Soapbox

If Mexico’s soda tax really works, why are tax revenues still rising?

The paper, entitled “Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study”, was written by M Arantxa Colchero, Juan A Rivera, and Shu Wen Ng—but the most significant co-author was Barry Popkin, a self-described “political activist” who has been a prominent lobbyist for soda taxes in the United States and other countries for many years.

His views are that “taxation, just like it did for tobacco, is the most effective way to change behaviour”. The work was funded by Bloomberg Philanthropies, which doesn’t mince words either when it admits its modus operandi is “quickly to fund aggressive media campaigns in support of the [Mexican] tax”.

Hardly surprising, then, that the study concludes the Mexican soda tax has been a roaring success. With soda tax activists around the world spending so much time and effort trying to convince political decision-makers to implement taxes with all eyes on Mexico, was there ever going to be any other conclusion?

Although, in the text of the paper, the authors are careful not to equivocally state that the tax has been the cause of reduced consumption of sugary drinks, this is not the way it has been reported in the media. International headlines include “Mexico’s sugary drink tax makes a dent in consumption” and “Mexicans begin to slim with the help of the soda tax”.

In New Zealand, pro-tax commentators leapt on the paper six months before it was officially published, using it to lobby politicians and government health officials, and making statements in the media that the results were “vindication” and that “New Zealand really needs to consider this evidence of impact”.

Here, and probably in many other parts of the world, now the sugar tax proposal has the formal BMJ stamp of publication approval, it’s being once again presented to political decision-makers and officials with all the solemnity of the Stone Tablets handed down to Moses as proof that such taxes work to reduce obesity.

The fact that the authors say—somewhat buried over halfway through the paper—that “a major limitation of this work is that causality cannot be established...” got completely lost in social media and the online hurrah that the tax had been a so-called success.

Professor Popkin’s public comments added to this impression too. Prior to its publication, he told the New York Times of the study’s findings: “It’s exactly what we thought the tax would do.”

Even while admitting in a recent interview that the tax has resulted in consumption changes too small to have a major impact on anything, he glossed over this, arguing that that wasn’t apparently the point of the study: "The point is proof of concept," he told online magazine Mic. "It shows the tax works."

Let's not be peso-mistic

Actually, it doesn’t. But to be fair, Mexico’s soda tax has worked in one major respect, in that it has been an easy way to raise many billions in tax. It has certainly provided a massive windfall for the government.

In 2014, Mexico’s treasury budgeted on collecting 12.5bn pesos (US$680m) from the tax—though, in fact, it netted 18.3bn pesos (US$1bn). Accepting that gain, it then budgeted for 18.3bn pesos last year—a clear indication that it wasn’t expecting purchasing or consumption to change any time soon.

Last November the collected soda taxes were already close to 19.5bn pesos, with December’s figures still to be added. The rising amounts of tax collected is probably the strongest evidence of all that the tax is not working to reduce consumption of sodas.

Pro-tax supporters have yet to answer the inconvenient question: if the tax is supposedly discouraging consumption in Mexico, why is the tax collected continuing to rise?

Having to collect money from a small number of beverage firms makes it an efficient tax and hard to evade, but in every other aspect the tax, which was implemented as an anti-obesity measure, does not work. There has been no evidence to date that it has had any effect on obesity or total calories consumed.

But back to the Popkin paper, which relies on reported data from respondents, not actual sales data. This means that it measures what people say they do, and as anyone who studies consumer behaviour knows, what people do and what they say they do can often be poles apart.

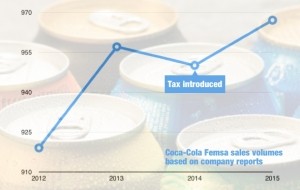

Put another way, what respondents say they consume is a long way from actual soda purchases, which in terms of sales volumes is nationally right back to where it was before the tax. It’s a surprise this is not mentioned in the limitations section part of the paper.

The paper is elegantly constructed, as sound as it can be once its limitations are considered, and creates the impression that it’s built on rock solid evidence with all sorts of impressive references to data, tables and complicated analytical techniques.

Post hoc ergo propter hoc

But it also makes some fundamental mistakes in understanding economic theory and consumer demand, the nature of the excise tax, the behaviour of local soda firms in Mexico, and worldwide beverage trends that pop the idealistic balloon that its conclusions demonstrate. These, according to Professor Popkin, are that “the tax works”.

