As part of its new strategic direction, Nestlé said it will sharpen focus on its international (Perrier, S.Pellegrino and Acqua Panna), premium mineral, and functional water brands.

The company also made several environmental pledges including achieving carbon neutrality across its entire water portfolio by 2025; 100% replenishment of the water it uses; and halving the use of virgin plastics by using less recycled PET in its packaging and supporting “alternative delivery systems."

Mark Schneider, Nestlé CEO, said: "The creation of a more focused business enables us to more aggressively pursue emerging consumer trends, such as functional water, while doubling down on our sustainability agenda. This strategy offers the best opportunity for long-term profitable growth in the category, while appealing to environmentally and health-conscious consumers.”

The review of its North American waters business unit is expected to be complete by 2021.

Euromonitor analyst: Conveying value for regional, standard water brands

So does this move come as a surprise?

“This possibility of selling Nestlé Waters doesn’t surprise me, for a few different reasons," Howard Telford, head of soft drinks, Euromonitor International, told FoodNavigator-USA.

"One of the long-term problems with the US packaged water market has been the difficulty in conveying value with regional, standard water brands in the portfolio."

Telford noted that US still bottled water has been one area of the few categories of FMCG where the US has much higher rates of private label penetration than Western Europe (Euromonitor estimates private label accounts for roughly 45% of US off-trade volume versus only about 18% in Western Europe in 2019).

American consumers are very price conscious when it comes to bottled water, explained Telford: “Particularly as we head into a difficult recessionary environment for the rest of FY2020 and 2021, these regional brands can often be ‘caught in the middle’ between low-cost private label alternatives and the premium/ultra-premium end of the market."

This consumer behavior of choosing the least expensive option (among mid-tier brands such as Nestlé) makes it harder for companies to justify the cost of using alternative, more sustainable packaging materials, according to Telford.

“When we think about the major obstacle with packaged water – sustainability and single-use packaging waste – it can often be harder for these mid-tier brands to justify the investment in alternatives to single-use PET when consumers are likely to trade down to cheaper PET private label options. This is a category wide problem.”

Divestment comes faster and stronger than expected

Investment banking firm Mainfirst commented that “a potential deal was expected but it came faster and stronger than expected.”

The firm continued: “The divestment is consistent with Nestlé’s strategy to focus on higher growth, higher margin businesses with stronger returns. According to our research, we expected the divestment of most of its US regional brands. However, the divestment of its largest US brand, Poland Spring, as well as Pure Life USA and the HOD (home and delivery), goes one-step further.”

The Nestlé Waters business in North America, excluding international brands, had sales of around US$3.58bn in 2019. And despite several years of investment into Nestlé Waters' North America unit, which included an overhaul of its sparkling water portfolio in 2018 and sustainable packaging improvements, several of its regional bottled water brands have lagged in sales.

Source: Mainfirst, A Stifel Company

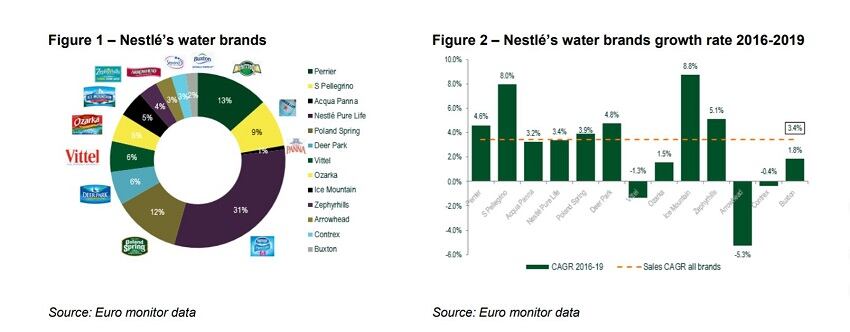

According to Euromonitor sales data from 2016 to 2019, Nestlé Waters North America business unit averaged 3.4% in dollars sales growth across all of its brands with regional water brands, Ozarka (+1.5%) and Arrowhead (-5.3%) seeing low- to negative growth compared to Perrier and S.Pellegrino, which registered a 4.6% and 8% sales increase respectively.

Despite some of its regional waters business performing well over that same time period – Ice Mountain and Zephyrhills saw dollars sales increase 8.8% and 51%, respectively, over the same period – Mainfirst speculates that Nestlé will divest the entire NWNA portfolio to get a higher combined price from a potential buyer.