Every year, Kantar puts together its ranking of the world’s most valuable brands: featuring top movers and shakers such as Apple, Google and Microsoft.

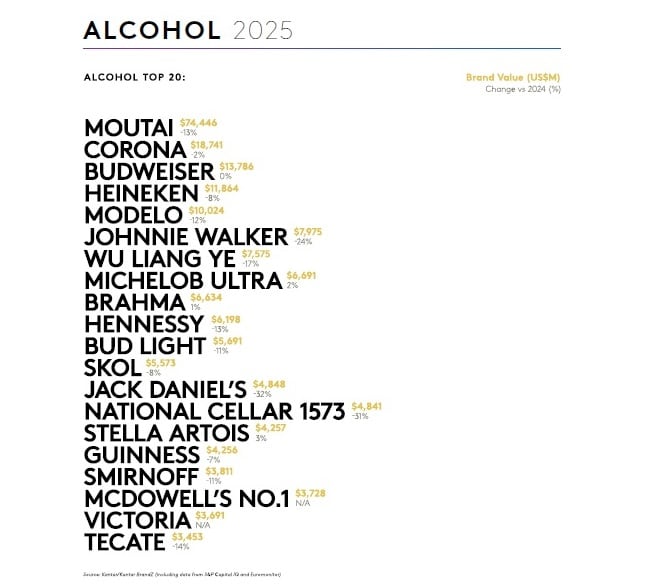

It also compiles the annual report on alcohol brands. It’s no secret that the alcohol industry faces plenty of headwinds: but this year’s ranking reveal the top 20 alcohol brands have declined an alarming 11% in value in 2025 compared to 2024.

Charting the last two decades

Alcohol enjoyed the ‘boom times’ of 2006-2007, as beer expanded to new markets (geographically, such as Budweiser’s sponsorship of the China Olympic team) and occasions (demonstrated, for example, by the premiumization of beer).

Then there was the rise of craft beer and craft spirits, challenging the dominance of big brands and breathing new life into the category.

That was only to be followed by mergers and acquisitions such as the mega-brew merger of AB InBev and SABMiller (2016).

Then there were the twists and turns of the recession (2008) and pandemic (2020), shaking up the alcohol category once again (some consumers traded down to cheaper options as the recession bit; others traded up to premium spirits as they embraced at-home cocktail making during the pandemic).

Fast-forward to 2025 and the alcohol industry is still shaky. Major issues include trade tensions, a cooling Chinese economy, competition from challenger brands, inflation, and declining consumption in key western markets.

An 11% decline in value for the top alcohol brands in 2025 compared to 2024 is worrying.

“This is the most significant drop since the introduction of our year-on-year ranking in 2021,” said Martin Guerrieria, global head of Kantar BrandZ.

“It reflects a shift in global consumption, driven by a combination of health and wellness trends fuelling the rise of low and no alcohol alternatives in Western markets, and normalization of alcohol consumption after the Covid-19 spike.”

One of the interesting trends seen is that beer brands have proved more resilient to the instability than spirits: mainly because their pricing has been more in line with the size of consumers’ wallets.

“Many spirits brands have moved up in price over the past decade, but without always increasing their pricing power,” said Guerrieria.

“Wider Kantar BrandZ analysis has proven that consumers demonstrate a willingness to pay significantly more - up to double that of cheaper alternatives - when a brand justifies it through its meaningful difference.

“That disconnect between cost and consumer perception has made it harder to justify premium positioning in today’s more cautious spending climate.”

“While the category has been impacted overall, beer brands have shown greater resilience, supported by being more visible in how they form a connection with consumers and offering more accessible prices than other options in the sector.

“What we are seeing now is a more competitive landscape where long-term brand foundations are essential for maintaining value.”

Top tips: Maintain a clear branding, mission and identity

It’s a difficult world for alcohol brands. So what are the top brands doing right?

“The most successful alcohol brands in this year’s BrandZ rankings are those that have remained clear about their identity while evolving to meet changing consumer expectations,” said Guerrieria.

“We have seen strong performances from brands that continue to invest in brand equity, refine their relevance and maintain emotional connection with their audiences.”

China’s Moutai, for example, continues to have a strong cultural significance and premium status. Its also worked hard to leverage its brand strength through partnerships and adjacent categories, such as ice cream, adding additional value.

Stella Artois, meanwhile, stands out as the fastest-growing beer brand: having grown 3% in brand value in 2025. That reflects a strong visual identify and premium image.

“Aside from their heritage, what links these brands is their ability to remain meaningfully different from competitors.”

The alcohol world is changing: with more and more challengers from both within (think RTD alcohol and craft drinks) to those outside (the growth of alcohol-free formats). But the biggest brands can still play to their strengths: that which has been built up over decades.

“In a category that continues to innovate, from low and no-alcohol formats to flavour-led releases, consistency has also become a crucial differentiator,” said Guerrieria. “The brands performing best are those that evolve while staying true to their core identity. That clarity helps to build trust, defend pricing power and protect long-term value.”

The full report of the world’s most valuable brands can be found here.