There’s fresh competition for market share in alcoholic beverages beyond traditional beer, wine and spirits. Cider, along with flavored malt beverages (FMB) like hard seltzer, is experiencing massive growth in the US.

At CiderCon 2019 in Chicago this month, Danny Brager from Nielsen spoke to attendees about growth trends in the alcohol industry and what can be expected for US cideries in the future.

Educating the masses

In 2018, off-premise beer sales dropped 0.2%, wine grew 2.1% and spirits grew 3.6%. It represents the consistently flat alcohol consumption rates seen in the US since 2000. But there is room for additional categories, as cider was up 8.4% in 2018 and FMBs grew 10.2%.

Cider represents less than 1% of the total alcoholic beverage market share. But Nielsen estimates that if cider’s share of beer in the US increases by just one point, sales would increase by 65%, or more than $800m.

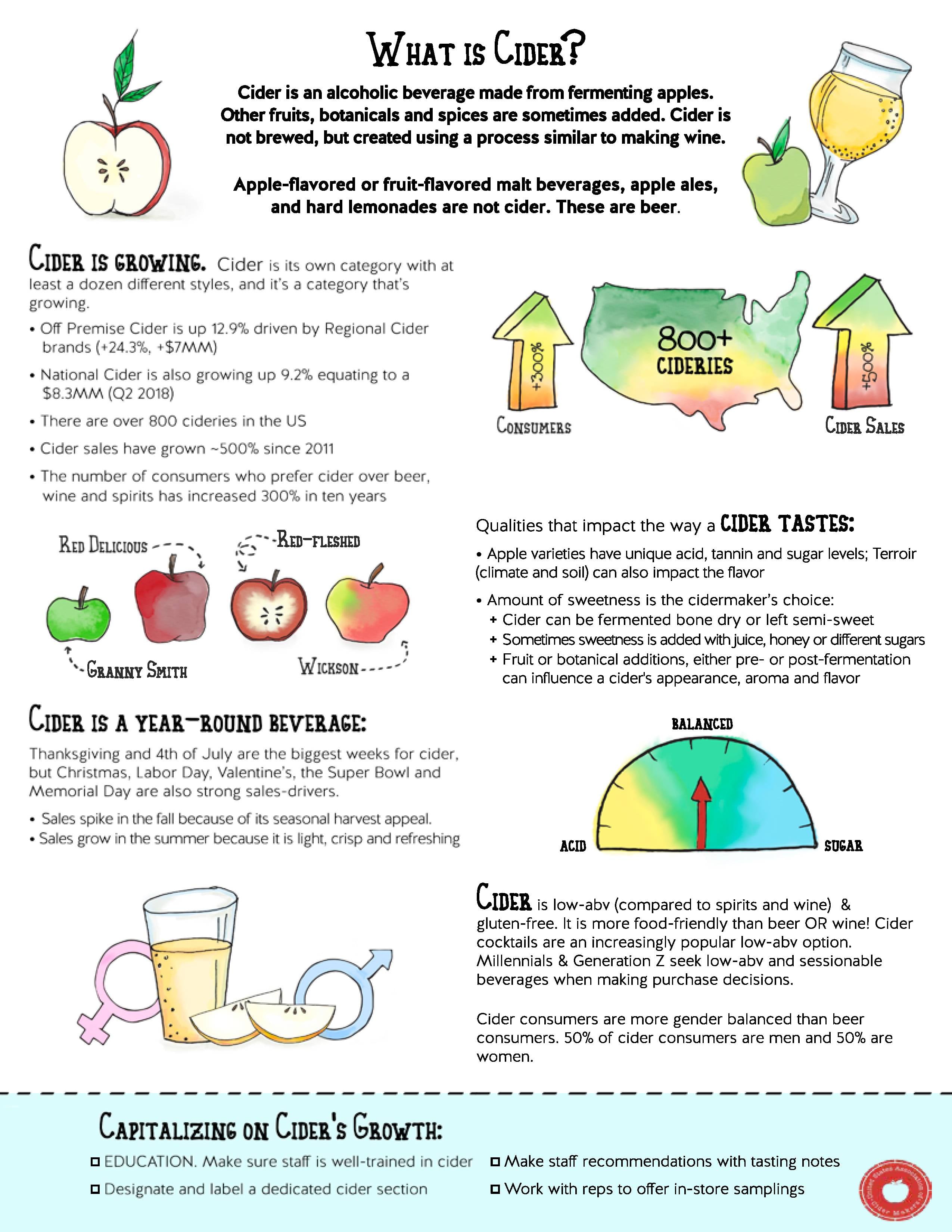

The category did reach more than $500m in retail sales last year, already making its impact 10 times bigger today than it was 10 years ago. There are now more than 900 cideries open in the US.

