Wine writer and broadcaster Sonal Holland admitted she was astounded to find that younger-generation drinkers had taken to the beverage with such relish.

“At my age, I don’t know what 31-year-olds are doing, but as we took in the overwhelming response from this generation towards wine, I was taken aback,” she told BeverageDaily. “It is so encouraging for the future of wine in India, but now we need to get our marketing strategies right to reflect this.”

Holland had been canvassing opinions while collaborating on a report with industry research firm Wine Intelligence. The first edition of their work, India Landscapes, was published earlier this month, and takes into account consumers’ behaviour, attitudes and relationships with wine in India.

“This popularity among millennials has happened completely organically and it absolutely took us by surprise,” she said. “This is one segment that the trade really knows nothing about, and it was a revelation to me.”

Good news for producers and importers

The report found that the millennial generation now accounts for more than half of India’s wine drinkers, largely due to the drink’s image for being “sophisticated, classy and palatable”.

“Indian millennials may have a lower level of wine knowledge than their older counterparts, yet they drink wine more frequently than them,” added Ben Luker, of Wine Intelligence, who co-authored the report. On the whole, they are also more willing to experiment with new and different wine styles.

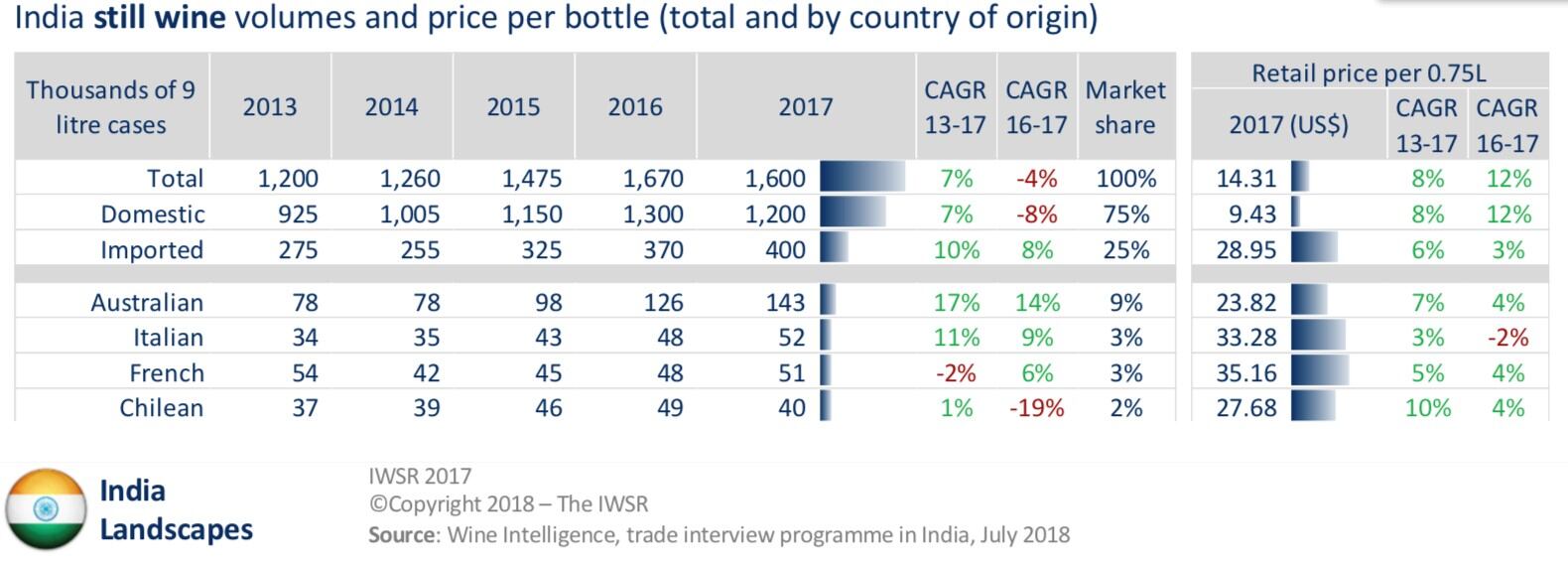

Other key findings identified by Holland and Wine Intelligence include steady volume growth followed by a recent decline as value has increased; domestic wine having greater reach, while imports are seen as better quality and more expensive; Indian wine drinkers being primarily brand-focused due to lack of experience with the category; and trade channels developing with the opening of more wine-focused retailers and dedicated wine bars and restaurants.

