While the country may be best known for its wine, its beer industry is carving out its place. New Zealand now has 218 breweries, employing 22,000 people directly and indirectly in the sector. One of its key advantages is the country's hop industry, offering a local twist to beers.

And the beer industry can learn from the wine industry’s success by embracing Brand New Zealand as it seeks to grow both at home and abroad.

Hop heaven

At the latest count, New Zealand now has 218 breweries: up from 75 in 2012.

Each year these breweries produce more than 2,000 different brews. In fact, the average brewery now produces nearly twice the number of varietals it did four years ago.

As with other developed beer markets, key trends are the growth in craft beer, increasing innovation in low and no-alcohol options, and the drive to experiment with new brews.

“In the past few years we have seen a lot more excitement about beer and the growing range of styles and taste experiences it offers consumers,” notes The Brewer Association of New Zealand.

“We have really seen the shift in the last few years from volume to value, where consumers are looking to spend more on less.”

The Brewers Association of New Zealand

The BANZ is ‘committed to the promotion of beer as an enjoyable & refreshing lower-alcohol alternative to other alcohol categories’. Its members DB Breweries LTD & Lion Pty LTD produce 83% of the beer brewed in NZ.

Like other markets, a growth in the brewery numbers and a rising craft sector has led to the introduction of new and diverse styles in New Zealand, explains the organisation’s executive director, Dylan Firth.

“In many ways, New Zealand has followed America with big hoppy Pale Ales and IPAs,” he told BeverageDaily.

“The timing of this growth has been driven twofold by consumer demand and production ability.

“With consumers looking more and more at their food and beverage consumption, they have been focusing on quality over quantity in many areas.

“This comes along with the growing ability for brewers to get their hands on brewing equipment which has come down in price considerably, with the increase of fabricators in Asia being able to produce equipment and import it here much cheaper than traditional European sources.”

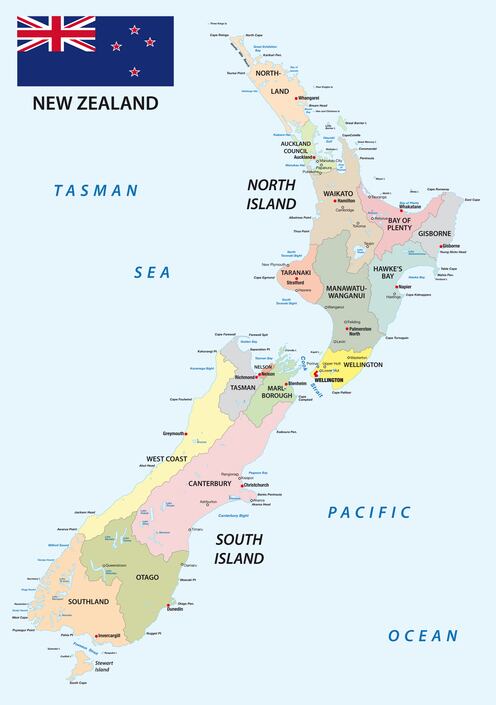

Local ingredients play into the New Zealand beer story, particularly with regards to hops. The New Zealand brewing industry uses $15m worth of hops, the majority of which are grown in the Tasman region on New Zealand’s South Island.

“New Zealand is lucky enough to have such quality agricultural environments which allow for great ingredients to be sourced locally,” said Firth. “Our hop industry is very strong. Today the primary industry model is one of a cooperatively grower-owned company.

“In 2018, New Zealand produced 18 New Zealand specific varieties and six northern varieties. With high demand for the product, the co-op exports 85% of its harvest to over 30 countries worldwide.”

Small but big: New Zealand on the global stage

New Zealand’s beer industry is a ‘significant contributor’ to the country’s economy, says the association.

Research from New Zealand Institute of Economic Research (NZIER) reveals that from the grain to the glass, the New Zealand brewing industry was worth $2.3bn ($1.6bn USD) in the year to March 2018.

Brewing contributes $640m ($438m USD) a year to the government in GST (goods and services tax) and Excise Tax.

New Zealand has more breweries per capita (4.56 per 100,000) than some other established beer markets - the UK (3.04), Australia (2.10) and the US (1.96).

“In terms of volume, we are not on the scale of these markets, purely due to population size,” said Firth. “However, we have seen that our growth in the number of breweries, including contractors, has been at a rate on par - if not higher - than some of these other strong markets.

“Looking at these other markets, we see similar trends, such as the growth in craft and no and low alcohol options.”

One of the most important areas for New Zealand to address in the coming years will be ensuring it has an adequate skilled workforce to follow its growth.

“Some things we struggle with are similar to any industry that experiences growth in production from new businesses - that being a growing skilled workforce," said Firth. "There are some great opportunities for brewers in New Zealand - its just finding enough people sometimes can be difficult.”

New Zealand's beer market

DB Breweries (a Heineken subsidiary) and Lion (parent company Kirin) are well-established as New Zealand's two largest brewers. However, the craft beer revolution hit the country in force in 2012, leading to an increasing number of small independent brewers.

Craft beer is particularly prominent in the biggest cities of Auckland and Wellington, but is spreading across the country.

In recent years Lion and DB Breweries have acquired craft brewers such as Tuatara Brewing Company (DB Breweries) and Panhead Custom Ales (Lion).

Source: Euromonitor International

As with other markets, the influx of new brewers is good news for the category – but this also brings with it another set of challenges.

“Another issue we see is the ability for those coming in to be able to develop consistency of product," said Firth. "Quality is important: not only for an individual brewery or brewer, but for the industry as a whole.

"We don’t want beers that are flawed in the marketplace - this can be a negative for those trying beer for the first time or trying new varieties in the category.”

Brand New Zealand

Kiwi beer is also contributing to the country’s thriving tourism market, with $242m being spent on beer by international visitors. And this highlights another opportunity: exports.

Currently, 10% of the beer produced in New Zealand is exported, totalling $41m. In comparison, the wine industry exports 70% of its production. “The potential for export growth is enormous,” says the association.

However, New Zealand’s remote location remains a challenge for exports. Consequently, exporting to neighbouring Australia – where consumers are also on the search for new products – is a key opportunity, as is exploring Asian markets.

“Brand New Zealand is important for any collective success in export,” said Firth. “This is particularly true for China, our second largest beer export market after Australia. New Zealand is seen as a safe, clean and a quality-focused country.

“Our New Zealand story is crucial to any exporters’ international success. For many consumers, country of origin is key to purchasing decisions, and this is strengthened by consumers’ desire to understand the brand story behind the product.

“Working together to build strategies on how to leverage this as an industry - much like our wine sector has been successful in - will be important if we wish to grow in an export sense.”

For the beer industry, the focus of Brand New Zealand is its raw materials. “I believe our greatest opportunities are in showcasing the quality of the inputs that allow us to create such high-end product," said Firth. "Highlighting our homegrown ingredients and locally produced product will go a long way to increase the overall New Zealand beer brand.”

New Zealand beer brands

Lion New Zealand: Speight’s, Steinlager, Mac’s, Emerson’s, Little Creatures, Crafty Beggars, Guinness, Kirin, Budweiser, Pacifico, Stella Artois and Corona

DB Breweries: DB Draught, DB Export, Heineken, Monteith Brewing Company, Orchard Thieves cider, Murphy's Irish Stout, Rekorderlig Cider, Sol, Tiger, Tui.

Pictures top to bottom: getty/joppi; getty/huafires; getty/rainerlesnieweski; getty/zephy18