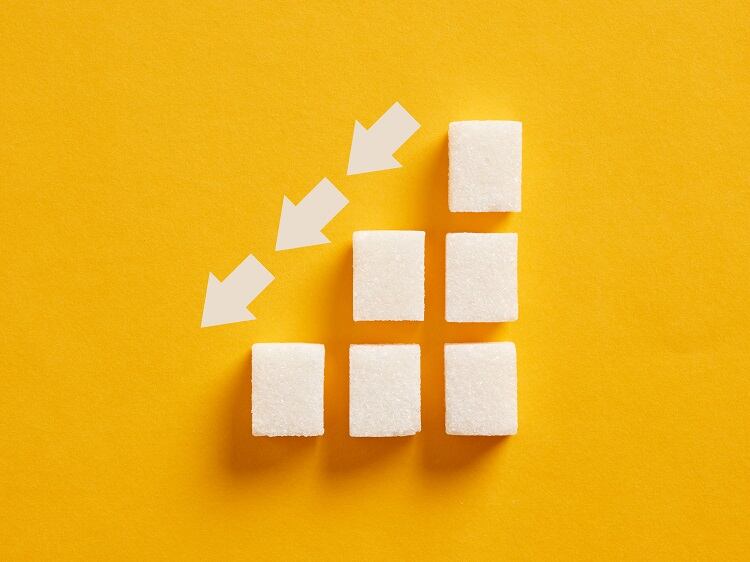

Over the last few decades, sugar has well and truly fallen from grace. The ingredient that once made up a significant proportion of sodas and breakfast cereals, has in many cases now been reduced, if not cut out completely, in favour of sugar substitutes.

Whether voluntary or mandatory, such reformulation efforts have been informed by alarming research findings: excessive sugar consumption is known to increase the risk of chronic diseases, including type 2 diabetes and heart disease.

But at the same time, sugar substitutes – and most notably non-nutritive sweeteners (NNS) – are coming under fire. The World Health Organization (WHO) recently advised against the use of NNS to control body weight or reduce the risk of non-communicable diseases. Further, Nutri-Score’s latest algorithm update now scores negatively against their use.

With clean label demands still strong, could consumers end up favouring ‘natural’ sugar over non-nutritive and artificial sweeteners?

The non-nutritive sweetener category – so-called because they offer no nutritional benefits such as vitamins and minerals – includes well-known sweeteners allulose (not approved in Europe), aspartame, sucralose, stevia, and monk fruit. They may be low in calories or have no calories at all.

NNS are many times sweeter than sugar. Just 5g of steviol glycosides (extracted from the stevia plant) for example provides the sweetness of the equivalent of 1,000g sugar, because it is perceived to be 250 times sweeter.

Is sugar perception changing?

Consumer research suggests that overall, consumers are turning to reduced sugar products as healthier alternatives. But a deeper dive into this research reveals more nuanced findings, particularly amongst younger respondents.

According to taste and nutrition-focused Kerry Group, which conducted a quantitative survey of 12,784 people across 24 countries and six continents, younger consumers were found to be ‘breaking the norm’ when it comes to sweetener preferences among different generations.

Unlike older Millennials, Gen X and Boomers, Gen Z and younger Millennials are placing greater importance on sugar in food and drinks, with 36% of these respondents sceptical of ingredients used to replace sugar in food and drinks.

Kerry found that 92% of younger consumers said they preferred sugar, honey, coconut sugar, and palm sugar much more when compared to older generations.

Across all generations, preference for ‘natural’ sweeteners over artificial alternatives was loud and clear, with 75% of global consumers saying they prefer sweeteners such as honey, sugar, or stevia.

Indeed, the top five most preferred sweeteners globally were honey, sucrose/sugar, stevia, coconut sugar, and fructose.

“We found that consumers in almost every market clearly prefer the taste, sweetness and mouthfeel/texture of traditional natural sweeteners such as honey and sugar,” Soumya Nair, global consumer research and insights director at Kerry told FoodNavigator. But the popularity of natural perceived high intensity sweeteners such as stevia is also on the rise, we were told.

