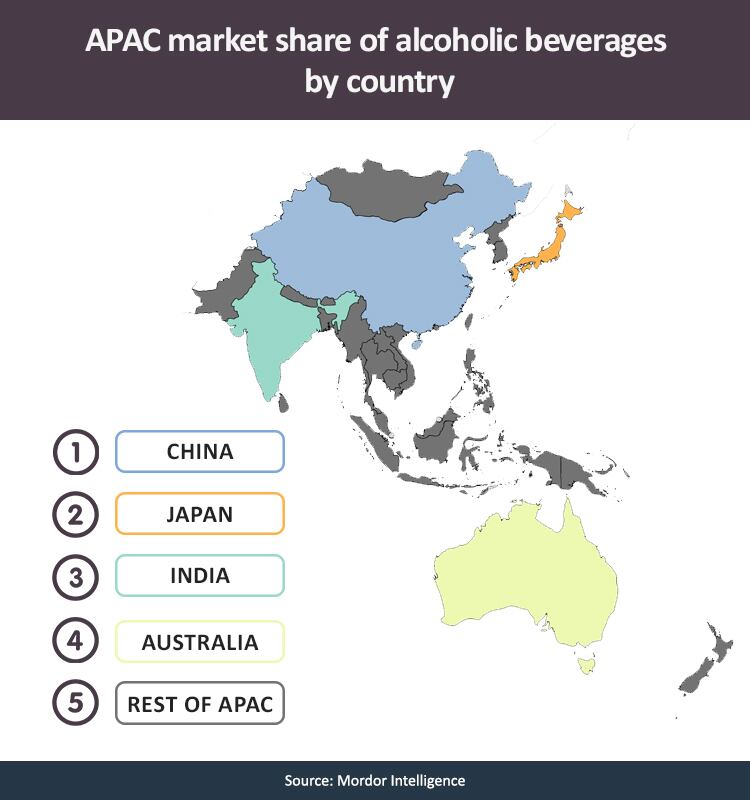

As of last year, healthy growth was still being predicted by experts for the alcoholic beverage market in APAC, such as by analyst firm Mordor Intelligence which expected a CAGR of 4.41% for the sector between 2020 to 2025, and Statista which expects revenue for the market to hit US$540bn in 2023, up from US$480bn in 2019.

Much of this growth was, and still is, expected to come from China, which holds held the largest market share of alcoholic beverages in the region, followed by Japan, India, and Australia.

However, the recent COVID-19 pandemic has hit many F&B industries hard, and alcoholic beverages have felt the brunt of this, especially with lockdowns throughout the region banning foodservice operations such as restaurants and hotels, thus depriving the sector of its major source of business.

In Australia, for instance, trade body Alcohol Beverages Australia (ABA) has reported that ‘overall alcohol consumption in Australia is lower than it was at the same time last year due to pubs, bars, clubs and restaurants closing’.

“Our beer, wine and spirits producing members are all telling us that sales lost through ‘on-premise’ pubs, bars, clubs and restaurants has only marginally been made up for by an increase in packaged retail liquor sales,” said ABA CEO Andrew Wilsmore.

“Indications are that overall sales and volume loss range from 10% to 30%, with many small producers even more severely impacted as they are unable to access the retail channel or have had to close their cellar/brewery/distillery door.”

These findings have been echoed by alcohol beverage firms throughout the APAC region. According brewery giant Asahi’s public relations manager Kristin Chiu, the firm also saw a decrease in sales from the food service sector (restaurants, cafes, hotel), especially after Japan announced a month-long nationwide state of emergency.

Sapporo Breweries Public Relation Manager Yasuhiro Nagumo reported similar findings, telling us that beer sales in March 2020 only reached 89% compared to the same period last year, and that more people were purchasing alcohol on e-commerce during this period.

“It seems that there are fewer opportunities to drink alcohol at restaurants, and more opportunities to drink at home. As a result, more consumers are buying alcohol through e-commerce,” he said.

Kavalan Distillery – Taiwan’s first whiskey label – has also seen the impacts that lockdowns can have on alcohol sales. Its Global Public Relations Officer Kaitlyn Tsai told FoodNavigator-Asia that although it managed to maintain its local Taiwanese revenue because the country did not impose strict lockdowns, restriction in its other markets worldwide meant a drop in overseas sales.

“The negative impact cannot be quantified at this moment, but it is not as severe as expected and recent sales are gradually recovering,” said Tsai.

That said, it has not all been doom and gloom for the firm as off-trade sales (retail) have increased since the pandemic, as has e-commerce which has ‘soared’.

