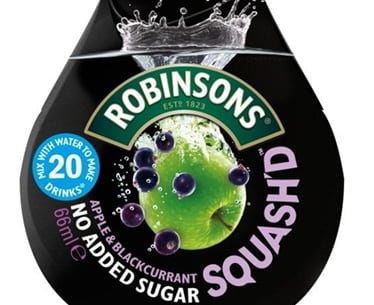

A lot is being made of Robinsons (Britvic) and Vimto (Nichols) forays into the arena of so-called ‘liquid’ enhancers, Squash’d and Squeezy, with envious glances at at a US market now worth $400m attending the recent roll-out of these products in the UK, including a own label launch from Tesco.

Will it work? I’m skeptical, at least when presented with these first incarnations. Vimto Soft Drinks commercial director Andrew Milne rolled out a eulogic video at the Zenith International/BSDA UK Soft Drinks Conference in London last week, invoking platitudes for the product from the public

'This allows squash to be portable - people can use it on the go!'

“A brilliant idea!”, “Saves space in the kitchen!” were just two glowing testimonies. Well, clearly Milne wasn’t going to show an industry audience, which included some of Vimto parent Nichols Soft Drinks’ customers, any negative reviews.

“The pack is 50ml and makes 25 servings…this allows squash to be portable, people can use it on the go, whether it’s in the suitcase, handbag, briefcase or office desk, etc.,” Milne told delegates, including retail buyers from Asda, The Co-operative Food and Tesco, who by and large, buy the idea.

But when I challenged him on price, especially given that Tesco, with One Squeeze, has just launched its own ultra-concentrate in a similar sized, 30-serve format at £2.09, Milne reiterated Nichols’ confidence in the product’s RRP of £2.49 ($4.20) and insisted the product offered great value at circa. 10p/serve.

But save a brief flurry of excitement over the new format (and the eye-catching bottle will appeal in a currently uncluttered sub-category) I don’t think that this product, Britvic’s or Tesco's are worth the premium they attract, since the liquids inside the bottle are nothing new.

You can currently buy Mio in a legion of flavors for $3.49 in the US at Walmart, and energy (via guarana as an ingredient) and fitness (electrolytes and B-vitamins) are just two of the need states catered for.

However you dress it up – and you could stick in in royal robes and introduce it to the ‘world’s most stylish monarch’ (Crown Princess Mary of Denmark, it seems), at a dress dinner – it’s just squash. The Brits need to go further faster, or go cheaper, and perhaps do both.

(To fill in you US readers not in the know, and I'm aware of your penchant for powders in this space, liquid concentrates/squash have a long UK history. Zenith data shows that dilutables had a 33% of the nation’s soft drinks category in 1984; the share was 21.7% in 2014.)

Squash - the stock preserve of kids' birthday parties...

Squash. Stock preserve of kids’ birthday parties and bouncy castle-induced burps when served with a mountain of sandwiches and biscuits, at least for we millennials who grew up in the 80s and 90s. As the parents among you know, kids don’t really do moderation when eating at such events.

And in the UK squash is still as cheap as the unhealthy (potato) chips that also squeezed their way onto the guest list in those strangely wonderful, technicolor, artificially colored and concentrated childhood afternoons.

Sure, things have changed and Vimto Squeezy only uses natural flavorings and colorings, but doesn’t everyone nowadays? You also have a slightly tough upsell there in terms of educating moms or millennials that less (volume wise) is more, in terms of splashing out on a pricier ultra concentrate.

The problem is, and it is a problem, is that however hard you drive the point that a portable, squeezable product opens up new consumption opportunities, and on-the-go convenience, squash is a commodity category in the UK, with large volumes driven by value propositions.

To take one example, Vimto’s product will go up against Tesco Everyday Value Double Strength Apple & Blackcurrent squash with no added sugar – sold online for £0.42 for 750ml.

Milne assured me that Vimto squeezable costs less than 10p/serve, but the Tesco product weighs in at around 1.55p/serve. A 750ml bottle contains roughly 27 servings diluted in a 1:9 ratio with water.

Where, on the UK market, will you get better value in soft drinks? And this is precisely the problem. Even Vimto’s 725ml bottle only costs £1.39 in Waitrose today. OK, it’s not an ultra concentrate, but there’s nothing to stop me chucking a few serves of this in a small bottle to create an on-the-go concentrate to jazz up water.

Liquid enhancers excite, but need functionality

If I drank squash (and I haven’t since I was 15, bar more adult cordials) then I wouldn’t be drinking Vimto squeezy at £2.49/bottle. I might pay £1 or £0.99. And I truly believe I speak for many UK consumers.

£1/bottle would be a more sensible price point – and I guess the manufacturer would still make a margin here, given the cheaper cost of shipping a super-concentrated product, and the clear savings on packaging versus squashes in larger bottles.

This is not to say that liquid enhancers aren’t exciting, or that the wider concept is flawed. In London, Milne from Vimto (Nichols) also discussed future water enhancer possibilities using their brands: health (Weight Watchers), sports (Extreme Sport), energy (Extreme Energy)

I believe this is where the promise lies in the UK, there must be enough added value or functionality to attract a price premium over traditional squash products in bigger bottles; perhaps we’ll end up with a two-tier squash category where ultra-concentrates are the new norm, with unadorned squash the budget option.

Speaking personally, I think people would be prepared to pay more for an isotonic enhancer for sports, a milk enhancer, perhaps a product with Omega 3s for heart health, or one especially high in antioxidants. As for Vimto Squeezy and Robinsons Squash'd - feel free to disagree in the comments box below - I expect to see such unadorned squash on promotion very soon.

Ben Bouckley is Editor of BeverageDaily.com