Brito – who has been with AB InBev for 32 years with 15 years as CEO – is credited as being “the architect who led and built AB InBev into the world’s leading beer company and a leading global consumer packaged goods company by masterfully integrating the many businesses that comprise AB InBev today,” according to board chairman Martin Barrington.

Brito joined what was then Brahma in Brazil in 1989: 'never imagining the journey our company and I would embark on over the next three decaides'. As CEO he oversaw InBev’s acquisition of Anheuser-Busch in 2008 to create AB InBev; followed by the acquisitions of Grupo Modelo in 2013 and SAB Miller in 2016.

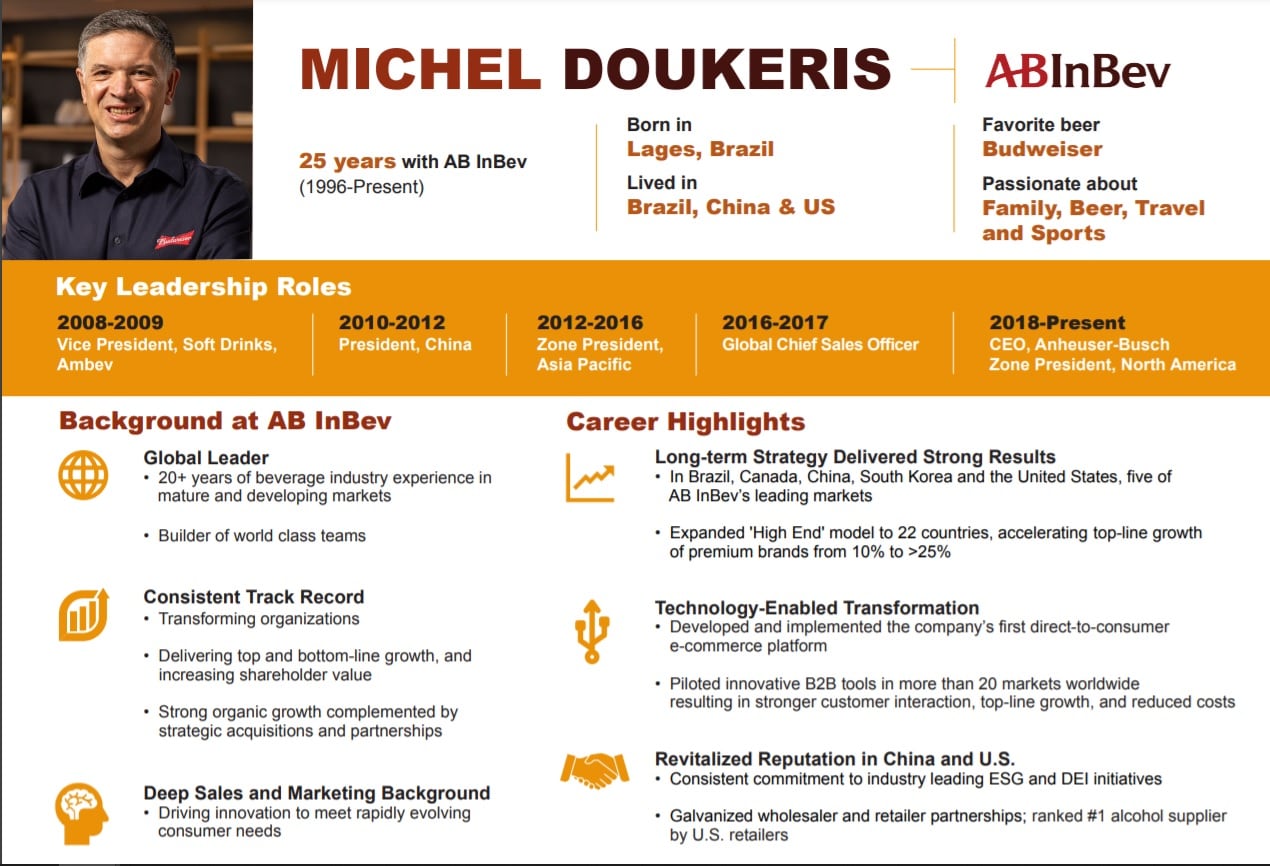

Fellow Brazilian Michel Doukeris is currently president of AB InBev’s North America Zone: with the US business having ‘delivered consistent topline growth and led the beer industry in innovations for the last two years’. Prior to leading the North America Zone, Michel was the company’s global Chief Sales Officer.

