But along with global expansion comes short-term growing pains that brewers must endure before seeing their investments pay off, Rabobank global strategist, Stephen Rannekleiv, said.

“EMs (emerging markets) may see short-term volatility and occasional setbacks, but they remain attractive volume growth drivers with increasing signs of premiumization in many categories,” Rannekleiv said.

‘Roll with the punches’

Global beer consumption increased by 60bn liters between 2000 and 2014, driven mostly by growth from emerging markets. However, over the last few years brewers have faced declines in emerging markets including China, Africa, Russia, and Brazil.

China’s austerity measures, for example, cracked down on the sales of luxury goods affecting growth of premium international consumer brands in the market, according to Rannekleiv. Additionally, Russia has been pushing its citizens to consume less alcohol with more restrictions on alcohol sales and higher penalties for drunk driving.

However, when these headwinds occur Rannekleiv advises beverage companies to “roll with the punches” and remain open to adjusting their brand strategies.

AB InBev has responded to Russia’s declining beer market by consolidating its operations in Russia with the merger of Anadolu Efes, creating AB InBev-Efes, Rannekleiv added.

“Despite these headwinds, brewers have continued to invest in EMs,” Rannekleiv said.

The mega brewer also saw sales of its alcohol-free beer portfolio grow by double digits in Russia as a result of regulatory changes and will be an important area of focus according to AB InBev as the company said it aims to have it its low- to no-alcohol beer segment represent 20% of its global sales by 2025.

Outside of AB InBev, Heineken bought Brasil Kirin (previously known as Schincariol) of Brazil to increase its exposure to the South American market and Vietnam announced the planned privatization of two of its major brewers, Sabeco and Habeco.

“Although some of these deals will encounter short-term volatility, we do believe they are beneficial in the long term,” Rannekleiv said.

Asia fuels premium beer growth

Asian consumers throughout China, South Korea, and Southeast Asia are trading up in their beer purchases fueling the surge in imported beer volume and the spread of a local craft beer scene, Rabobank found.

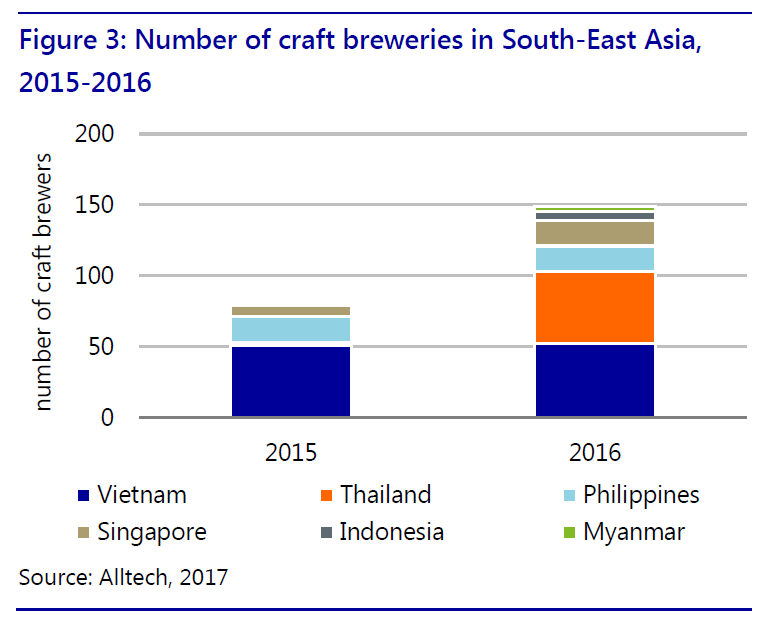

The number of craft breweries in Southeast Asia grew by 80% between 2015 and 2016 to nearly 150 breweries with Thailand showing the fastest growth rate.

Imports are also fueling the South Korean beer market in particular which grew its imports of premium beer by 28% in 2016 to approximately 30 million cases (not including locally-brewed international brands like Budweiser).

“Imported beer has progressively increased its share of overall domestic consumption as consumers adapted to higher-priced but more exciting international offerings with a wider palate ranging from ales and pilsners to pale lager,” Rannekleiv said.

The premium beer market is poised for further growth next year as two free trade agreements are set to go into effect, one with the US (KORUS) and another with the EU.

Under KORUS, beer can be imported into Korea duty-free beginning January 2018 and the existing 30% tax on beer from the EU will be phased out by July 2018.

AB InBev will likely be the leader in South Korea’s premium beer segment as its acquisition of Oriental Brewery in 2014 in combination with the country’s weakening domestic beer segment has given a strong foundation to develop a leading market position, according Rannekleiv.

“Looking forward, there will be moments where individual EMs disappoint, but the long-term overall outlook for volumes and value growth in emerging beer markets remains favorable,” Rannekleiv added.