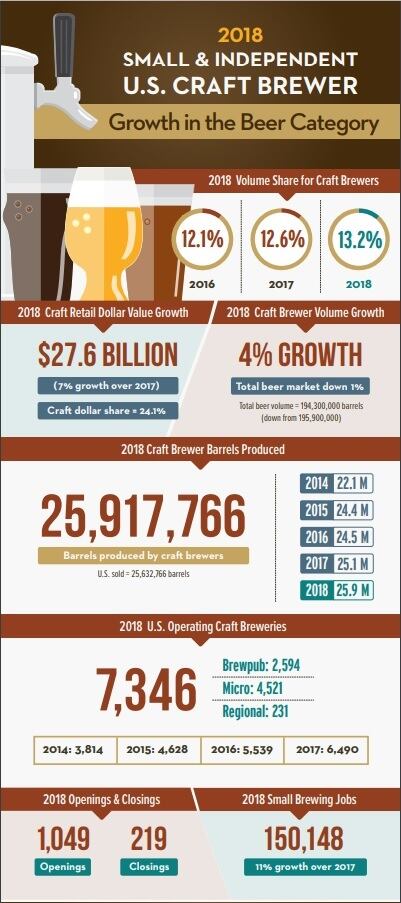

The 4% growth comes against a backdrop of a 1% decline in the overall beer market; but the BA warns that the days of 'meteoric growth' experienced in the past are over.

Brewers need to adjust their business models accordingly: and plan their strategies around a much more competitive market, says the trade body for US craft beer.

In value terms, the craft beer category enjoyed 7% growth to $27.6bn: taking a 24.1% market share.

'Mixed outlook'

Craft beer production has increased considerably in the US in recent years. In 2014 there were 3,814 operating craft breweries across the country, and in 2018 there were 7,346. But the industry is not without its challenges: while 1,049 breweries opened last year there were 219 breweries that shut their doors.

Bart Watson, chief economist for BA, said that the outlook is mixed for craft beer, a category facing competition from other alcoholic drinks and pressure from consumers turning their back on alcohol completely. But production did increase to 25.9m barrels of beer, up from 25.1m in 2017.

“It’s much harder to give a single message, good or bad, than it has been in some previous years," he said.

"Certainly a category that adds a million barrels in gross share, even as overall beer saw volume losses in 2018, that’s a positive sign. But it’s certainly a slower growth market, even for a growing category like craft, and a more competitive market than we’ve seen in the past.

“The growth level isn’t what it has been, and that’s going to pose challenges for breweries that built their business model around large chunks of growth and particular segments in the market.”

A mature growth pattern

More than 150,00 people were employed in small brewing jobs last year, an 11% increase over 2017. But the BA has made ‘slight tweaks’ to its methodology last year in communication with brewers, allowing for a more accurate jobs estimate.

The BA report broke down craft beer’s growth by category, revealing that microbreweries contributed 80% of the total growth, up from 60% in 2017. Brewpubs were up 13%, accounting for about 20% of total growth. At-the-brewery sales are still well below retail, at just 3.1m barrels out of the 25.9m produced.

Any category growth last year was driven heavily by the newest breweries, and those in their second and third years. Markets that are seeing a steady increase continue to be out west, particularly concentrated in California. But New York, Texas and Florida are also showing brewery strength.

“Craft has settled into a more mature growth pattern and is unlikely to return to the meteoric growth levels seen over the past decade,” Watson said.

Staying competitive with experimentation

Of the 219 breweries shuttered in 2018, 123 were microbreweries, 90 were brewpubs, five were regional and one was classified as ‘large.’ Despite this, Watson says that the smallest brewers are the most successful. In a crowded and specialized market like craft beer, it’s hard to resonate outside of a brand’s home market.

Even still, it can be a struggle for a brewery to ‘make it’ in certain parts of the country. Densely populated and beer-saturated states like California, Oregon and Colorado are above average. It’s unlikely for states like Florida to reach their level, even with steady growth.

To reach more consumers, many breweries choose to expand their draft list beyond beer. It’s common now for small and large craft operations alike to experiment with other alcoholic drinks, including hard cider, hard seltzer and even wine and spirits.

“We’re seeing brewers in a competitive marketplace look for ways to make their brands resonate with beer lovers and drinkers more broadly,” Watson said.

“Particularly in regions where growth is a challenge, brewers are looking to experiment and grow any way possible.”

Many craft breweries produce more than beer, but all the dollar amounts and volume growth in the BA report come solely from beer performance. In December, the BA updated its definition of a craft brewer, no longer requiring the majority of what a brewer sells to be beer.

The BA says this will support the innovation of craft brewers who are evolving and shifting the craft brewing practice, allowing more freedom to generate revenue in alternative ways.