Focusing growth: Can Australia's wine export strategy beat industry challenges?

Exports are crucial to the Australian wine market: some 62% of wine produced is exported. And Australia’s wine industry has enjoyed decades of success as a thriving wine exporters, with the nineties and noughties representing years of significant expansion.

But declines in the global wine market mean wineries need to carefully pick where the opportunities are.

'Extremely challenging' conditions

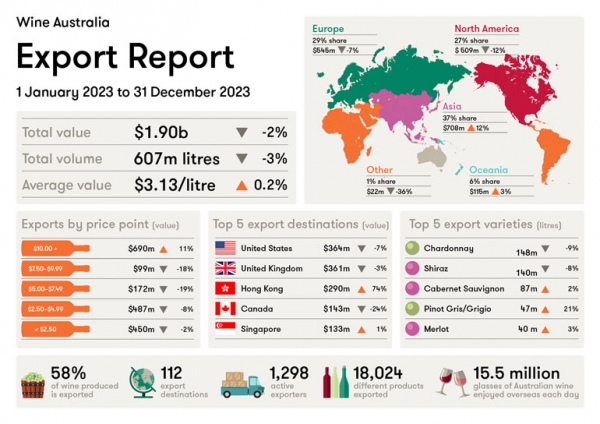

In 2023, the value of Australian wine exports declined 2% to $1.9bn AUD while volumes declined 3% to 607 million liters.

Overall, trading conditions remain ‘extremely challenging’ for Australian exporters. Out of the 112 destinations that received Australian wine during the year, only 44 imported more value than the previous year.

Globally, wine consumption is declining, due largely to a combination of a global economic tightening resulting in less discretionary spending and consumers cutting back on alcohol. This has seen alcohol consumption fall, including for wine. For consumers who do drink alcohol, there’s a lot of competition from other categories.

Adding to these pressures is the global oversupply of wine, with an average excess wine production of just under 3 billion liters every year since 2012 (to put that into context, that’s more than double Australia’s total annual wine production).

Australia still punches in high on a global scale, however, being one of the larger global exporters of wine. But its regional focus is shifting.

Its 2023 export report, published this month, shows a decline in value to Europe’s top 15 markets (in value terms) as the region suffers through high inflation. North America, too, saw its share of Australia’s wine export market decrease.

Asia’s share of export value, however, has grown to 37%: which makes it the largest market against 29% for Europe and 27% for North America.

Hong Kong and Singapore are ‘stand-out’ destinations: with these key trading hubs also on-shipping wine to other markets.

And Asia represents a long-term opportunity, says Wine Australia's General Manager of Marketing, Paul Turale.

“Within Asia, there are many emerging markets that need nurturing to grow the long-term demand for wine – and many wine businesses are already doing so.

“Asia is where most of the world’s economic growth will come from in the next 30 years – and this translates into greater purchasing power. This will help fuel growth in wine consumption in the region. Australian wine is well-placed to take advantage of this growth given proximity to the region and our already strong position in many of these emerging markets.

Bumping up premium

Consumers are trading up their wine choices: choosing to drink less but pay more.

That’s a trend that Australian wineries need to adjust to: given that the majority of Australian export volumes are in the commercial (less than $10 USD) a bottle) price segments.

With premiumization expected to play a key role in wine’s future, focusing on this area will be a key priority. In 2023, for example, all categories below the $10 a bottle mark declined: but the $10+ category grew 11%.

Wine consumption globally is declining, and this is most prevalent at the commercial end of the market and especially in mature markets such as the US, UK and Australia. However, there is growth in premium price points. Tightening economic conditions have seen this growth slow in recent times but the longer term the expectation is that growth in premium wine will continue in the long-term.

“The biggest opportunities currently for premium Australian wine are in the more mature markets where premium wine sales are growing such as the US, Canada, Australia and, to a lesser extent the UK and Japan,” notes Turale.

The top five markets by value (AUD) were:

• US (down 7% to $364 million. 19% share of total export value)

• UK (down 3% to $361 million. 19% share of total export value)

• Hong Kong (up 74% to $290 million. 15% share of total export value)

• Canada (down 24% to $143 million. 8% share of total export value), and

• Singapore (up 1% to $133 million. 7% share of total export value).

The top five markets by volume were:

• UK (up 2% to 220 million liters. 36% share of total export volume)

• US (down 5% to 134 million liters. 22% share of total export volume)

• Canada (up 7% to 73 million liters. 12% share of total export volume)

• New Zealand (down 2% to 29 million liters. 5% share of total export volume), and

• Germany (down 7% to 27 million liters. 4% share of total export volume).

Building export prospects

There are, says Turale, many hurdles for the Australian wine sectors. But he is confident that extensive activities planned for 2024 will assist in building sales and distribution across both emerging and established markets.

Those activities need to be carefully planed for each market.

“Every export market has nuances, and approaches have to be tailored to suit the needs of each market," he said. "However, generally activities have to be multi-faceted comprising everything from navigating market access challenges, to building relationships with distributors, getting wine in front of buyers (as well as matching wines to needs), and marketing products to consumers – these are not one-off activities, but all require ongoing time and investment over many years.

"For example, the US market has a complex structure and can be difficult for wineries to navigate, so one of Wine Australia’s activities is a business matching program that assists wineries to find routes to market as well as providing guidance on compliance, logistics and marketing.

Some other activities this year in key markets for Australian wine that aim to bring wines and wineries to key members of the trade in different markets are the Australia Trade Tasting, Vinexpo and Wine Paris, ProWein, Vinexpo Asia, Australian Wine Tastings in Osaka and Tokyo, and South East Asian Roadshow.

"We’ve also recently hosted monopoly buyers from Canada, sommeliers from Brazil in Australia to experience our continent of wine first-hand, and later this year will host visit programs for a small number of trade and media from the UK and Europe, US, Japan, Korea and Vietnam."

Tackle challenges with innovation: 'There will always be opportunities'

As a new world wine, Australia’s wine industry has always prided itself on being able to think a little more outside of the box than its European counterparts, which are often firmly rooted in tradition. Take, for example, the low/no alcohol wine category: where producers can be more open to exploring and innovating beyond the traditional alcohol content of wine.

“It’s a particularly difficult period currently for many wine producers around the world,” admits Turale. “But the wine industry is full of innovative businesses. Consumption patterns are changing as consumers expand the range of beverages that they drink. Wine has competition from other alcoholic drinks, but also from growing demands for no and low alcohol options. Businesses will innovate in response to this to continue to grow.

“There will always be opportunities for wine and there are many trends that can be harnessed by wine companies that suit their business plans.”