GSK's iconic tonic: Abandon Ribena and Lucozade to Big Beverage

After completing a strategic review GSK chief executive Sir Andrew Witty confirmed ongoing market speculation that, “the tremendous growth potential of these iconic brands, particularly outside the ‘core’ Western markets, could be better leveraged by companies with existing category presence and infrastructure in these regions.”

“As a result, we have decided to pursue the divestment of these brands, subject to the realisation of appropriate value for GSK shareholders.”

£1bn ($1.53bn) is the price being bandied about for both brands, with Japanese player Suntory and Coca-Cola mentioned as leading candidates by analysts. GSK said it had already received interest but did not name names.

Both brands remain strong sellers, especially in the UK (Nigeria is a booming market also), although Lucozade sales dipped 2% in the quarter, while Ribena sales increased 2%. Combined sales, mostly in the UK, are estimated at around $900m.

Lucozade has struggled to keep pace with global energy and sport drink leaders like Red Bull and Pepsi-owned Gatorade. In energy drinks it slipped from 3rd in 2007 to 7th last year.

Euromonitor International senior beverage market analyst, Hope Lee, said there was no guarantee the brands would land in the same beverage house.

“…it makes sense for the two established brands to go to different companies as what they offer is very different,” Lee said, noting Lucozade extensions like energy shots had failed to take in the market and been withdrawn. A US entry had also stalled.

“Lucozade appears tired and has found it hard to regain the strength to recover.”

“At a corporate level, consumer beverages are far from a core business for the brand’s pharmaceutical parent. Therefore, selling off Lucozade at a time when it is still highly valued in several markets and using the proceeds to fund other growth areas sounds like a good idea.”

Potential suitors

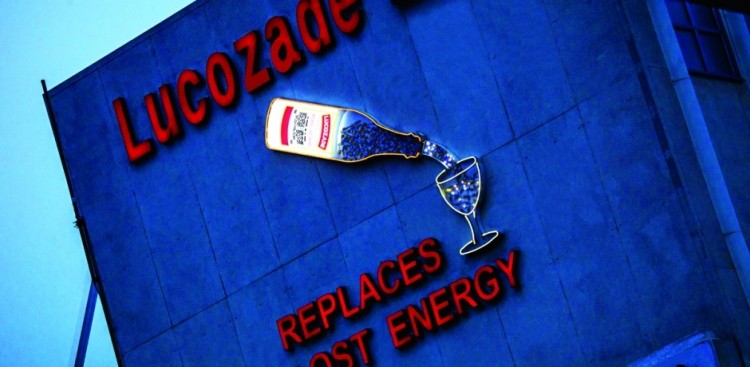

Lee said the brand launched in 1927 to "replace lost energy" could tempt Coke.

“History has taught Coca-Cola a sad lesson. While it hesitated, PepsiCo snapped up Gatorade. Ever since, Coca-Cola has remained under PepsiCo’s shadow in the category. Last year, there was a rumour that Coca-Cola might be interested in purchasing a stake in Monster, but the company refuted this.”

“However, there are signs that the company desires a strong sports and energy drinks brand. Lucozade would lift Coca-Cola’s category share by two percentage points, taking it closer to Red Bull.”

She added that, “Although PepsiCo has no international energy drinks brand, building a global fruit/vegetable juice brand would seem more important to PepsiCo than acquiring Lucozade at this time.”

Then there was ambitious and expanding Suntory.

“Suntory, which ranks ninth globally in sports and energy drinks, could also be interested in Lucozade. Along with V, Lucozade could become another international brand to aid Suntory’s globalisation ambitions. Suntory has established a new department specifically for acquisitions, with Lucozade perhaps being its next target.”

She said a firm like Eckes might be interested in Ribena, which was in general less interesting, due its rather niche proposition.

"Euromonitor International believes that whoever purchases the two brands will have to seriously consider growing them globally in order to make the cost of the purchase worthwhile."