Previous roles with AB InBev over the last 25 years have included President of the Asia Pacific Zone, where he is credited with accelerating top line, volume and EBITDA growth and implementing the ‘High End’ division in China, a new route-to-market initiative focused on building premium brands. He also implemented the company’s first direct-to-consumer e-commerce platform.

The new leader for the North America Zone is yet to be announced.

Q1 shows growth on pre-pandemic levels

Reporting its Q1, 2021 results this morning in conjunction with the leadership announcement, AB InBev says the business is ‘off to a very strong start in 2021’, showing a return to pre-pandemic levels.

Beer volumes in Q1 were up 2.8% compared to Q1, 2019, with revenue per hl growth, despite the continued impact of COVID-19 restrictions (felt particularly in the on-trade in Europe).

Compared to Q1, 2020, total volumes were up 13.3% while total revenue was up 17.2% (pandemic restrictions began to bite at the end of Q1 2020, with ran from January to March),

Of particular note, the company’s premium portfolio grew by 28% in Q1 2021 (compared to Q1 2020), representing over 30% of the company’s revenue and carrying a higher profit per hectoliter than core brands. AB InBev’s global brands – Budweiser, Stella Artois and Corona – led growth, delivering 46% revenue growth outside of their respective home markets, where they typically command a price premium. Compared to Q1 2019, they grew by 24% outside of their home markets.

Meanwhile, AB InBev’s e-commerce business quadrupled in size in Q1 2021. Its courier platforms are now available in nine markets and 220 cities, covering nearly 120 million consumers. In Brazil, Zé Delivery continues to grow exponentially, delivering over 14 million orders in 1Q21, more than half of the amount delivered in all of 2020.

“Our industry-leading portfolio of brands is connecting us with more consumers on more occasions, as shown by continued top-line growth,” says the company. “We are solving real customer and consumer needs with digital platforms, connecting us more closely to those we serve worldwide.”

Strong US sales; challenges in Europe

In the US, sales-to-wholesalers grew by 2.9% and revenue per hl grew by 2.4%, resulting in total revenue growth of 5.4%. Sales-to-retailers were down by 0.8%, estimated to be below the industry, a temporary impact largely due to a challenging comparable from ‘pantry-loading’ behavior in March 2020.

“We continue to strengthen and premiumize our portfolio, rebalancing toward faster growing above core segments. Our 1Q21 results were fueled by our innovations, as we led the industry in total innovation. Our above core beer offerings continue to outperform, highlighted by the strong growth of Michelob ULTRA and our craft brands. Our seltzer portfolio continues to grow ahead of the industry according to IRI, and we delivered triple-digit growth of our canned cocktail brand, Cutwater.”

In Europe, challenges remain from continued shut-downs and restrictions in the on-trade, leading to a total volume decline of low-single digits. However, the off-premise channel saw double-digit growth and a shift towards premium brands.

In South Africa, the business was once again impacted by another government ban on alcohol sales for a month. Volumes were flat compared to Q1 2019.

“Once the ban was lifted, we saw strong underlying consumer demand for our brands,” notes the company. “Our premium portfolio led the way, driven by Corona and our flavored alcohol beverages. We also continue to advance the digital transformation of our business, with approximately 50% of our revenue now coming through digital sales.”

In China, revenue grew by more than 90%, surpassing pre-COVID levels of 2019.

“Continued momentum led to strong volume growth of nearly 85%, estimated to be ahead of the industry, and was enhanced by a successful Chinese New Year campaign. Revenue per hl increased by 4.1% driven by the continued success of the premiumization strategy. EBITDA grew versus both 1Q20 and 1Q19, with growth of more than 200% versus 1Q20.

“Budweiser doubled its revenue compared to the same period last year and reached double-digit growth versus 1Q19. Our Super Premium brands achieved strong double-digit revenue growth when compared to both 1Q20 and 1Q19. To drive further premiumization, we have established two new exclusive distribution agreements: one with Sazerac, including Fireball Whisky and other premium spirits, and one with Red Bull, the leading premium global energy drink.”

Brazil, too, has seen volumes above Q1 2019 levels.

“We saw continued success of our innovations, such as Brahma Duplo Malte, and the growth of the premium segment, particularly our global brands, which grew by nearly 20%. BEES continues to rapidly expand across the country, now in use by more than 65% of our active customers. Our direct-to-consumer platform, Zé Delivery, fulfilled over 14 million orders in 1Q21, with an all-time high of 5.1 million orders placed in March 2021.”