Pointing out quietly a key limitation of the paper, that it doesn’t show causation, doesn’t stop the authors carrying on their analysis as if it does. They note an apparent drop in consumption and assume this is solely due to the tax.

But could it be that the slight drop in consumption during the period might simply be more in keeping with the biggest worldwide trend of all: that over the past few years, consumers have shifted their preference from full-sugar to lower-calorie or zero-sugar drinks, and in some cases away from carbonated drinks as a category?

The study makes the worthy statement that attempts have been made to factor in other potential influences that might affect the findings, but then ignores the recent trend altogether.

The beverage industry believes this trend is due to a number of factors, such as the development and launch of many popular low/zero sugar variants of well-known brands and the fact that consumers are getting the message that excessive sugar consumption is not healthy and that water should be the key source of refreshment.

It’s a trend that appears in countries where there are no soda taxes, such as New Zealand and Australia, but in the study and media commentary, the authors seem happy to claim the minimal decline reported by the sample of Mexican consumers as the exclusive success of the tax.

There should have been more contemplation in the paper that the tiny decline in consumption—less than a few sips per day per person—could be due to other influences. Here in New Zealand, carbonated drinks sales have been in decline for the last few years, dropping a further 4.4% in the past 12 months alone—without a soda tax in sight.

The study also overlooks a potential flaw in timing. Even if the scenario is that the tax had an impact in dampening consumer demand in the short-term, the medium- and long-term analysis shows the tax has not affected sales volumes significantly over time.

While it reports the reduction of a few sips a day, industry says sales volumes overall are the same as before the tax. For some firms, volumes are even growing. To repeat: firms report that sales volumes—a very accurate proxy for sodas consumed—are now the same as before the tax or growing.

Like the overall rising tax collected both measures show clearly that the findings of the Popkin research paper do not reflect what’s really happened in Mexico.

All of this means the only thing that’s really changed is that consumers are paying more for drinks and the Mexican government can extract almost twice the amount of tax it had budgeted for. There is no evidence that the tax has affected the number of calories consumed or has had any effect on obesity.

Excise: the demon

There’s a final point the authors have failed to grasp. Apart from potentially raising the prices of all beverages by a small amount by way of the tax, there is no price signal to consumers to differentiate between sugar and non-sugar drinks. This is because sugar and non-sugar sodas within the large manufacturer brands are priced the same.

Many proponents have wrongly assumed that taxes raise the price of only the sugary sodas, making them more expensive, and therefore less likely to be purchased due to the cost differential with non-sugar choices. But that’s not what has happened in Mexico, because the tax is an excise tax, not a sales tax.

Because of that, beverage companies have full freedom as to how they apply it across their entire range of products, more or less treating it as they would any other overhead, which is exactly what they did.

The tax was passed on to consumers in higher prices for all drinks, be they sugary drinks, non-sugary drinks or even bottled water. In application, the tax has had the effect of raising prices (by 15.3% for sodas)—but this has been the case for all beverages, not just those with a sugar content.

When the final price in the store of a regular Coke is exactly the same as a Coke Light, or a Pepsi the same as Pepsi Light, it’s remarkable that academics can still cling to the idea that an excise tax paid by a manufacturer way back at the beginning of the supply chain (and spread across the range like any other overhead) is magically going to affect consumer behaviour at the store level and encourage consumers to choose non-sugar over full-sugar drinks.

When brands are priced identically from the perspective of the consumer, regardless of sugar content, consequent changes in volume consumed cannot be attributed to the presence or absence of the tax.

In summary, this study is very far from “proof of concept” that soda taxes work as a public health intervention. What it is proof of is that we all need to continue to remind consumers around the world about moderation, balancing energy with activity, and making sure they drink enough water each day.

There is no doubt that some people consume far too many calories and are not active enough for good health. Industry, public health, governments and families all play a part in encouraging fellow citizens to adopt healthier diets. However, the punitive taxation of food and beverages to price goods beyond citizens’ incomes is unlikely to be a humane or effective solution.

- Katherine Rich served as a member of the New Zealand House of Representatives for the National Party from 1999 to 2008. She has been chief executive of the New Zealand Food & Grocery Council, an industry lobby group, since 2009.