Yet of greatest interest is the attraction of millennials to wine drinking. This can only be good news for Indian wine producers and importers, who have been struggling to find ways to tap into the beverage’s rich potential, in a country where almost half a billion people are over drinking age.

“The number one challenge that faces any wine producer or importer is how to bring new consumers to wine,” said Holland, who is also India’s only Wine Master, adding that marketeers have contributed very little in the way of branding and publicity for their drinks.

Instead, Bollywood has been very helpful as an envoy for the industry. Whereas traditionally, lead actresses have rarely been shown to be drinking alcohol in India’s wildly popular film industry, increasingly more are being shown enjoying a glass of something red—perhaps tipping a hat to wine’s reputation of being more socially acceptable than beer or whisky, the traditional staples for characters.

“We could make existing consumers drink more wine, but what would be more interesting in a population as big as ours is to bring more consumers to wine,” Holland added.

A healthy reputation

Consumption is largely divided among millennials and experienced wine lovers, or fuddy-duddies, as Holland refers to them, who tend to be wealthy, have travelled widely and claim to have some knowledge of wine brands—and are “massively prejudiced against Indian wines”. This is even though imports can be expensive due to India’s Byzantine system of taxation which requires importers to pay to register each label on a state-by-state basis, and the plethora of local taxes.

In comparison, younger drinkers are more open to consuming locally produced brands that have been growing in reputation as good-quaffing, everyday drinking, clean wines that may not yet be very complex or cellar-worthy.

At an average price of US$9.43, compared to US$28.95 for imports, according to the report, domestic wine is also certainly more in tune with the millennial wallet.

“Unlike the older population, who imbibe wine as part of a western lifestyle and often see themselves as connoisseurs, among millennials the learning curve is much shorter and they are taking to it much quicker,” said Holland.

“That leads me to think, if you fast-forward another five or 10 years, the wine culture will really ramp up. These days the media often covers wine now in the lifestyle pages. This shows that there is growing cultural acceptance for wine among the urban strata; it’s increasingly being viewed as a drink of preference.”

Interestingly, wine has developed a healthier reputation than other alcoholic drinks in India, with more doctors advising their patients to drink wine over whisky. One might think this could tap into the wider trend among Indian millennials towards healthier food and beverage choices that has been turning the industry upside down over the last couple of years.

Yet based on focus groups conducted by Holland and Wine Intelligence, there is little evidence that this has been a contributing factor for the growth of wine consumption among their tribe. While health was one of the many points cited by the study group, it was not one of the leading factors for its popularity.

Increasing varietal awareness

The study found that millennial wine drinkers have been embracing wine as part of a broad repertoire of beverages and are more likely to experiment with new and different wine styles—though their knowledge of varietals is still low.

In addition to being the more frequent wine drinkers than traditional wine enthusiasts, they typically spend more on wine. They also have a desire to learn more about wine, particularly through tasting opportunities.

Consumers are now showing better awareness for varieties like Cabernet Sauvignon, Syrah, and increasingly Pinot Noir—suggesting that the Indian market is not fond of wines with big tannins.

Wines from the New World have been doing well, with South African bottles and Argentinian Malbecs particularly sought after—especially among women.

Of the whites, Chardonnay, Sauvignon Blanc and Chenin blanc are in abundant demand in India, while Pinot Grigio is also becoming very popular.

“I found it especially surprising that in this hot country, reds are more popular than whites,” said Wine Intelligence’s Luker. “I really wasn’t expecting that, and neither was I expecting the fact that just as many women are drinking wine as men. That’s a long way from the Indian stereotype of men doing most of the drinking.”

The next step is for consumers to start to really understand what they’re drinking—the next step in the ladder for any emerging wine economy.

“In comparison to western markets, awareness is lower—but it’s very early days right now,” said Holland. “It’s all a matter of time. There’s an interest in and openness about wine, and a lot of curiosity about it too. Consumers believe they will enjoy wine better if they know about it, for better or for worse. I don’t know if that is true, but it is certainly encouraging for all of us.”