Total company sales grew 9.2% to 69.1bn Swiss francs with pricing up 7.5% for the first nine months of 2022 compared to the same period last year. On a three-year basis, growth remains stable at around 3%. Volume growth - which remained positive in the first half - turned slightly negative in the third quarter.

In North America, organic growth was 11.2% for the first nine months of 2022 with pricing was up 11.1% reflecting the higher cost of inflation.

"In addition supply chain constraints and the super high base of comparison, volume development was reduced by active and conscious choices to cut the number of low rotation and under-performing SKUs," said CEO Mark Schneider on the company's 2020 nine-month earning call.

"This strategy, which we call 'cut the tail to push the head,' is one of our ways to counter cost strategies and supply limitations. Over time this strategy is also expected [to deliver] top-line benefits through better on-shelf availability and visibility of our core SKUs," he added.

"As in the previous quarters of this year, growth was primarily driven by pricing. We maintained our responsible approach to pricing but further pricing steps were clearly needed to react to significant levels of global inflation hitting us."

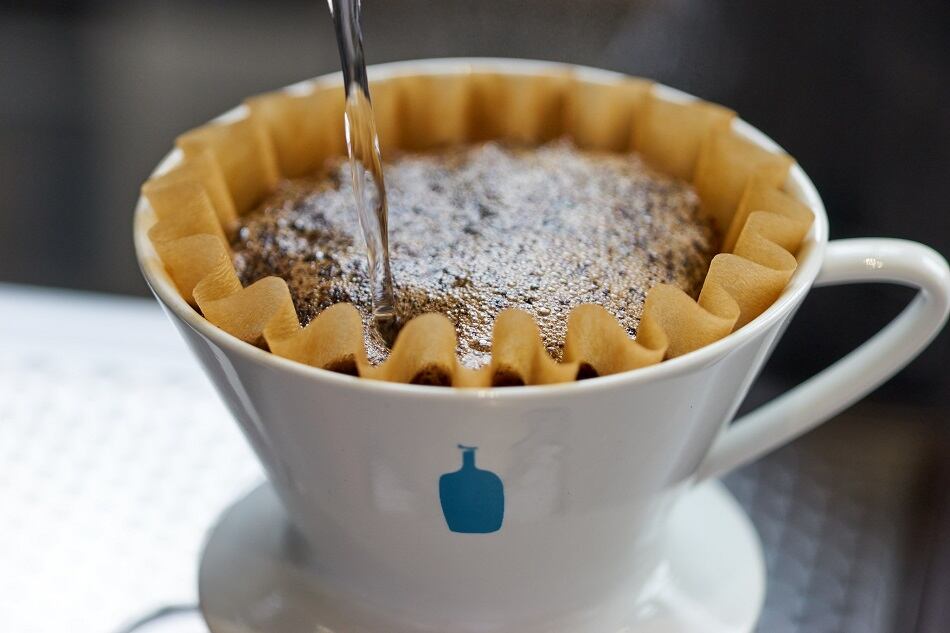

Growth pillar: Coffee

Coffee continues to be a strong suit for Nestlé with sales growing by high-single digits for the first nine months of 2022 compared to the previous year. This week, Nestlé announced its plans to acquire Seattle's Best Coffee brand from Starbucks to diversify its portfolio with a mid-tier, mainstream brand.

"We have come to like this trusted brand a lot. It give us a highly credible mid-range mainstream offering that competes very effectively and protects the premium position of Starbucks," said Schneider.

"Full ownership of this brand will now allow an even more complete integration of this business into our highly efficient coffee supply chain."

Nestlé Health Sciences: 'The slowdown is less than we expected'

Performance of the company's Nestlé Health Sciences business slowed in the first nine months of 2022 due in large part to tough comparables vs 2020 and 2021 and several acquisitions which will be accretive to the business over the course of a few years.

"We have also patiently and steadily built our Nestlé Health Sciences portfolio this year. Not in leaps and bounds but with very manageable, incremental steps," said Schneider.

"Do not over-interpret the current short-term organic sales growth compression. Mathematically, this had to happen after two years of extraordinary sales growth during the peak pandemic period. Compared to our plans, the slowdown is less than we expected."

Nestlé Health Sciences completed the majority stake acquisition of plant-based nutrition company Orgain with the option for Nestlé to fully acquire the brand in 2024. The company made other acquisitions this year including Brazil's Puravida nutritional and health lifestyle brand and the acquisition of New Zealand's leading supplement brand GO Health.

"Our acquisitions models and valuations for the deals we made in this space during the pandemic fully reflect this temporary post-COVID growth compression," said Schneider.

"Second, I would like to reconfirm that we have no intention of turning Nestlé Health Sciences into a pharma business. Nutritional supplements and vitamins in particular are fast turning into major brand and premiumization opportunities. We saw this trend early and are leading it with globally recognized and trusted brand names."

'Pricing will need to continue'

Looking ahead to the rest of the fiscal year 2022, the company expects organic sales growth to be around 8% as it continues to roll out further SKU rationalizations and pricing across its portfolio.

“Pricing will need to continue when it comes to the remainder of this year and next year as we’re still in catch-up mode towards repairing and restoring our gross margin,” noted Schneider.