Product innovations with local ingredients have been particularly prominent in the industry, as can be seen by Kavalan having focused on fruits native to Yilan, the district where its distillery is located in, for its gin launch.

“Our entry level Kavalan Distillery Select No.1 looked at more subtropical fruits like mango, pineapple, and green apple, whereas the number two will be have floral and herbal notes. As for our first gin in the portfolio, we will include the normal juniper and anise, but also include fruits native to Yilan like red guava, starfruit and kumquat,” said Tsai.

The same has been seen in the craft beer sector as well, for example Singapore sustainable brewery Crust Brewing, which brews beer from surplus bread, has created a beer using ulam raja (the King’s salad) which is a herb commonly consumed as a raw vegetable by communities in the South East Asian region.

Crust was also impacted by COVID-10 and had to shift more to direct consumer sales from its previous B2B business model to survive, as well as put a lot more focus on collaborations with local breweries, e.g. launching a 12-pack of mixed beers, each one from a different brewery.

“We started off as a B2B company, but when COVID-19 hit we saw a lot of investment interest and commitments affected, which was understandable given the situation, so we made a shift to selling more B2C, and surprisingly, have done pretty well given everything,” Crust Founder and CEO Travin Singh told us.

“It did affect us quite badly at the initial stage, but right now I would say we’re doing better than when we were only doing B2B.”

Watch the video below to find out more.

Handling the health trend

In addition to COVID-19, the industry has also had to deal with changes such as a rising health awareness trend amongst APAC consumers – a major challenge for the industry, especially as ‘alcohol’ is not commonly associated with ‘health’.

It is for this reason that many major brands have opted to widen and diversify their portfolios, adding healthier choices in hopes of retaining consumer interest.

HEINEKEN APAC Marketing Transformation Director Sarah Maddock told FoodNavigator-Asia. “[In] recent years, consumers, especially Millennials and Gen Y drinkers, have increasingly become more health conscious and that drove the introduction of Heineken 0.0 to the market, [giving] the consumer a zero-alcohol Heineken with only 69 calories and without compromising on taste.

“These drinkers [are] also a generation that prefers lighter, easy to drink beers – which is why we put Tiger Crystal (lighter variant) in multiple countries, and Heineken Silver (smoother brew) in Vietnam were put on the market for that reason as they take away some of the bitterness that traditionally appeals to more mature beer drinkers.”

This is not to say that Heineken and Tiger have not been impacted by COVID-19 though – Although she chose to remain coy on details, HEINEKEN APAC Heineken and Tiger Brand Director Maud Meijboom said that ‘some impact’ has been seen, though it has widely differed based on brands and channels.

“Where countries have had to close F&B outlets and implement some form of lockdown as part of safe distancing measures, yes, we see an impact on the sale of our beers,” Meijboom told us.

“The impact differs by brand, for example whether they have a significant footprint in the F&B outlets. For newer products it also depends on what channels we are looking at. For example, new products we have launched in retail are performing in line with the trend in that channel.”

Low-to-no-alcoholic beverages are a must-mention here when it comes to the rise of the health trend in alcohol, and apart from Heineken’s Heineken 0.0, other big firms such as Kirin have also picked up on this.

Kirin Brewery recently released its non-alcoholic beer, Kirin Greens Free in Japan to meet demands of consumers with increasing health concerns, and the firm’s Corporate Communications spokesman Ataka Takashima told us that this was an important area for the firm.

“Non-alcoholic beers constitute just 5% of all alcohol in Japan and while it may not seem much, it has been growing 3% over the last three years,” he said.

“Japan’s alcohol tax will be reformed in October this year, which will likely lead to [more] existing beer consumers shifting to non-alcoholic beers.”

Kirin also has another non-alcoholic beer option with a health focus, Kirin Karada Free, which claims to reduce body fat.

New, unique ingredients

Another direction that the alcoholic industry in APAC has taken is to innovate using unique ingredients – such as hemp and dairy.

One example is Australia’s The Cannabis Co., which has become known for its hemp-based gins. Its secret ingredients are called ‘terpenes’, essentially natural organic compounds, rich in flavour and aroma, that are found in cannabis and hemp.

“We carry three very distinct, premium gins in our current portfolio: ‘The Myrcene’ (40% ABV/alcohol-by-volume), ‘The Jilungin Dreaming’ (42% ABV) and the ‘High Seas Navy Strength’ (58% ABV),” The Cannabis Co. Brand and Strategy Director Martin Dybalski told us.

“The terpene ‘myrcene’ provides “The Myrcene” Gin with a bright, fresh, grassy herbaciousness, whereas ‘limonene’ provides “Jilungin Dreaming” with delicate, lingering notes of candied citrus and ‘b- caryophyllene’ provides the “High Seas Navy Strength” with a sweet, dry and spiced profile.

