“The penetration of online grocery is 13 years behind the rest of retail,” Rabobank analyst Bourcard Nesin said.

“The channel’s relative irrelevance will not last long. We firmly believe that it will develop into the most important driver of online alcohol sales.”

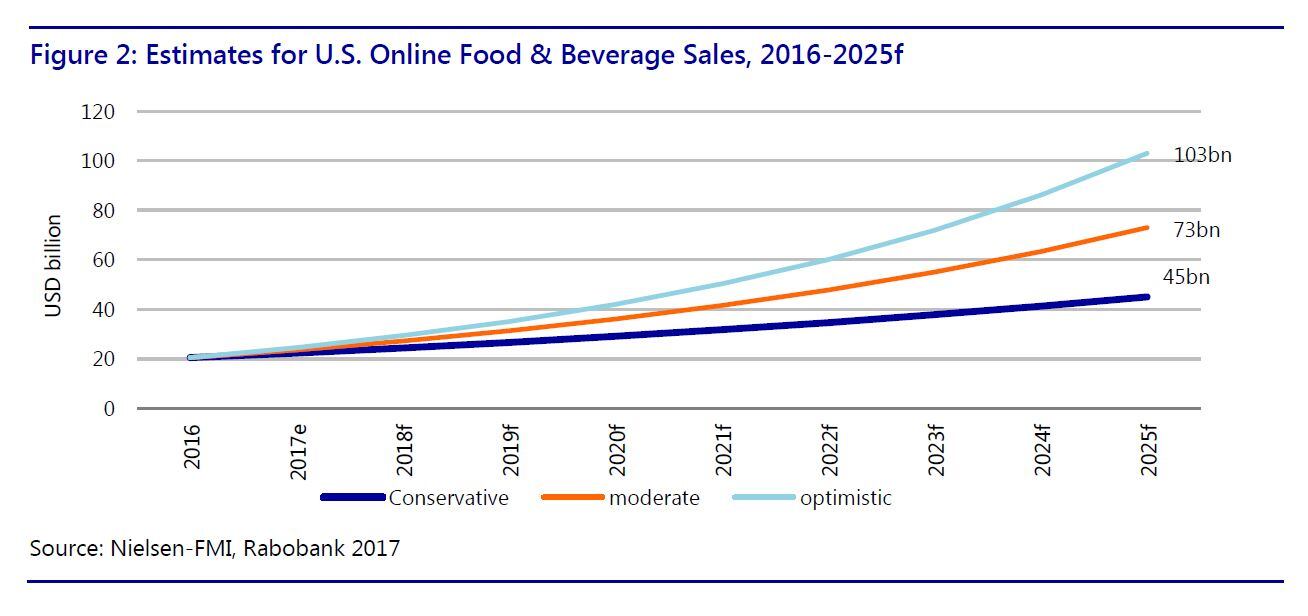

Nielsen predicts that the online channel will account for 14% of food and beverage sales by 2025, up from 2.5% currently.

As such, Rabobank urges alcohol brands to carve out a space in e-commerce channels or risk losing share to more online-forward competitors.

Online alcohol sales could eclipse grocery

Grocery chains, historically resistant to adopting online retail, are facing increasing pressure from digital services like Instacart, meal kit delivery, and Amazon, according to Rabobank.

“The largest grocery chains are now scrambling to offer online options,” Nesin said.

He predicted the five largest grocery chains in the US with 15,000 locations would increasingly leverage their brick-and-mortar infrastructure to drive online sales.

Kroger, for instance, increased its e-commerce presence by expanding its click-and-collect services and saw its online sales grow by 126% and 109% for Q2 and Q3 of 2017, respectively.

Additionally, Google data shows the rapid pace of alcoholic sales coming online (currently 1.6%) will catch up and potentially surpass grocery overall, according to Nesin.

“This is exactly what is happening in Europe. According to One Click Retail, Amazon sales of alcohol in the UK and Germany grew by 96% and 230%, respectively, in 2017. Overall grocery sales did not surpass 60% in either country,” Nesin pointed out.

Wine and beer to be big winners

Rabobank believes that beer and wine are natural fits for the online grocery channel as more than two-thirds of the US population live in states that restrict or ban the sale of spirits in grocery stores.

Restrictions also apply to limited promotions of alcohol brands in some areas of the US.

“In online grocery, brands must find a way to promote their product within a legal framework built for brick-and-mortar stores – not an enviable task,” Nesin said.

However, Rabobank foresees that purchasing beer and wine online will be a natural progression in consumer behavior.

“We feel that beer drinkers will simply continue buying beer when they move their grocery dollars online, as this has proven true in other countries,” he said.

In the UK, 34% of beer drinkers buy their alcoholic drinks online, according to Profitero.

Online grocery is also well suited to wine sales as 44% of wine purchases are made at large-format grocery stores, according to Rabobank.

“In states that do not allow any grocery-store wine sales, retailers can partner with, or open, stand-alone liquor stores to offer wine on their website,” Nesin add citing FreshDirect in New York City as an example.

On-demand delivery model

Another emerging channel in online retail is on-demand alcohol delivery through apps like Drizly, Minibar Delivery, and Saucey that create online marketplaces that allow brick-and-mortar stores to sell their products online.

“The revenue for on-demand apps does not come directly from alcohol sales. Instead, they license their software platforms to retailers,” Nesin explained.

Drizly generated sales of $65m in partnership with more than 1,000 retailers. Minibar Delivery saw 103% year-over-year sales growth in 2016.

“Despite strong, long-term growth, on-demand alcohol companies have not gained the scale of startups like Instacart… the largest US markets have already been penetrated, so we expect growth to be moderated moving into 2018,” he said.

“Without expansion, these companies must use other tools like price competition, product management, and brand partnerships in order to keep growth at current levels.”

Wine leads shift in direct-to-consumer sales

According to Rabobank, the winery tasting room remains the leading direct-to-consumer (DtC) experience and major wineries are upping their online retail game. The top 20% of wineries selling through their websites are responsible for 90% of revenue flowing through the channel with an average order value of $363.

“Interestingly, production capacity and bottle price are not correlated with online success,” Nesin said. “Instead, the most important factors were the size of the winery’s email and how much it charged for shipping.”

However, DtC wine sales are expanding beyond the traditional small to medium-sized wineries connecting directly with consumers in a tasting room. Companies like Naked Wine and Winc ($31m in equity funding) are blurring the direct-to-consumer model by operating as licensed wineries and fulfilling deliveries across the US.

Naked Wines, a public company, brought in $38m in reported for the first half of 2018, selling 550,000 cases and amassing 100,000 US members and a waiting list of 200,000.

“If their waiting list is any indicator of longevity, these companies are here to stay,” Nesin said.

Launched in 2012, Winc has brought the DtC experience to the casual wine drinker by offering wine varieties at an average price of US$13 per bottle. All of the wine brands offered on the platform are made and owned by Winc.

“These wines compete directly in the same price segments as brand like Apothic, Cupcake, or Ruffino, a situation that large brand owners will not have failed to notice,” Nesin added.

"The emergence of a low-cost DtC wine market, enabled by marketplaces and wine clubs, means that the DtC channel may start poking at the margins of producers like E. & J. Gallo, The Wine Group, and Constellation Brands."