In a new report from Brightfield Group, the CBD and hemp market research firm leveraged its newly-launched social listening platform, Evergi, which integrates psychographic consumer survey data with social listening to help CPG marketers and innovation teams better understand consumer need states within the emerging wellness industry.

“‘Wellness’ is still a fairly nascent industry with significant opportunity for growth,” said Brightfield Group managing director, Bethany Gomez.

“Consumer behaviors are evolving much too quickly to rely solely on traditional methods of research. By pinpointing what consumers are feeling and talking about right now, brands and innovations teams don’t have to risk the possibility of launching products destined to underperform in an already saturated market.”

This is especially true for the fragmented and fast-growing functional beverage category, said Brightfield.

Energy drinks and sports drinks

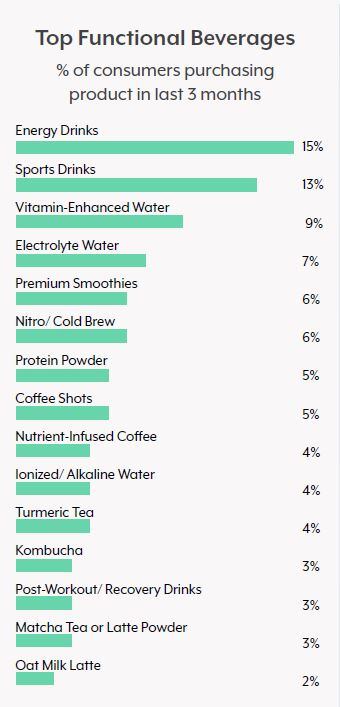

It’s impossible to analyze the functional beverage category without digging into what motivates consumers to purchase sports drinks and energy drinks, the two most widely-consumed functional beverages in the US, according to Brightfield.

Brightfield defines energy drinks as products infused with ingredients meant to improve energy, mostly commonly caffeine, and sports drinks as source of hydration and electrolyte replacement of minerals (calcium, potassium, sodium, etc.) lost through sweating and exercising.

Sports drinks consumers, according to Brightfield’s research, are more concerned with what they’re ingesting and therefore pay closer attention to additives in their beverages, looking out for things like no added sugar, sweeteners, or preservatives.

While the main functional benefit consumers seek from sports drinks is hydration, Brightfield’s Evergi platform uncovered heart health as an important secondary health benefit.

“Purchasers of sports drinks also tend to be more concerned about health claims, especially when it comes to supporting heart health,” noted Brightfield in the report.

Brands like Gatorade, for example, which have been traditionally mostly about hydration are now responding to this consumer need with a targeted product positioning, according to Brightfield.

Energy drink consumers, on the other hand, tend to be more concerned with the effect the product has rather than what is in it, Brightfield found.

“Purchasing an energy drink appears to have a singular purchase—to feel energized—while sports drinks purchasers are looking for more nuanced health benefits,” said Brightfield.

Energy drink consumers tend to skew younger with a greater number of Gen Z, Millennial, and Gen X consumers, who over-index on social media app usage.

“In general, there is more of online engagement around energy drinks. Brands of these drinks have historically made a bigger effort to create distinct communities both in-person and online,” the report noted. (For example, in 2021, Red Bull has 5.2 million followers while Gatorade has 60,000.)

Kombucha vs. turmeric tea: The wellness-focused consumer

Kombucha and turmeric, two other popular functional beverages, occupy a different segment of the functional beverage spectrum and attract consumers who prioritize relaxation, mental and bodily health, as well as sustainability.

Where the two sets of consumers diverge is in their focus on certain ingredients: turmeric tea consumers are significantly more concerned about additives and tend to buy organic more frequently while kombucha consumers are more concerned about artificial sweeteners and have a stronger desire for probiotics.

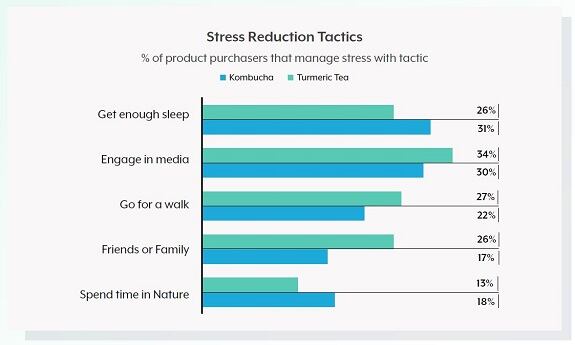

And while both audiences prioritize wellness and sustainability, Brightfield found that turmeric tea consumers take a “crunchier” (i.e. eco-minded) approach to well-being and spend more time by themselves in nature to unwind and relax, whereas kombucha drinks de-stress by engaging in media, friends, and family.

Caffeinated landscape: Oatmilk lattes, nitro/cold brew coffee

Found at nearly any café or coffeeshop throughout the US, oatmilk lattes and nitro/cold brew coffee have been popular trending beverages on social media in recent years, Evergi uncovered.

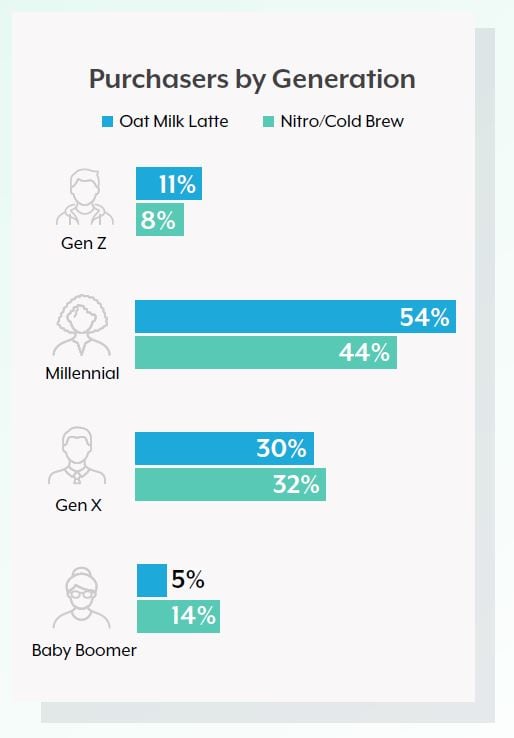

Despite all the conversation taking place across various social media platforms, cold brew is purchased significantly more (~2.5X more) by consumers than oatmilk lattes.

However, oatmilk has gained popularity over other plant-based dairy alternatives as a better substitute for dairy milk in lattes, said Brightfield. In addition to being environmentally friendly, oatmilk is easier to steam in latte applications.

Nitro/cold brew coffee is brewed cold by grinding the coffee beans and soaked them in room temperature for hours before serving, resulting in a product that is smoother, sweeter, and overall less acidic than standard coffee.

As two distinct styles of coffee, consumers are reaching for each type for different reasons. In general, oatmilk latte consumers tend be more ingredient and brand conscious while cold brew consumers are looking for a caffeinated jolt.

According to Brightfield, oatmilk latte consumers tend to be male (nitro/cold brew is purchased more by females), higher income, and are comparatively more concerned with sustainability, exercise, holistic wellness, immunity, and plant-based goods. They also tend to agree more that high quality is worth the additional cost and believe companies should have a social cause.

Takeaways for functional beverage brands

What does this is all mean for brands? According to Brightfield, brands need to understand that not all consumers within a category are the same and that it’s important to understand the slight behavioral and attitude nuances, as all functional beverage aim to satisfy a specific consumer need.

“Those differences are the key to effective segmentation, product development, and marketing of new products. The most successful products will be created with the need state already in mind,” said Brightfield.