The food and beverage marketplace is still crowded with processed, sugary products, but in general has more healthy options than it did 30 years ago. Consumers now look for products that proactively boost their wellbeing.

But it's functional products that really have the edge - the key question for manufacturers today is what extra function or benefits their products can offer consumers.

More function, less sugar

Soda was the dominant beverage in the US in the late 1980s and 90s, with a strong rivalry between Coca-Cola and Pepsi. In the mid-90s, Starbucks introduced its popular Frappuccino beverage and Red Bull hit the market, solidifying Americans’ love of caffeine.

By the turn of the 21st century, soda brands began to cave to changing consumer needs. Coca-Cola, for example, made a major move into water with the launch of Dasani.

Between 2000-2010, Kantar said that beverage brands learned not to innovate just for the sake of it. Rather, identifying and targeting changing consumer behavior gives brands the best chance of success.

Countless healthy beverages launched in this decade, with some spurring new categories. Vita Coco introduced coconut water and Bai Infusions blurred the lines between water and fruit juice.

Since 2008, Kantar found that ‘relaxation’ beverage occasions have risen by 48%. In 2018, 46% of occasions were solo, up from 36% in 2013. Kantar said that in 1987, 65% of all beverage occasions were with a meal, but in 2018, that had fallen to 53%.

“Fueled by so much information, consumers are seeking out the next way to maximize function but with a story. Brands need to tell us where the product is made and what it does better as a result,” Kantar said.

Functional beverages

Functional drinks with specific health benefits have now well and truly reached the mass market, says Kantar. Fermented beverages, such as kombucha, and CBDs and adaptogen-enhanced drinks are growing in popularity.

Furthermore, the needs consumers want met have become more varied.

'The key question for manufacturers is: "What more can we do?"'

As the functional beverage category develops, so too does the variety if products on offer.

Jonathon Cantor, US beverage expert at Kantar, said: “Functionality is evolving to play in a higher, more sophisticated level of need — even entering the realm of feelings and emotions. Cannabidol (CBD) beverages, for example, have risen in popularity over the last couple of years, with claimed benefits of increased relaxation and mental stimulation meeting the functionality needed.

“This will continue to develop, and we’re now seeing the permeation of adaptogen ingredients (that support the adrenal system) across many categories that push the same agenda.

"As consumers continue to ask, ‘what more do I need?’, the key question for manufacturers is ‘what more can we do?’”

In-between occasions

Ross Smith, consumer insight director at Kantar, told BeverageDaily that in order for beverage brands and categories to succeed today, they have to understand the competition, target a specific consumer mindset and keep their product messaging relevant.

“If you take a soda, back in the 80s that was really the only category that served the need around the taste, the fun, the enjoyment, the food accompaniment,” Smith said.

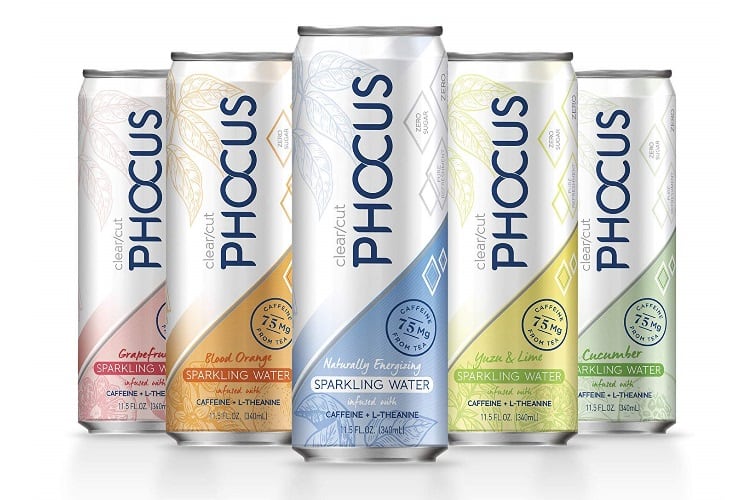

“And now things like sparkling fruit juice and sparkling flavored waters are all entering into that category in a different way and adding additional functionality. So everyone needs to think about their competitive set widening as the market develops and those lines between categories blur.”

Long term, Smith said the amount of beverages being consuming hasn’t changed that much. There are still around 35 drinking occasions over the course of a week. But what is changing is the beverage categories, what is being consumed and why.

The Kantar report emphasizes that people don’t follow the traditional breakfast-lunch-dinner routine, but eat and drink throughout the day. In-between meal occasions are opening drink categories to snacking, all-day nutrition and hydration.

The ‘occasion’ itself is becoming slightly more complex, according to Smith. With more new products and information available, people are being less forgiving--they want to know what a drink is going to do for them beyond the basics.

The winners and losers

One of the most evolved categories has proved to be water. According to the Kantar report, just one in six people consumed bottled water regularly in the 80s. That’s now risen to more than half, and tap water accounts for a third of all US beverage occasions.

Variants of water have bolstered the category, including flavored, sparkling options like La Croix. Kantar considers it a legacy brand that has remained successful through innovation, crediting its more than 20 flavors and its gain of 3 million drinkers between 2014-2018.

Hot coffee has fallen into a fading category, with Kantar pointing to instant coffees Folgers and Maxwell House that were once staples of the American household. The brands have lost 82 million weekly occasions between them since 2013, according to Kantar, which is the equivalent of 4.2 billion cups of coffee consumed elsewhere.

Though very recently milk has upped its game with options like grass-fed, organic, a2 and ultrafiltered, overall the category hasn’t seen enough innovation to compete with emerging beverages that meet more modern needs. Kantar said that milk’s penetration has decreased by 23% in the US since the 80s.

Sodas have arguably seen the most obvious downturn, not having met the needs, the nutritional benefits and healthy choices people are looking for today.

“The decline in soda is a prime example of what happens when manufacturers and retailers take their eyes off how consumer needs and consumption habits are changing. Others who make the same mistake may soon find themselves in a declining category,” Kantar said.