“[All] three are very distinct from one another, [and although] it’s a little unfair comparing a premium to a regular product, I’d say the biggest differences between our gins and regular gins are found in aromatics, complexity and quality of grain spirit/mouthfeel.”

Although Dybalski made sure to emphasise that the firm makes no health or therapeutic claims for its products, many terpenes are being studied for potential health benefits.

“[A] lot of terpenes found in Hemp are being studied for their potential medicinal benefits, with some early research showing promising anti-inflammatory, anti-bacterial and anti-carcinogenic effects,” he said.

That said, innovating with this unique product carries with it some unique challenges too.

“[One] of the most immediate obstacles we’re facing is building our digital presence on platforms like Facebook, as at present, Facebook policy prohibits advertising of any ‘consumable’ hemp or Cannabis products across the platform globally,” he added.

Another example in this category is Hong Kong’s OH CBD beer, which claims to be ‘anti-hangover’ according to Henry Leung, founder of the start-up OH5 Company.

“Although more research is still needed to be done by scientists to look into the effects of combining CBD and alcohol, however we believe there is certain therapeutic value that can be present,” he said.

“Some reports have suggested blood alcohol level can be lowered while reducing some of the alcohol’s toxic effects on the liver.

“Bottom line is, the way our body takes in and metabolise CBD and alcohol is complex, and everybody is different, an individual’s response to a CBD infused beer is largely dependent on genetics. So, everyone’s experience may be different.”

OH CBD’s beer contains a citrus flavour with floral notes, inspired by hops and hemp. According to Leung, hops and hemp are both are from the Cannabaceae family, and are close relatives.

He added that he also faced challenges with his unique product in Hong Kong, because the awareness of CBD there is relatively limited.

“Unlike in Canada and US, they have many CBD products like chocolate, candies, coffee, and even cocktails mixed with CBD oil,” he said.

OH CBD had planned to release its second batch of beer at the end of February, but also had to also production due to the COVID-19 pandemic.

“Due to the coronavirus, no one is going out now, so we are focusing on promotion, creating awareness of our products, and working on recipes,” said Leung.

Dairy has also been a rising star in alcoholic innovation – for instance, Lewis Road Creamery and Kahlua teamed up to form a liqueur enriched with cream.

“We re-mixed our fresh, rich cream with Kahlúa’s original and legendary coffee liqueur, [blending] 100% Arabica coffee with subtle aromas of vanilla and chocolate combined with rich cream,” Lewis Road Creamery General Manager Nicola O’ Rourke told FoodNavigator-Asia.

“We also blended fresh New Zealand cream and real, rich chocolate with a touch of triple distilled premium spirits [to form our] Chocolate Liqueur.

“[Both] these liqueurs are different as they don’t have unnecessary additives, just liqueur and our fresh homogenised cream – as it should be.”

Sustainability in alcohol

Another rising trend in the APAC alcohol industry is sustainable production, such as reducing food waste or using recycled water.

This is growing particularly quickly in Singapore, such as with Singh’s firm Crust Brewing which brews beer using fresh surplus white bread as a means to minimise food wastage in the country, where food wastage rose 30% to 40% from 2008 to 2018.

“The bread is used to substitute 30% of grains in beer production [and we have] plans to further reduce waste, including using spent grains, the by-product from beer production as a possible animal feed or fertiliser,” Singh said.

The company is currently developing a bread-based spirit as well.

Craft brewery Brewerkz is also in collaboration with Singapore’s national water agency, Public Utilities Board (PUB) to brew beer using treated water using NEWater, Singapore’s own brand of recycled water.

Alcohol in Asia

While the sector certainly faces it challenges, most experts remain optimistic about its future prospects.

Kavalan’s Tsai emphasised to us that drinking in Asia, such as in Taiwan, has traditionally been associated with business occasions, but has gradually evolved to become a social experience.

“These days with economic development, more Asians, especially the younger generation, are likely to associate drinking with personal occasions and enjoy alcohol purely for fun,” she said.

China wine industry expert Emilie Steckenborn also told us that millennial consumers in China are likely to lead the e-commerce boom for the wine industry in China, which is slowly emerging out of its lockdown.

“E-commerce can provide rich information about a wine at [younger consumers’] fingertips, which they crave, plus they can get reviews and descriptions of flavour, origin, storage conditions and so on – even face-to-face retail businesses may not know some of this information,” she said.

All in all innovation and flexibility, whether it comes to marketing, retail or product innovation, is clearly the way forward for alcoholic beverage firms in APAC both big and small to make it through the current crisis and those that master this are likely to emerge stronger.