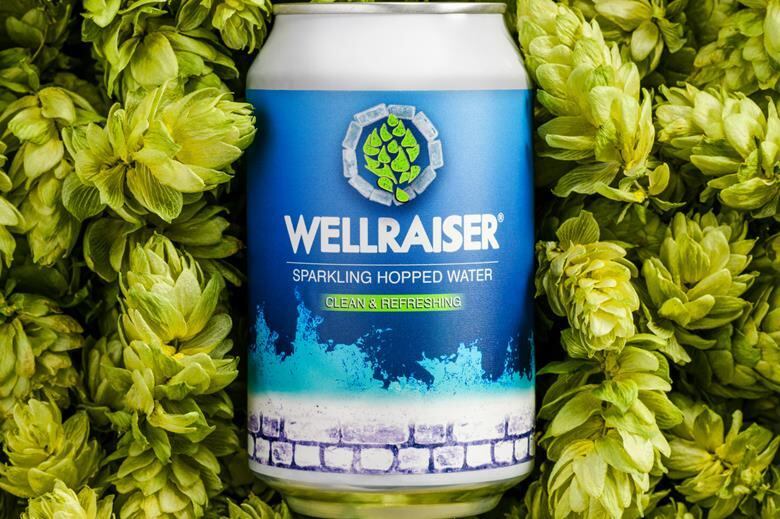

Innovations in the UK beer market include everything from zero alcohol alternatives to big brands (take for example Heineken 0.0 or Carlsberg 0.0) to BrewDog's Nanny State craft beer, while brands like Big Drop Brewing and Nirvana Brewing have dedicated their entire company to no or low ABV products. Then there's also the rise of low alcohol wines or the use of herbs, spices and botanicals in no or low alcohol spirits.

And the category is boosted by increased shelf space in supermarkets and even a pop up pub dedicated solely to no and low alcohol products, ensuring the buzz around products continues to grow.

Looking forward, forecast growth for low/no ABV in the UK by category includes ready-to-drink products at +44.3%; wine at +6.6%; and beer at +4.9% (CAGR 2018-2022), according to the IWSR.

But its the spirits category that's the one to watch: with no/low ABV spirits predicted to grow at 81.5% CAGR. “In terms of growth forecasts in the UK, IWSR predicts that no/low alcohol spirits will outpace the other categories in the coming years,” said Rand.

The US: growth in RTD

Across the Atlantic, American consumers don’t yet have the same exposure to no/low ABV products as those in the UK. And this is what needs to change if the category is to evolve.

According to IWSR's survey, over 70% of consumers say they have not yet considered drinking low or no alcohol beverages.

“Availability at retail and at bars and restaurants is lagging in the US so there is room to grow the low/no alcohol category in general as consumer demand increases and more products become available,” said Rand.

“While we’ve seen increases in ‘Zero-Proof’ and ‘Mocktail’ sections on menus in the on-premise, this is not widespread. Bartender advocacy for the development of great-tasting, visually appealing non-alcoholic cocktails is critical.”

Low/no ABV: IWSR

Beer:

- No-alcohol: 0.0 – 0.5% ABV

- Low-alcohol: >0.5–3.5% ABV

Still and Sparkling Wine:

- No-alcohol: 0.0 – 0.5% ABV

- Low-alcohol: >0.5–7.5% ABV

Mixed Drinks:

- No-alcohol: 0.0 – 0.5% ABV

- Low-alcohol: >0.5 – 3% ABV

Spirits (liqueurs):

- No-alcohol: 0.0 – 0.5% ABV

- Low-alcohol: >0.5 – 10% ABV

Spirits (non-liqueurs):

- No-alcohol: 0.0 – 0.5% ABV

- Low: >0.5–37.5% ABV

An increasing number of brands have, however, been entering the market. After a successful trial in Canada, AB InBev's non-alcoholic Budweiser Prohibition arrived in both the US and UK in 2017.

Heineken followed its 2017 European launch of Heineken 0.0 with a US roll-out in January this year. Coca-Cola, too, has been edging in from its soft drink stronghold with the launch of Bar None, its ready-to-drink mocktail line, in March.

And it's worth noting that no/low alcohol beverages are by no means a new concept - Anheuser-Busch's non-alcoholic beer O'Doul's has been present in the market for almost 30 years.

Like the UK, beer is the dominant force in the no/low ABV market, taking a 60.4% share of the market.

However, it’s the RTD category which is predicted to show the biggest growth: at 38.8% CAGR 2018-2022).

That’s followed by wine at +17.7%, spirits at +7.1% and beer at +5.6%.

“Beer commands the largest share of the no/low alcohol market and is the most advanced segment in terms of product offering and consumer uptake," said Rand.

"Low-alcohol beer grew by 18.4% in 2018, vs 0.2% growth for non-alcoholic beer.

“Overall, the US features strongly as a market for low-alcohol opportunities, whereas other key markets are firmly in the no-alcohol territory.”

With most traditional alcohol beverage categories only showing moderate growth (or declines in the case of beer), larger beverage companies have been looking to the no/low ABV category as an alternative and investing in new products. With their drive, it's anticipated the no/low ABV category can bring in a new generation of consumers in the coming months and years.

The low and no alcohol revolution

With falling alcohol consumption, more mindful drinking and a trend towards premiumisation, the stage is set for a bright future for the low and no drinks sector.

The Low 2 No Bev Show is a brand new - and unique - dedicated trade event which will be held at The Old Truman Brewery in London in June, 2020. Find out more at low2nobev.com