An interesting finding was that sugar popularity as a source of energy has increased among consumers reaching 51% of respondents globally.

What does Kerry make of this? “It means that taste continues to reign supreme among consumers. Product developers need to be very mindful when reducing sugar content and optimising the sweetness and nutrition profile of products.”

Ingredients major Cargill’s research has yielded somewhat similar findings: that nature-derived sweetener solutions have gained in popularity as consumers continue to move away from artificial sweeteners.

“Almost two-thirds of global consumers (63%) say ‘no artificial sweeteners’ is an extremely or very important statement on food and beverage labels,” Fatiha Rhaiem, product line manager for Sweetness at Cargill told this publication, citing 2022 HealthFocus International research.

Ingredients derived from natural origins or that are naturally sourced are perceived as healthier options, said Rhaiem. Honey, stevia and stevia leaf extracts are examples of sweeteners with positive health perceptions according to a Cargill survey.

‘Sugar alternatives will never be obsolete, but sugar-based solutions preferred’

Kerry and Cargill are not the only ones noticing artificial sweeteners are falling out of favour.

Israel-headquartered Incredo (formerly DouxMatok) has similarly observed a growing preference for clean label in sweet products. But unlike the two ingredients companies, Incredo puts stevia in a similar category.

“We’ve seen a shift toward more clean label ingredients over the last several years as consumers are becoming more aware of the impact highly processed and artificial ingredients have on their health, and more recently, as a result of new guidance from the WHO and other research around stevia and other artificial sweeteners,” Incredo CEO Ari Melamud told FoodNavigator.

“As a result, we see an increased number of food companies reaching out to us, and we expect it to grow as it appeals to consumers’ desire to reduce sugar intake without sacrificing the taste that they know and love and as it avoids the health risks associated with sweeteners.”

Incredo has developed sugar technology that wraps sucrose molecules around silica particles to form structures that are perceived to be sweeter than conventional sugar. By replacing sugar with Incredo Sugar (based on real cane or beet sugar), the company believes a 30-50% sugar reduction can be achieved without impacting flavour.

Incredo Sugar, said Melamud, is clean label and simply listed as ‘sugar’ on ingredients lists.

As to whether consumers will completely turn their back on sugar alternatives in favour of its conventional counterpart, the Incredo CEO is unconvinced. “I anticipate that consumers will be more hesitant about consuming sugar alternatives or new sweeteners that have no science to back them up in the future, but I don’t think alternatives will ever be obsolete.”

Sugar alternatives will always ‘have an audience’, he explained, especially for those who for health reasons cannot consume sugar or are looking for non-sugar options. But for consumers without a specific health concern, the company predicts solutions made with real sugar will be preferred.

But consumers still looking at sugar content on-pack

While natural sweeteners are very obviously preferred, it would appear that sugar content – no matter its source – remains front-of-mind for consumers.

According to Cargill’s proprietary research, today’s consumers are more aware of how much sugar they’re consuming: two-thirds of EMEA consumers reported checking the ingredient lists when shopping for packaged food or beverages they have never purchased before. In this instance, sugar continued to be the most important element of the nutritional label.

Kerry has similarly observed that consumers are ‘very’ concerned about healthy eating habits and the long-term negative health effects of consuming too much sugar. The company’s own research found an overwhelming majority of global consumers (73%) have either reduced or are actively seeking to reduce their sugar consumption; 70% do so wanting to live a healthier live and 59% do so to avoid future health problems.

“While consumers are concerned about their health and sugar consumption, it’s imperative that any new sugar-reduced products continue to match or exceed the great taste and mouthfeel of sugar,” said Kerry’s Nair. “Consumers will notice any change in type of sweetener and level of sweetener.”

The Ireland-headquartered ingredients company is backing stevia to meet demands for clean label and organoleptic profile.

So too is Cargill, which believes there will likely always be a place for both conventional sugar and alternatives like stevia. “Consumers are trying to manage their health and wellness through foods and beverages, and reduction of sugars is one of the ways to improve the overall nutritional profile of these products.

“At the same time, there will remain room for indulgent products made with conventional sugar.”