The desire for sustainability is not going away anytime soon. Consumers and beverage companies continue to prioritize recyclable materials, seek alternatives to single-use plastics, and explore new materials.

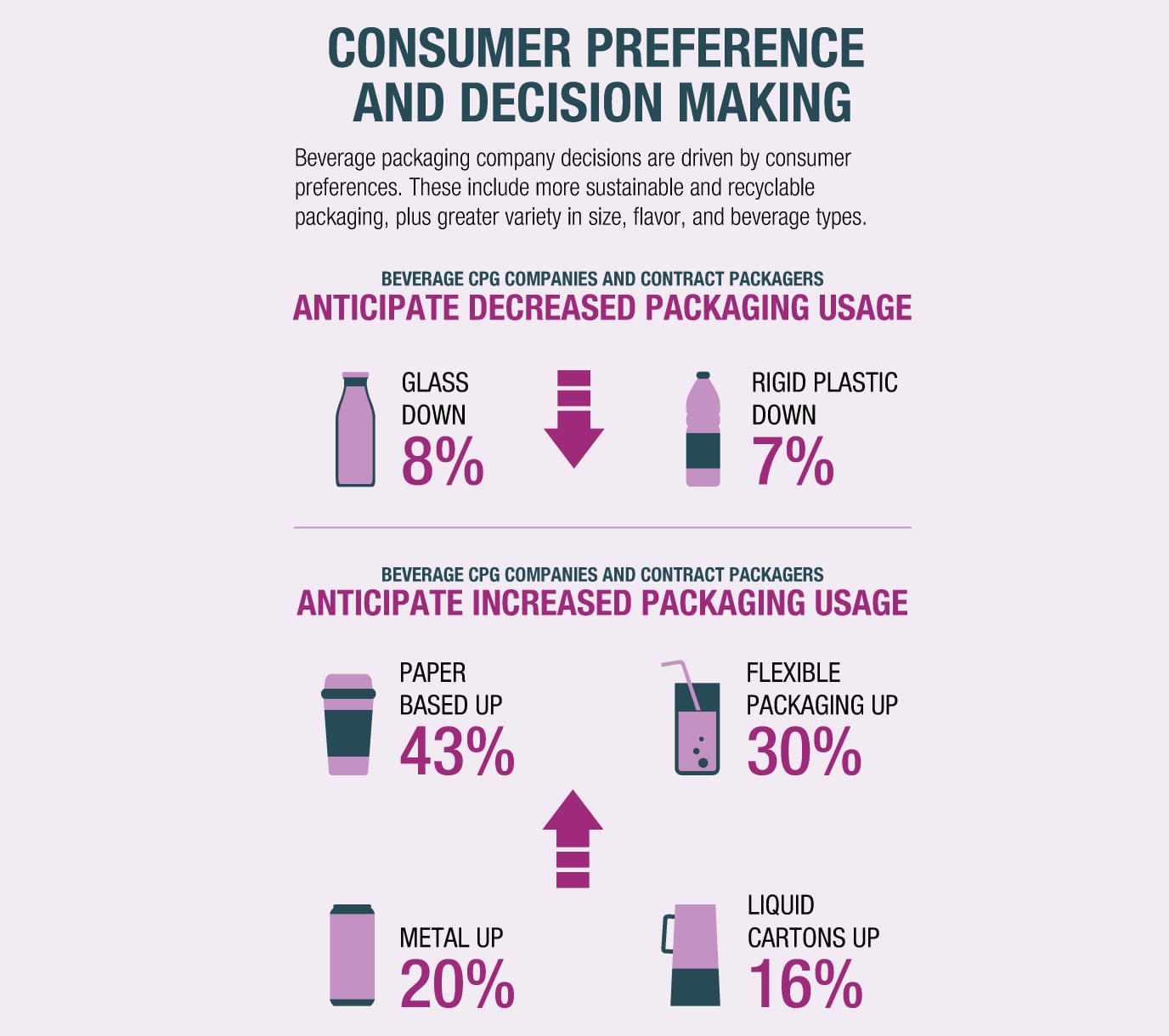

Consumer preferences are driving many of the decisions made by beverage packaging companies today. They want more sustainable and recyclable packaging while also demanding a greater variety of sizes, flavors, and beverage types, according to 2025 Beverage Industry Packaging Trends, a report from PMMI, The Association for Packaging and Processing Technologies.

And yet, translating these demands into operations is not always straight-forward.

The report - which surveyed consumer packaged goods companies and contract packaging companies - has been published ahead of Pack Expo Las Vegas (September 29 - October 1; Las Vegas Convention Center).

Key consumer trends: Less plastic, smaller pack sizes

Consumers are clear that they want to see a move away from plastics. Yet rigid plastic is still the most used beverage packaging material, according to the report.

But beverage producers are expected to shift their packaging mix accordingly.

“The beverage producers surveyed expect to see a decrease in the use of rigid plastics over the next two to three years,” Rebecca Marquez, director of custom research at PMMI, The Association for Packaging and Processing Technologies, told us.

“Consumers also want ready-to-drink and single-serve, smaller-sized packaging. In response to this trend, the creative and unique packaging being developed today will continue to evolve and will be a focus of future development to spur interest and drive sales growth.”

During this process, sustainability (and specifically the elimination of plastic) will be a major goal for beverage producers. However, eliminating plastic presents challenges in cost and maintaining product quality.

“While minor cost increases may go unnoticed, significant price jumps can force difficult decisions, creating a delicate balance for beverage companies, according to the study,” said Marquez.

“For instance, those proactively addressing sustainability have implemented changes they believe will drive innovation within their businesses. On the other hand, survey participants feel unprepared to address talent acquisition and inflation. However, they did not elaborate as to why, perhaps because they feel external forces give them little control over these issues in the current economy.”

2025 Beverage Industry Packaging Trends: Key findings

According to PMMI’s research, 68% of beverage companies anticipate moderate to significant increases in packaging machinery investments over the next two to three years.

Nearly 90% plan to purchase equipment.

Investments are being fueled by three main factors: company expansion, consumer demand, and advancements in technology.

Equipment priorities include:

- Filling, capping, and closing systems (62%)

- Conveying, feeding, and handling equipment (51%)

- Palletizing and load stabilization (50%)

- Coding, labeling, and printing technologies (46%)

Consumers are putting their emphasis on sustainability, recyclability, and variety in beverage sizes, flavors, and types. Beverage packaging is responding: PMMI’s white paper notes a projected decrease in rigid plastic and glass use, alongside notable increases in paper-based (+43%), flexible packaging (+30%), and liquid cartons (+16%).

Packaging formats are being adapted to cater to single-serve, ready-to-drink, and health-focused beverages such as mocktails, nutraceuticals, and THC-infused drinks. These trends necessitate more versatile machinery which can handle new SKUs, packaging formats, and materials.

But the report identifies that beverage producers, in general, will invest more in beverage packaging machinery over the coming years as they seek to meet these goals.

“To meet evolving packaging demands, most survey respondents anticipate moderate to significant increases in beverage packaging machinery investment over the next three years,” said Marquez. “Reasons for these expenditures include not only meeting consumer demand but also increasing opportunities for co-packers and improving or replacing current infrastructure.

“Survey respondents are also seeking to optimize machinery use by leveraging digital insights and diagnostics for faster, more efficient production. Since downtime directly impacts revenue, technology-driven troubleshooting is a top priority.”

It’s not easy being green: Sustainability issues present challenges

A key insight revealed by the survey is a jarring disconnect between those who champion sustainability and those actually responsible for implementing it on the production floor.

“Those who prioritize sustainability often don’t understand its impact on packaging operations,” explained Marquez.

“Simply put, some do not recognize the complexities of production or the effort required to implement new machinery, according to our survey.”

It’s the same when it comes to recycling.

“Consumers want to support recycling and, therefore, expect companies to provide recyclable products. However, some of our survey participants stated that societal and infrastructural limitations can impede the successful end-of-life management of the products they are expected to provide.

“Potential sustainability-related regulations are also a concern. Although no single regulation has emerged that greatly affects the overall industry, state laws are having some impact. For example, California is focused on single-use plastics not being recyclable, and Michigan has a highly regulated cannabis market. In addition, a few survey participants believe the tariffs being proposed by the current presidential administration might adversely affect their business.

“Regardless of the challenges, the mandate for sustainability is here to stay, and companies continue to prioritize recyclable materials and seek alternatives to single-use plastics, while exploring new materials and production methods for beverage containers.”

See the latest tech at Pack Expo Las Vegas

Recycling and sustainability technologies will be presented at Pack Expo Las Vegas (Sept. 29–Oct. 1; La s Vegas Convention Center).

- Exhibitors with sustainable packaging materials or machinery solutions and educational sessions on related subjects will be flagged with the Pack Expo Green logo in the exhibitor directory and on-site placards.

- The Sustainability Central area will feature expert-led sessions to help attendees navigate the complexities of sustainability and what it means for their brands. Other sustainability-related sessions will be presented at the Innovation Stage, Processing Innovation Stage, and Industry Speaks.

- PMMI’s Sustainability Solutions Finder , a powerful online resource directory, connects attendees with professionally vetted suppliers offering environmentally friendly solutions.

- The Reusable Packaging Pavilion , organized by the Reusable Packaging Association, showcases solutions that help companies implement sustainable transport packaging practices. It also houses the Reusable Packaging Learning Center, which presents free sessions to help brand owners embrace a greener future.

- Beverage producers also will want to visit the Processing Zone to see the latest front-of-the-line innovations.

- Now 30 years since its debut, PACK EXPO Las Vegas will feature 2,300 exhibitors, over 1 million net square feet, and is expected to attract 35,000 attendees from more than 40 vertical markets. Registration is $30 through Sept. 5, after which the price increases to $130.