Not very, according to product intelligence business, Vypr: who recently surveyed everyday shoppers in the UK to understand what they think about functional beverages.

It found that 35% of respondents have heard of functional drinks but don’t understand what they are; while 61% have never tried a functional beverage.

So what’s stopping them from exploring the category?

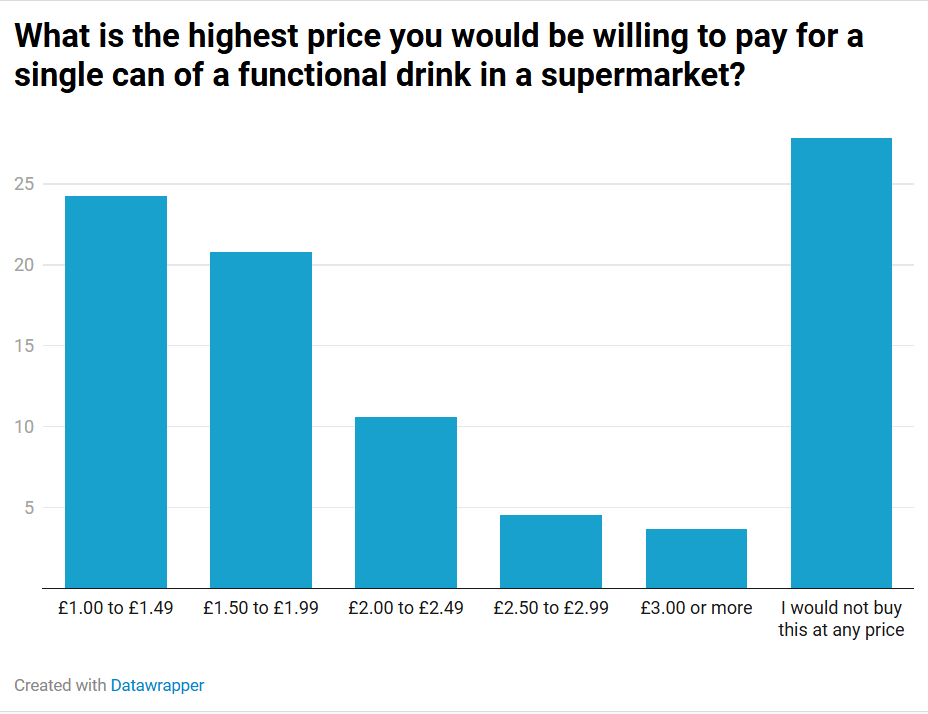

Price: How much are people willing to pay?

Price is the main barrier. Almost a third of UK consumers (32%) discount the category as being too expensive.

Consumers were asked how much they would be willing to pay for a single can of a functional drink in a supermarket.

The bad news: 27% said they would not buy a functional beverage at any price. Another 8% said they were only prepared to pay up to £1: meaning most functional beverages are out of their budget.

Only 18% of respondents were willing to pay more than £2 a can for a functional beverage.

On the market

- Goodrays Natural CBD retails at £7.50 for 4 x 250ml cans at Tesco (£1.875 per can).

- FIX8 Kombucha Ginger Turmeric retails at £5.50 for 4 x 250ml cans (£1.375 per can).

- Trip Mindful Blend retails at £4.50 for 4 x 250ml cans (£1.125 per can).

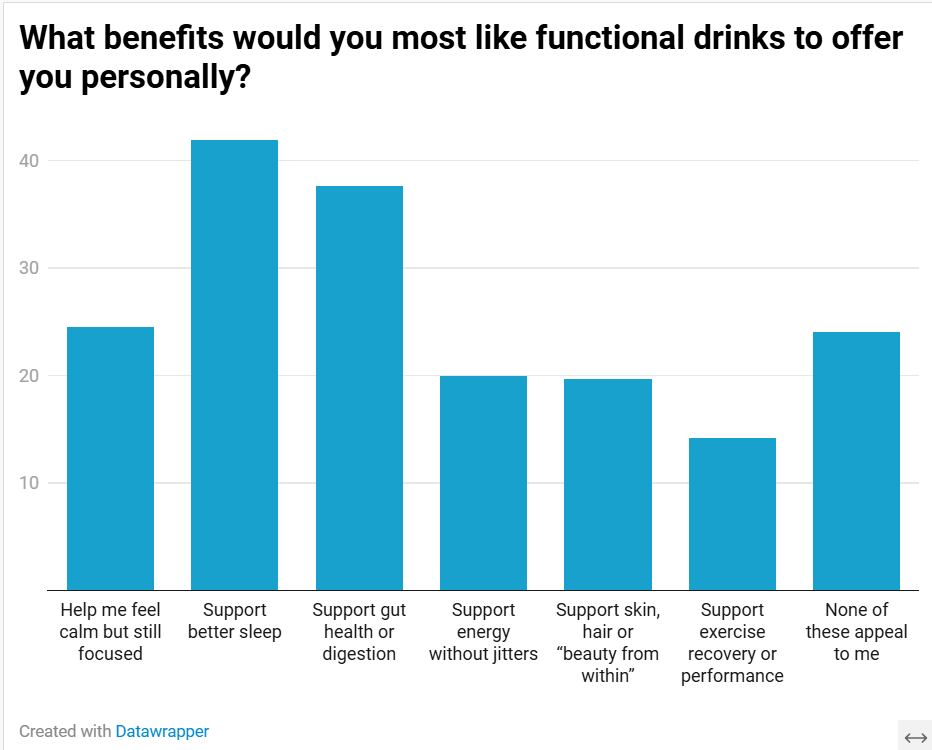

Functional benefits

So what would tempt consumers into the category?

Sleep remains the top priority for consumers: 42% of consumers said they’d like to see functional drinks with this benefit.

That was closely followed by consumers who want to see gut health or digestion benefits (37%).

But 24% of consumers said they couldn’t see a way that any functional benefits would appeal to them.

Electroyles and collagen are the ingredients that consumers are most familiar with: 64% of respondents said they’d heard of each of these ingredients, even if they weren’t necessarily exactly sure what they do.

With CBD products now stocked widely, 59% of consumers said they were aware of CBD or hemp products.

Despite the wave of media attention around gut health, only a third of consumers said they had heard of prebiotics such as inulin or chicory root fiber.

And Ashwagandha, L-theanine and functional mushrooms still have work to do it getting their message across (only recognised by 30%, 18% and 17% of consumers surveyed).

How to create mass market appeal?

So how can brands make inroads in the functional beverage category?

“Functional beverages still have a way to go to be seen as mass market, but their visibility is increasing and more mainstream with brands such as Trip being readily available on supermarket shelves,” said Adam Simpson, drinks expert at Vypr.

“They are certainly the growth engine within the soft drink category and are stealing market share from traditional soft drink brands.”

Functional drinks brands

While price is the main consideration, it’s not just about being cheap, continues Simpson.

“Functional is often associated with a small number of well-known, long-standing brands rather than new or emerging products, suggesting trust is rooted in familiarity,” he said.

“Shoppers are looking to validate before they buy and will need to have the benefits clearly explained, they need to be believable and they’re also looking for easily understandable ingredients lists.

“It’s not new news that consumers are ever more price conscious and this isn’t necessarily a barrier to purchase, but brands need to justify their price through genuinely felt outcomes, taste and real value for money.”