“Overall, 2021 marked the first time in Pacesetter history when such a significant percentage of the top 100 Pacesetters are beverages,” said IRI in the report, which tracks the top-selling new products in food & beverage in measured US retail channels.*

“Nearly evenly split at 23% each, alcohol and non-alcohol beverages combined represent nearly half of 2021 New Product Pacesetters.”

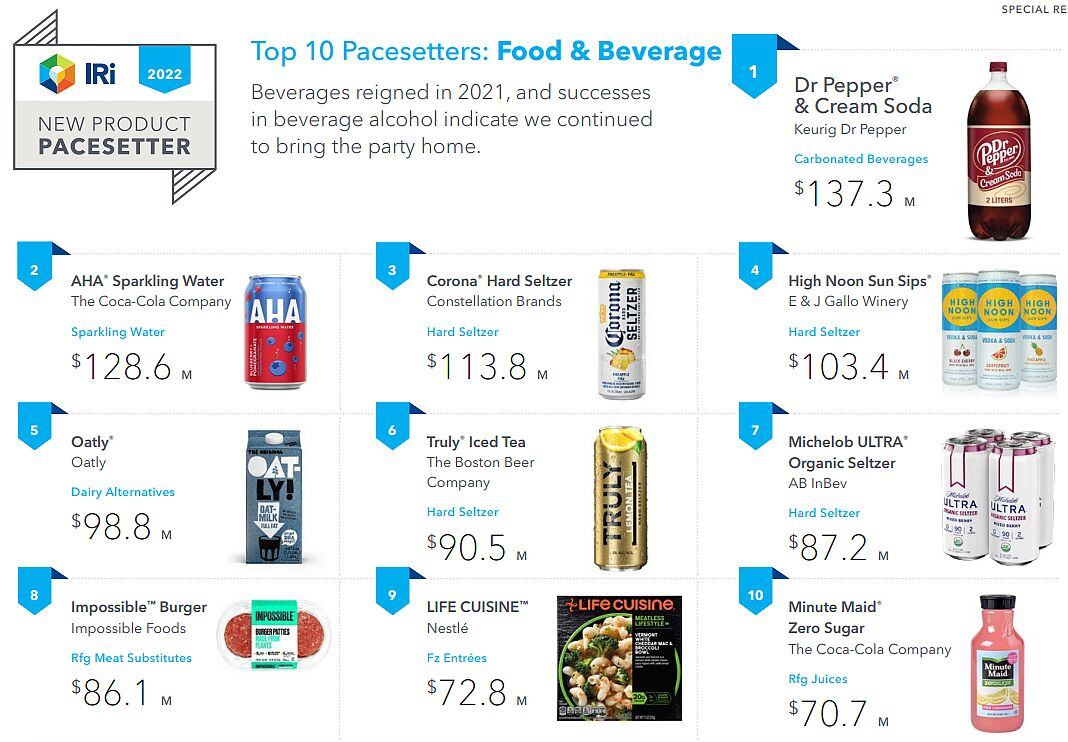

Top 10 Food & Beverage New Product Pacesetters:

- Dr Pepper & Cream Soda (Keurig Dr Pepper): $137.3m

- AHA Sparkling Water (Coca-Cola): $128.6m

- Corona Hard Seltzer (Constellation Brands) $113.8m

- High Noon Sun Sips (E&J Gallo): $103.4m

- Oatly (Oatly): $98.8m

- Truly Iced Tea (The Boston Beer Co): $90.5m

- Michelob ULTRA Organic Seltzer (AB InBev): $87.2m

- Impossible Burger (Impossible Foods): $86.1m

- LIFE CUISINE (Nestle): $72.8m

- Minute Maid Zero Sugar (Coca-Cola): $70.7m

As for broader trends reflected in the report, which you can download HERE, said IRI, “Consumers returned to proactive self-care, convenience and indulgence in 2021, a noticeable difference from 2020’s focus on scratch-cooking, staples and cleaning, driven by greater levels of quarantine and lockdown in a pre-vaccination world.

"Zero sugar and low sugar are top growth claims across categories."

While multinational CPG giants such as Coca-Cola, Nestlé, Constellation Brands, and AB InBev dominate the top 10, two challenger brands (Oatly and Impossible Foods) made #5 and #8 respectively, noted Joan Driggs, IRI's VP content and thought leadership.

