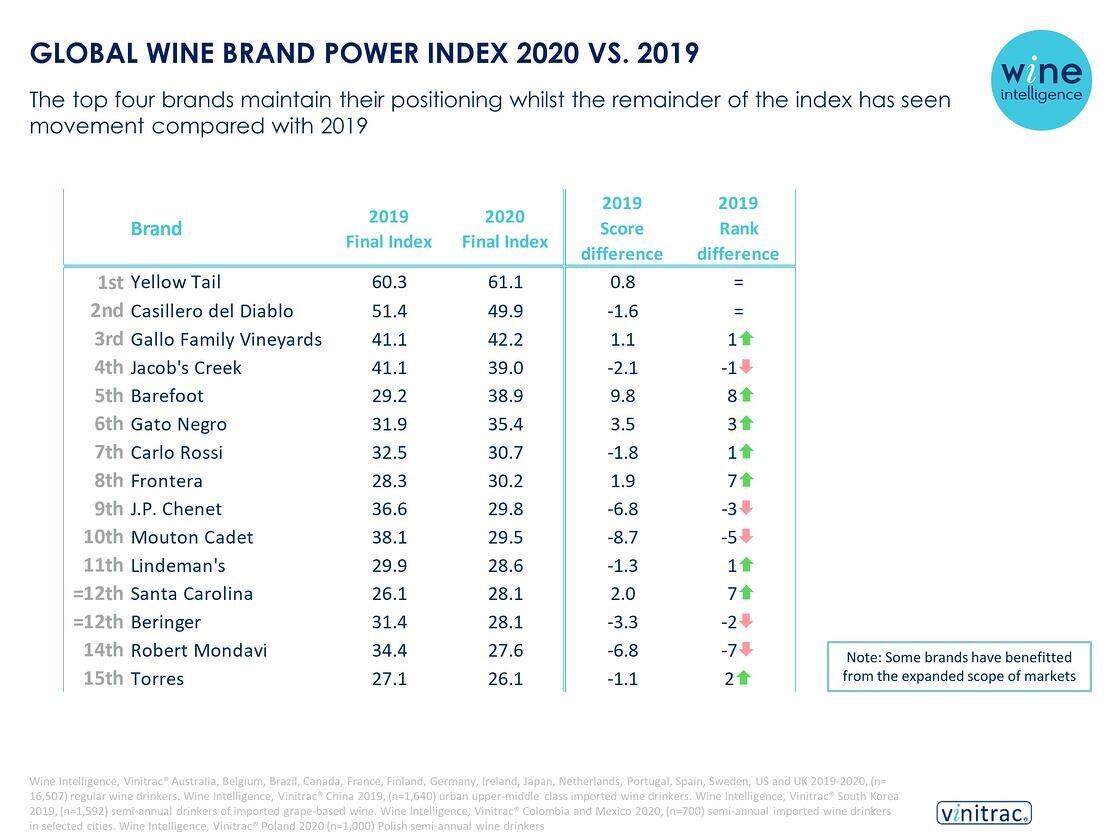

The Australian and Chilean brands take the top spots, with a third of the top 15 comprised of US brands such as Gallo (number 3) and Barefoot (the latter jumped up 8 places to make number 5).

But overall the wine category is seeing intense competition from other categories. “The advantages of a powerful brand are clearly demonstrated in the global wine market today,” said Lulie Halstead, CEO, Wine Intelligence.

“However, the path to becoming a power brand is becoming harder, as consumer knowledge levels in the wine category decline and ‘noise’ from other drinks categories increases.”

Brand power: Chile and Australia

The Global Wine Brand Power Index builds on feedback from more than 20,000 wine consumers in 21 markets: taking into account consumer awareness, purchase intent, and consumer connection with the brand (it doesn’t look at sales or volume figures – it’s intended to complement such data).

Notable movers on the Global Wine Brand Power Index include Barefoot, which has jumped 8 places to make it into the top 5, and Frontera, which has climbed seven places to make 8th in the index. Santa Carolina has also climbed seven places to tie for 12th with Beringer. On the other hand, Mouton Cadet has fallen 5 places to 10th and Robert Mondavi has fallen 7 places to sit at 14. Torres has also climbed two places to make it into the top 15 this year.

Australia’s Yellow Tail is produced by Casella Family Brands in New South Wales. While it saw a decline in overall awareness and purchase indices this year, its strong connection index continues to anchor it in top position. It features in the top five most powerful brands in Canada, China, Hong Kong, Ireland, Japan, South Korea, the UK and the US. It also has a top 20 position in three other markets.

Casillero del Diable dominates its home market in Chile, as wall as coming in top of the index in Colombia and Ireland. It also features in the top 10 in eight other export markets.

In taking the top spots, Yellow Tail and Casillero del Diablo mean that Australian and Chilean brands perform very well in the index relative to the size of wine production in these countries. But it’s not down to these two brands alone: Chilean brands now account for four of the 15 most powerful wine brands globally, even though the country produces only 4% of the world’s wine. Australia holds three of the top 15 brands, with two of them in the top five (Yellow Tail and Jacob’s Creek at number 4).

The dominance of US brands in the top 15, meanwhile, is attributed to the loyalty of Americans to domestic brands.

France maintains its stake while Spain sees the entry of its first top 15 brand with Torres.

Brand awareness in decline

The overall findings of the 2019 edition of the report, however, show that overall scores are lower than 2018: driven by declining brand awareness levels. Nearly every brand in the top 15 is seeing continued decline in brand awareness compared to 2019.

And it’s a trend Wine Intelligence sees continuing into 2020, as wine competes against other categories such as hard seltzer and cannabis.

Wine Intelligence says that lower consumer awareness is logically translating into lower purchase. This may also be influenced by the global consumer trends of lower wine knowledge and shrinking wine drinking populations, both of which affect purchase rates.

The good news for wine brands, however, is that this decline in scores is less pronounced than it was between 2017 and 2018. So while brand awareness may continue to decline, this could potentially signal the plateauing of the downwards awareness trend.