The growing conditions in many regions were widely reported to be the most challenging in at least 20 years, says Wine Australia: although it highlights than an exceptionally cool season was conducive to producing ‘high quality fruit with excellent flavour development.’

“This smaller vintage, which will reduce the wine available for sale by around 325 million litres, is likely to have a considerable impact on the bottom line of grape and wine businesses all around Australia, at a time when the costs of inputs, energy, labour and transport have increased significantly,” notes the organisation.

Cool, wet conditions play havoc with yields and management

Wine Australia’s annual vintage report is based on survey data collected across all winegrowing regions in Australia.

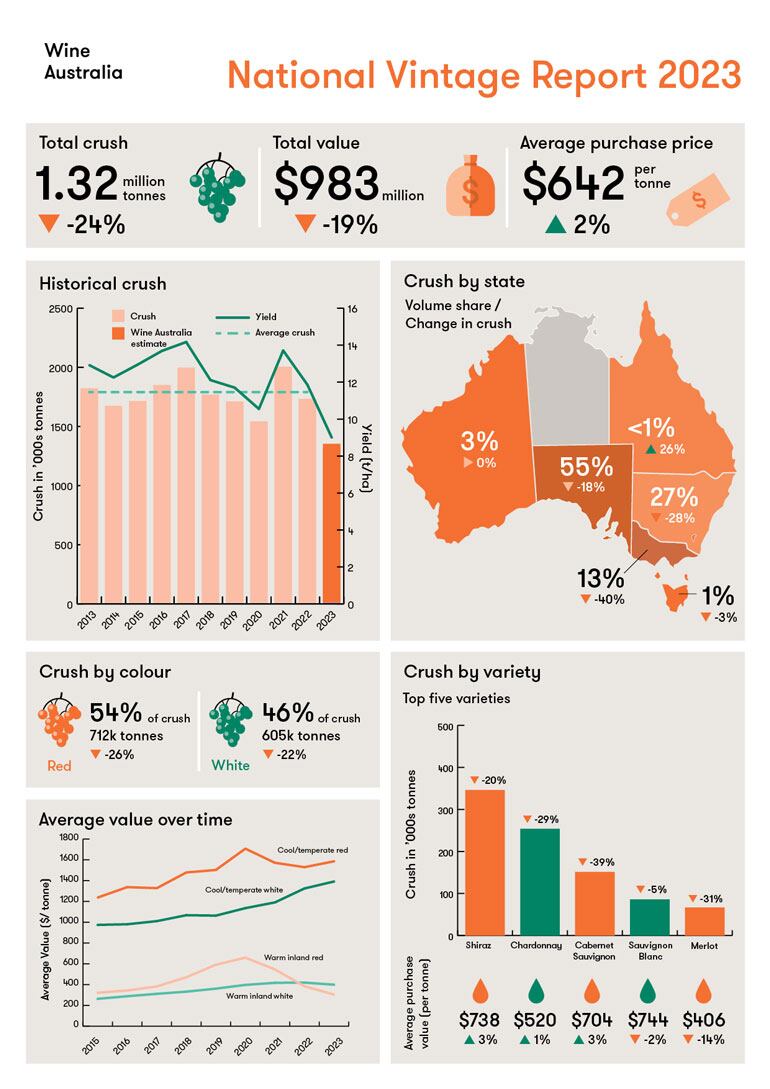

The 2023 winegrape crush is expected to come in at 24% below 2022 and 26% below the 10-year average of 1.78m tonnes.

The total value of the vintage comes in at $983m, down 19% on the year before; although the average purchase price risen 2% to $642 per tonne.

"A third consecutive La Niña event produced the wettest year since 2011 and it was also Australia’s coolest year since 2012, notes the report. "Persistent winter and spring rainfall across much of South-Eastern Australia made access to vineyards difficult as well as causing flooding in some regions. The cool, wet conditions through spring and summer in some regions also led to lower yields, delayed ripening and challenges managing disease.

"Further reducing the size of the crush were winery inventory pressures resulting in some yield caps being imposed, uncontracted grapes not being sold and/or vineyards being temporarily taken out of production."

Wine Australia Manager, market insights, Peter Bailey said that it was impossible to determine what share of the overall reduction, compared with an average vintage, could be attributed to demand-driven effects as opposed to seasonal conditions.

“However, white grapes – which are in higher demand – were reduced by a similar percentage to reds, which suggests that seasonal effects were the main contributor to the reduction,” he said.

The crush of red grapes in 2023 is estimated to be 711,777 tonnes – a 26% reduction compared with 2022 and 25% below the 10-year average of 943,146 tonnes, while the white crush was an estimated 605,321 tonnes – a decrease of 22% compared with 2022 and 28% below its 10-year average of 839,013 tonnes.

Key wine producing regions

Australia’s largest wine producing state, South Australia, had its second smallest crush since 2007 with volumes down 18% on the prior year (although it still accounts for a 55% share of the country's total).

New South Wales was second-largest with 27% of the crush, followed by Victoria with 13%. Western Australia, which overall had a very good season, increased its share to 3.5% while Tasmania and Queensland each accounted for slightly less than 1%.

"The main reduction in the crush came from the three large inland wine regions: the Riverland (South Australia), Murray Darling – Swan Hill (New South Wales and Victoria) and Riverina (New South Wales)" notes Wine Australia. "The crush from these regions combined was down 28% to 899,936 tonnes, whereas the crush from the rest of Australia’s 59 GI wine regions and 26 GI zones together was only down by 15% compared with 2022, at 417,162 tonnes. This meant that the large inland regions reduced their share of the national crush to 68%, compared with the long-term average of 74%."

Despite the challenges, there are some positive parts to the picture.

"Many wineries reported anticipating that the season would produce good fruit quality and excellent flavours as a result of the cool conditions and low yields. Some wineries reported their best season ever. Regions in Western Australia, in particular, generally had a good season, while reports from the Barossa Valley, Clare Valley and Mornington Peninsula were also mainly positive."

The full report can be found here.