“If you look at the full list of 200 Pacesetters, you can see that there are very few large launches and many, many, smaller launches,” she told FoodNavigator-USA.

Is making the top 10 a good predictor of long term success?

Asked whether appearing on the Pacesetters list is a good predictor of long-term success, or merely proof that large companies have the money and clout to ramp up distribution and notch up sales of new lines very quickly, Driggs, said: “Based on historical analysis, we find that many Pacesetter brands drive continued momentum through year two and beyond by continuing to support and create news against the brand via new sizes, flavors, and so on.”

She added: “While the top 100 new products are reported based on dollar sales, the path to sales achievement was not one and the same.

“A few of the top 10 food and beverage and non-food Pacesetters did not have media spend behind their respective launches, instead focusing on grassroot influencer strategies to drive awareness, or relying on high consumer demand enabled by pandemic-driven requirements [hand sanitizers, antibacterial wipes].

“In some cases, Pacesetter brands started as direct to consumer offerings and then made their way into traditional brick & mortar distribution once the new product had an initial following.”

She added: “We usually have a few standout products and they all have their unique stories – i.e., the right product at the right time (Microban24), or spot-on launch plan (Dr Pepper & Cream Soda). The majority are finding their success in deciding and targeting a specific audience and working against and supporting a defined forecast.”

* To identify its 2021 Pacesetters, IRI tracked ‘year one’ dollar sales in measured channels (MULO and convenience) for brands that completed their first year of sales in 2021. The “clock starts ticking when a product hits 30% distribution and lasts 52 weeks", explained IRI, so would cover, for example, sales of a brand that hit 30% ACV in September 2020 and completed its first full year of sales in September 2021.

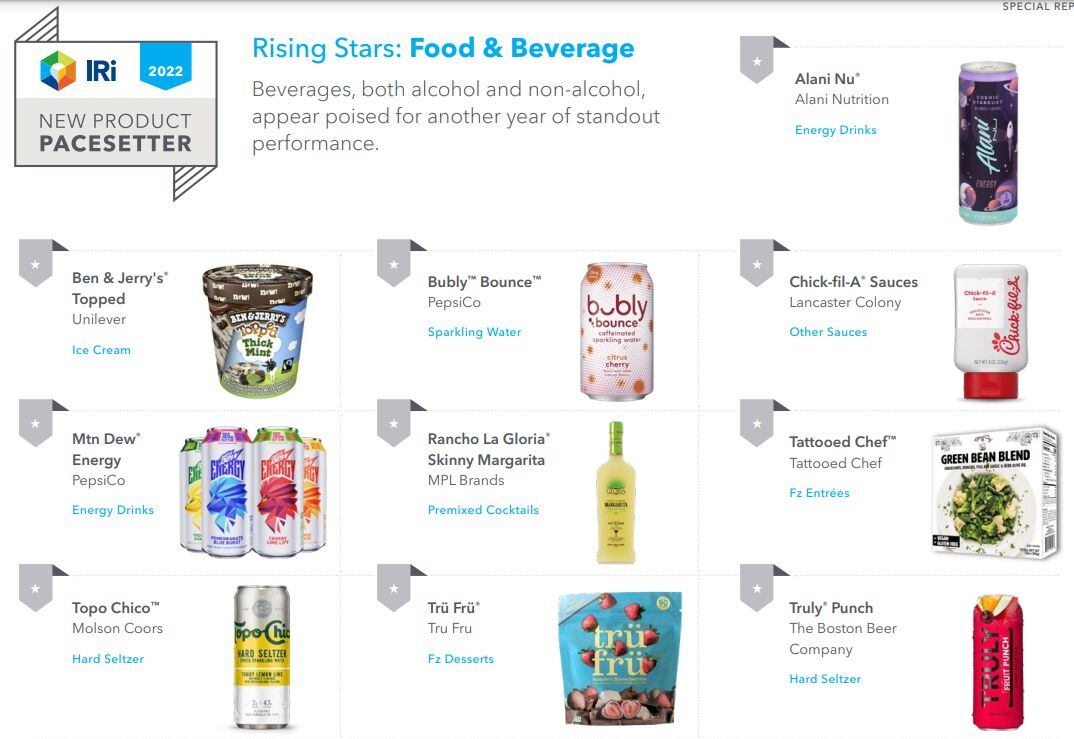

'Rising Stars' that IRI is watching this year include: