The group, led by high-profile Auckland University professors Boyd Swinburn, Rod Jackson, and Cliona Ni Mhurchu and backed by public health advocacy Fighting Sugar in Soft-drinks (FIZZ), wrote an open letter to the cabinet stating that there was sufficient evidence to prove that the move would help fight childhood obesity.

"Multiple authoritative bodies worldwide have reviewed the available evidence on sugary drinks taxes and concluded that such taxes are likely to be one of the most cost-effective interventions available," they wrote.

But New Zealand’s health minister dismissed the academics’ calls. Jonathan Coleman said that credible proof that a sugar tax would have a desired effect was yet to be established, though ministers continued to monitor emerging research into the matter.

"There is no simple answer otherwise people would have tried it,” Coleman has said.

The academics believe that a 20% tax on sugary drinks would generate NZ$30m to NZ$40m (US$20m-27m) that could go towards obesity prevention programmes.

The government is committed to pursuing its “22 strategies” approach to make New Zealanders healthier, more active and better aware of safe nutrition—a policy which the academics dubbed “soft”, arguing that it did not go far enough to make a real difference.

The open letter also contained criticism of the anti-sugar-tax Food and Grocery Council, which it accused of putting “doubt in the public's mind and spooking politicians into inaction”.

Responding to the academics, Katherine Rich, chief executive of the FGC, said that calls for a sugar tax overlooked some realities about the nature of taxes and their lack of impact on actual sales volumes.

“The first thing that many don’t appreciate is that the sugar tax being discussed is an excise tax, not a consumption or sales tax,” she said.

Moreover, Rich said she believed that letters sent by health and education officials to school and health boards across New Zealand concerning the availability of sugary sodas had triggered more sensible action to encourage healthier food consumption than any sugar tax ever would.

Rich cited a recent letter from Peter Hughes, the education secretary, to all of New Zealand’s schools to encourage them to adopt water and milk-only policies as a turning point in the fight against childhood obesity.

She said: “This is a major shift for the ministry, which has previously told me [that these were] matters for schools to decide.”

Another letter, from the health ministry’s director general, Chai Chuah, served to “nudge thinking” within district health boards, said Rich, adding that the September missive was probably the first time the head of a ministry had made such a direct request.

“Both leaders appear to be encouraging sensible and realistic approaches to making sure schools and the health system are healthier environments without creating spartan hospital fare or shared-lunch food police,” Rich said.

More stories from Down Under…

Revealed: Australians’ tastes in tipples in terms of different liquor segments

Australians drink just over 426m glasses of alcohol between them each month, translating to an average of 23 glasses per person, according to the latest market research data.

Though a higher proportion of Australians drink wine compared to beer, this doesn’t necessarily mean that a higher volume of wine is consumed.

“By breaking down Australian alcohol consumption data into each 100 glasses drunk in an average four weeks, we get an instant understanding of the relative volume consumed of each beverage,” said Andrew Price of Roy Morgan Research.

“Especially striking is the fact that although a higher proportion of Aussie adults drink wine, those who drink beer consume it in greater volumes.”

For every 100 glasses of liquor consumed by Aussies in an average four weeks, 48 consist of beer, 25 are still wine, 11 are spirits, six are pre-mixed, four are sparkling wine or champagne, three are cider, two are liqueur and one is fortified wine.

Comparing the 100-glass breakdown between different age groups reveals some striking variations. For example, the beer component comprises 50 glasses out of each 100 consumed by the 18-24 year-old-age bracket, though only 42 among drinkers aged 65 and over.

Wine, on the other hand, accounts for 48 of every 100 glasses drunk by the 65+ demographic: 42 being still wine, four being sparkling or champagne, and two being fortified—substantially more than any other age group. Indeed, the number of glasses of wine consumed per 100 increases in proportion with age.

Drinkers aged 18-24 also consume more spirits (16 glasses), pre-mixes (also 16 glasses) and cider (three glasses) per average 100 glasses than any other age group.

“Comparing volumes consumed by drinkers from different socio-economic circumstances can also be interesting,” Price added.

“Beer consumption varies dramatically between the top, high-value AB socio-economic quintile of the population (who drink 45 glasses of beer per average 100 glasses of alcohol) and the lowest, least-wealthy FG quintile (57 glasses of beer consumed for every 100 glasses).”

Not surprisingly, the quantities of different beverages consumed by Australian women and men vary significantly. While beer accounts for 60 of every 100 glasses drunk by men (compared to 19 for women), women drink greater volumes of almost all the other beverages.

Natural nutrition industry lobbies for more inclusion in Australian health policy

The Australian complementary health industry lobbied state and territory ministers assembled at a Medicare reform meeting in Canberra last weekend to press for increased policy recognition for natural nutrition.

Carl Gibson, chief executive officer of Complementary Medicines Australia, used the opportunity to emphasise how complementary medicines could contribute to a required preventive health revolution.

“The reforms to deliver tailor-made care packages for individuals need to include a smarter role for preventive health measures,” he said.

“This is not limited to, but certainly includes, the use of complementary medicines for primary and secondary prevention of illness, and encouraging and empowering all Australians to take better care of their health.”

Gibson’s argument is backed up by a Frost & Sullivan report from 2014 which examined the use of six complementary medicines across four chronic disease conditions—cardiovascular disease, osteoporosis, age-related macular degeneration and depression, all of which contribute heavily to the national burden of illness in Australia.

The report estimated that between 2015 and 2020 average annual hospitalisation costs of A$922m (US$695m) could be potentially saved, along with gains in productivity of A$900m.

CMA’s effort is the latest move in a lobbying drive that saw Gibson present a health economics analysis to lawmakers in Parliament House in November.

The report showed that that the use vitamin B3—nicotinamide—could potentially save A$2 in healthcare costs for every A$1 spent.

It used economic modelling based on the Ontrac study, an Australian research paper published in the New England Journal of Medicine, which showed a 23% reduction in the risk of new skin cancers when nicotinamide was given as a supplement.

“A greater focus on preventive health is an essential move towards improving the cost- effectiveness of the Australian healthcare system and crucial in taking pressure off over- stretched hospitals,” added Gibson.

Beston beats import prohibition through Chinese distribution deal

South Australia’s Beston Global Food Company has signed a manufacturing and distribution agreement with Hondo Agricultural Company of China for the production, marketing and distribution of its range of allergen-free, ready-to-eat meals.

Roger Sexton, Beston’s chairman, said the agreement was an important stepping stone in BFC’s strategy to build its market share in China, especially as local import regulations currently prohibit the import of foreign processed meat products.

“We have been working with Hondo for some time, together with Chinese and Australian authorities, to find a way of taking our ‘no numbers’ range of meat products to consumers in China, who are increasingly looking for healthy, nutritious, high-protein foods for their families,” he said.

The ready-to-eat meals, which are free of preservatives, colourings and artificial additives, will be sold to retailers and food service businesses under the Yarra Valley Wholesale Meat brand owned by Scorpio Foods, a BFC investee.

The agreement with Hondo, one of China’s biggest meat processors, will allow Scorpio to export frozen boned-out meat to China, where it will be processed into ready-to-eat meals in the Chinese company’s facilities in Henan province.

Scorpio will provide the recipes for the meals under a proposed licence to Hondo, said BFC chief executive Sean Ebert.

“The proprietary sauces and other key natural ingredients in the meals will be supplied by Scorpio to Hondo for manufacturing of the final products under technical and QA supervision by Scorpio,” Ebert said.

Under the terms of the proposed licensing agreement, Scorpio will earn a royalty on its intellectual property in addition to revenue on its sale of raw materials and fees for services rendered.

BFC will provide Chinese consumers with product provenance and anti-counterfeiting verification on the products through Oziris and Brandlok technologies.

Using its established network, Hondo anticipates the manufacture and distribution of 15,000 tonnes of the Yarra Valley products in the first year, followed by a 5,000 tonne increment in the second.

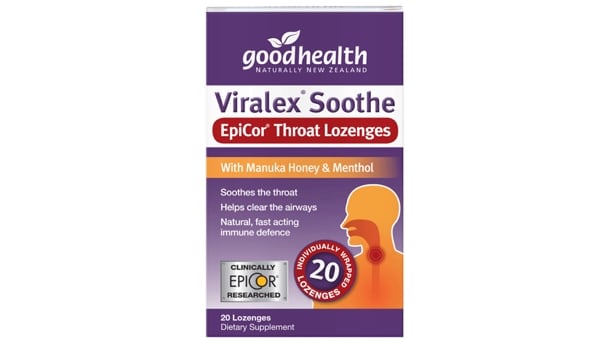

World’s first EpiCor yeast fermentate lozenge launched in New Zealand

New Zealand ingredients supplier Embria Health Sciences has announced the launch of the world’s first throat lozenge formulated with EpiCor yeast fermentate.

The product, Viralex Soothe EpiCor, become available across New Zealand this march through Good Health Products.

EpiCor is widely available across the world and is clinically shown to support a strong immune system.

Julia van de Coolwijk, Good Health’s marketing manager said the company had already been been using EpiCor in its Viralex Attack capsules, for which it had seen sales grow by almost 75%.

“We wanted to leverage the success of EpiCor by providing this unique ingredient in a different format and to specifically target a different cold and flu symptom: sore throats. We have also developed this product to be complementary to our existing Viralex range.”

“EpiCor provides a differentiated product by being natural and fast acting. It was also an effective material for making into a high-boil lozenge and with exclusivity in the New Zealand market it provides us with an ingredient that enables a strong and unique point of difference from our competitors.”

Jeff Cannon, chief executive of Embria’s parent, Diamond V, said: “Embria strives for partnerships with our brand customers. In a short period of time Good Health has become a valued partner of Embria’s in the New Zealand marketplace and a very effective marketer of seasonal products featuring EpiCor.”