Michelle McGrath, executive director of the US Association of Cider Makers (USACM), said “In 2017, USACM declared that it was the year of regional cideries. 2018 was really the year of expansion; cideries across the country increased their production, hired new staff, launched in new states, bought new equipment, and nearly 100 cideries opened their doors for the first time.”

The innovation within cider has taken off, giving consumers more options than ever before. Education is a major mission of the industry, getting bars, venues and the public to understand that cider is more than a one-trick, apple-laden pony.

Different types of apples produce different types of ciders, and certain countries have their own cider styles. There is also a whole slew of fermenting techniques and countless fruit, spice and botanical varieties on the market.

Chile Guava from Stem Ciders, Basil Mint from Seattle Cider and a coffee-infused option from Blakes Hard Cider represent a small portion of the out-of-the-box flavors that came from regional cideries in 2018. Cidermakers are working to impress upon customers that there is more to cider than apples and pears.

An approachable industry

Cider reaches an even audience and is the most gender-balanced alcohol category. It is 51% male drinkers and 49% female, while wine is 47% male and 53% female, beer is 61% male and 39% female, and spirits are 53% male and 47% female.

“That’s very much a strength that we need to leverage and should leverage, because our consumer base is gender diverse. What retailer or restaurant doesn’t want to appeal to a demographic base of both males and females?” Brager said.

In cider’s gender-equal base is a core audience of youth--40% are in their 20s. The lower ABV content attracts them because young people are tending to drink less alcohol and choose healthier options across all categories. Most dry ciders are very low in sugar and carbs, with a healthier label than traditional beers.

Cider also draws comparison to wine as an agricultural product, but considers itself a less intimidating and more approachable industry. But it's facing the challenge of retaining consumers, and making sure it’s a category that’s friendly to all drinking ages.

“Obviously we can hope that younger drinkers will be retained as they become older drinkers. But I don’t like to rely on hope as a strategy. It’s not a great one. So what are we doing as an industry to encourage older generations to give us a shot?” Brager said.

Nationally recognized brands like Angry Orchard, Woodchuck and Crispin are responsible for much of the category’s mainstream interest and growth, particularly in spreading the massive rose flavor trend in 2018.

But regional and local cideries are still the backbone of the industry. The category’s retail sales were up by 23% in 2018, and it now accounts for a third of all cider retail sales. In comparison, local craft beer increased by 9.3% in 2018.

Experience is key

A major opportunity for the industry lies in food pairing. In the same way that craft beer has leaned on the trend in recent years, cider can also do so today. Twice as many Americans now go out to eat and consume alcohol every week (70%) compared to those interested in just drink-led visits (30%).

In 2018, total on-premise cider sales in restaurants and bars was $722m, with a lot of room for growth. On-premise cider is about 4.5 times bigger than FMBs, and cider drinkers visit on-premise establishments more often than beer drinkers.

However, all drinkers are concerned with the experience they get from going out to a bar. Sales are expected to continue being driven by experiential drinking at brewpubs, taprooms and other venues for all categories.

Competition from outside alcohol?

Alcohol in general is fighting for consumers’ money and attention thanks to the expansion of the non-alcoholic category. Non-alcoholic beverages are $7bn higher today than they were four years ago.

Big players in that expansion are flavored waters like La Croix, a half-billion dollar brand. Kombucha is worth another half-billion dollars, grabbing customers with hard and alcohol-free varieties.

An increasing number of non-alcoholic brands are tapping into consumers' desires to drink less alcohol: positioning themselves as alternatives to alcohol.

According to Brager, a lot has changed in the non-alcoholic beverage grocery aisles in terms of colors, flavors and functional benefits that are available. He advises the alcohol industry to view it as competition, but also consider it for inspiration as to what can be adapted into alcoholic beverages in the future.