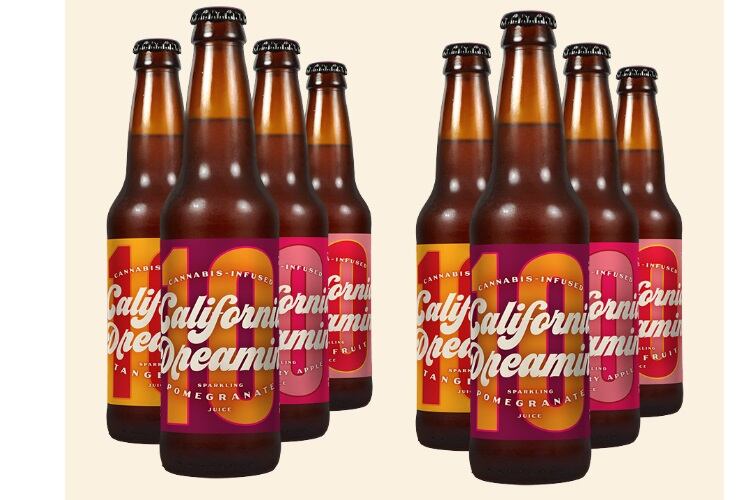

Constellation announced an initial investment in Canopy in 2017; boosting its investment in August this year to take a 38% ownership stake in the company. CEO Rob Sands says that although its initial investment in Canopy was focused at embracing the potential of cannabis infused beverages, the company now believes the potential is much, much wider.

Sands also rebukes any suggestion that the company has turned to cannabis as a defensive move: saying the company’s beverage portfolio is as strong as ever (beer net sales were up 11% while wine and spirit net sales rose 9% in the latest quarter) and cannabis offers an additional growth opportunity.

‘The cannabis space is opening up much more rapidly than originally expected’

Sands predicts that the loosening of cannabis laws across North America and the world is now inevitable, and with that comes an opportunity for Constellation Brands thanks to its investment in Canopy.

“With our focus on continuous growth, we’ve recognized the significant opportunity that the emerging cannabis space presents as potentially one of the most significant global growth opportunities of the next decade,” said Sands, speaking in the company’s Q2 2018 earnings call this month.

“Our incremental $4bn investment increases our interest in Canopy to approximately 35% and include warrants that provide us with the option to take our ownership position to greater than 50% over time.

“This will be the largest investment to-date in the cannabis space, a market which is expected to reach more than $200bn in retail sales globally within the next 15 years, and one that is opening up much more rapidly than originally anticipated.”

Canopy is the largest publicly traded cannabis supplier in the world and the leader in the medical cannabis market in Canada. Sands says Canopy is ‘poised to capitalize on the emerging global cannabis opportunity’, with an established global presence via numerous joint ventures and partnerships and experience and expertise in R&D and product development.

It already has been awarded some 35% of the supply contracts announced in Canada for recreational cannabis, which will become legal in Canada later this month.

The strategic priorities for Canopy beyond Canada include US states and other countries that are pursuing legal medical cannabis programs, as well as developing products for recreational cannabis markets.

Sands points to the growing number of global markets that are relaxing cannabis regulations, either in the medicinal or recreational space. On October 17, recreational marijuana will become legal in Canada. In the US, nine states have legalized marijuana for recreational use, opening the door for a wave of cannabis-infused beverages and other edibles. Medicinal marijuana is legal in another 30 states, while it is speculated that reconsideration of cannabis laws at a federal level will follow.

Some 30 countries are pursing federally permissible medical cannabis programs, says Sands. Last month the UK announced that cannabis-based products for medicinal use will be available for specialist doctors to prescribe legally; while Germany, Italy and Australia have all legalized medical marijuana at some level.

“As the growth leader in total beverage alcohol space, we expect to reap the benefits of our cannabis investment, which we see as being incremental to our core beer, wine and spirits portfolio. I am very excited about the excellent prospects for this business as the global cannabis space emerges.”

‘We’re playing offense’

Sands strongly rebukes suggestions that Constellation has chosen to enter the cannabis space due to concerns over its core beverage business, saying the move is very much ‘offense rather than defence’.

He says the company is ‘very positive’ about its core business – in Q2 2019 its beer sales rose 11% to $1.53bn – and that its cannabis investment is ‘totally incremental’ to the rest of the business.

Furthermore, Sands sees the alcohol and cannabis sectors primarily as two separate categories: saying he sees no danger of cannibilization on its alcohol business.

“We see no evidence whatsoever, especially in the US and the legal states of alcohol cannibalization. So we think the cannabis business and our position in the cannabis business is probably going to be close to a 100% incremental for us.

“We’re not playing offense, defense, we’re playing offense. This is an offensive move. We’ve got a fantastic core business - as you can see from these results and our projected results on our core business for the remainder of the year - we’re very positive, we have a lot of confidence in that business and we see nothing in the horizon that suggests that it’s going to be anything other than great as its continued to be.

“We’re playing offense on this [cannabis] and that we think that this is another very aligned category, that’s going to develop very fast and very large and it simply presents another opportunity for growth for Constellation in addition to our core business.”

Going beyond beverages

Sands says Constellations’ strategy with Canopy has evolved as the greater potential for the cannabis market has emerged.

“First of all, we got involved with Canopy in a joint venture to develop beverages,” he said. “As that progressed, it became evident to us that the whole market, all channels, all forms is going to be explosive and therefore, there was really no reason why we should only participate in a relatively small segment of that market, which is beverages, when other channels - i.e. medical for instance and other forms - are going to develop very quickly around the world and we had a platform, which we had a minority interest in that we can take advantage of.

“So we’re completely optimistic, it’s completely offensive on our part. We didn’t do it because we have any concern whatsoever about the core business, I’ve heard that suggestion made, I can tell you that our core business is stronger than ever and that had no bearing on why we did this.”