Collins, who was speaking to FoodNavigator-USA as Celestial Seasonings prepared to re-open its offices in Denver to move to a hybrid working model, explained: “In recent years there have been really low dollar growth and volume declines in the tea category, with growth coming from premiumization and pricing; the category had been really sluggish, losing households year over year for a number of years... until we hit the pandemic.

“And then we saw people really coming back into the category, so light users increased their usage, but we also had new people coming into the category, and household penetration expanded for the first time in about five years.

He added: “If you look at our bagged tea business, in the past 52 weeks, we're up about 10.5% in consumption. And then if we were looking versus two years ago, we're up 24.5%, so we’re outpacing the overall category.

“We've won an outsized share of TDPs or distribution points over the past year, so we’ve had double-digit increases in our distribution on our bagged business, and then we've also dramatically grown our K cup business over the past year.”

Sleep, energy, immunity…

So what’s behind the growth, aside from more people staying home?

According to Collins: “I think there's been a renewed level of interest in the category, but we're also proud of the innovation that we've brought to the market over the last 18 months, so we’ve been able to bring data to retailers really going after duplication in the category, so we can create space [for new products] by going after the ninth, tenth or eleventh versions of some of the category’s classic and repetitive flavors or benefits or formats.”

'Even the most ardent tea people still tend to start their days with a cup of coffee'

He added: “In our business, we’ve seen tremendous expansion of the Sleepytime businesses as consumers were looking for a way to get a better night's sleep, but immunity and energy have also been of intense interest over the past year.

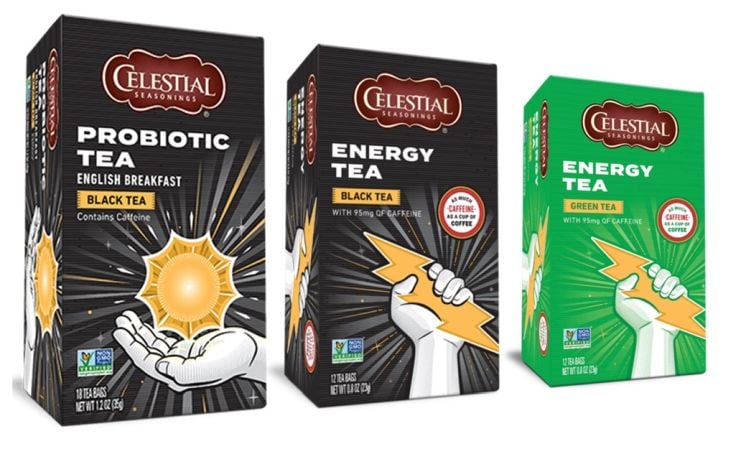

“So we launched an energy tea with as much caffeine [95mg] as a cup of coffee [and more than a can of Red Bull, which has 80mg] to really address that energy deficit that exists in the category, as we found even the most ardent tea people still tend to start their days with a cup of coffee.

“We also did a great job on bringing more millennials into the category with innovations such as the Tea Well premium organic wellness sub brand with some really disruptive and unique benefits like sleep with melatonin, gut health with pre- and probiotics and fiber.

“When you look at the younger generations, millennials, Gen Z-ers, they are drinking more tea, but they're also the 'more of everything' generations, they're sampling across a wider selection of categories than any other cohort so they don’t necessarily generate the same volumes, but what we're incredibly happy with over this past year is that we grew our millennial household penetration 47% faster than the tea category.”

‘There were some weeks where our business was up 60% versus the same week a year previously’

Asked about operational challenges during covid and inflationary pressures, he said he could not comment on pricing, but added: “We're certainly not immune to the inflationary pressures that most categories are experiencing.

“We're sourcing from over 35 countries and we've had to weather supply chain disruptions and shipping container shortages, so I'm incredibly proud of the way we were able to deliver over this past year; we took a category that has been essentially flat for a number of years, and then you're layering on 25% growth… there were some weeks where our business was up 60% versus the same week a year previously, and we retained a very high service level.”

‘We’ve seen really explosive growth in the world of e-commerce’

As for the e-commerce business, he said, “We’ve seen really explosive growth in the world of e-commerce, both our direct to consumer business and in the rest of our e-commerce ecosystem; we've just seen phenomenal growth, and it’s become a really effective way for us to get innovation out there.

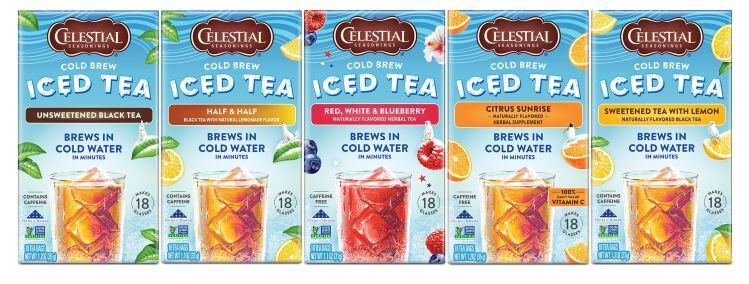

“We recently launched a new line of cold brew iced tea, and on Amazon that's quickly risen to our number one selling variety pack on Amazon."

Tea potential: ‘I feel tea has every imaginable tailwind’

So when it comes to per-capita consumption, how does the US stack up to some other markets, and will this ‘covid-bump’ last, or is it a blip?

Said Collins: “I often like to look north of the border at Canada, where they have 2x the per capita tea consumption of America. There are a couple of reasons for that, so one is cultural - it's a Commonwealth country - plus you get colder weather that helps drive some of that consumption.

“But as we look at the category I feel tea has every imaginable tailwind over the last five years that really matters in food and beverage, it’s flavor-forward, it’s global, it's better for you, it's low or no sugar, so there is an opportunity there if you come in with unique and different offerings, and right now, we're still seeing significant double digit growth, so consumers [that bought into the brand during the pandemic] are sticking around.”

*According to Nielsen data (total US xAOC), US retail sales of packaged tea rose 16.8% in the 52 weeks to Jan 2, 2021, and rose 1.7% in the 52 weeks to July 3, 2021.