The Coca-Cola bottling partner saw volume growth of 14% across the portfolio: which represents 9% growth on 2019 levels. FX-neutral revenue grew 20%, with reported revenues up 16.9%.

Coca-Cola HBC credits its ‘24/7’ strategy – offering a drink for every occasion during the day – as one of its strengths that continues to drive performance and create a more resilient mix of categories.

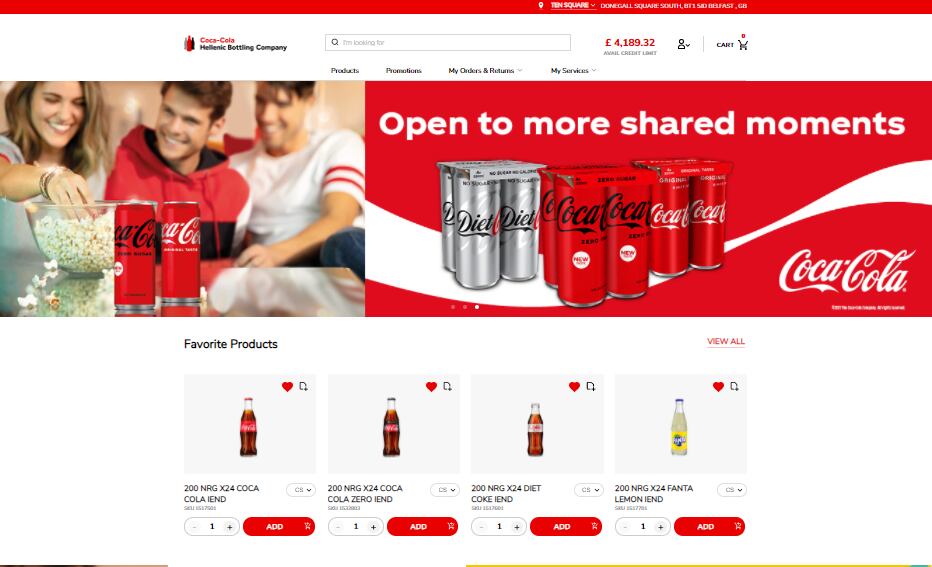

Sparkling volumes grew by 13.8%, with low- and no-sugar variants up 47.3% and adult sparkling brands up 31.8%.

Trademark Coca-Cola volumes were up 12.3%, Fanta volumes up 14.4% and Sprite volumes up 18.8%.

Energy volumes grew by 45.3% thanks to Monster, Burn and Predator, benefiting from innovation which is also broadening the appeal of the category across a wider range of consumer profiles.

The coffee category represents a ‘significant growth opportunity’ that CCHB is addressing with two brands, Costa Coffee in the mass premium segment and Caffè Vergnano in the premium segment. Costa Coffee is now live in 17 markets and Caffe Vergnano in five with additional roll out plans for the rest of the year.

Water volumes grew by 11.3%, a solid recovery after the prior year was heavily impacted by lockdowns. (CCHBC sells proportionally more water in the out-of-home channel compared to Sparkling drinks and channel reopening is leading to volume recovery).

Juice volumes grew by 11.7% on a like-for-like basis with growth across all segments. RTD tea volumes grew by 12.8% with growth from Q2 onwards, aided by category recovery.

Serving a total of 29 different markets, Coca-Cola HBC is split into three geographical divisions.

Its established markets division (Austria, Cyprus, Greece, Italy, Northern Ireland, Republic of Ireland and Switzerland) grew volumes 9.9% in 2021. “Due to greater exposure to the out-of-home channel compared to other segments, the ongoing reopening of outlets provided strong support to volumes. At the same time, we continued to see growth in the at-home channel, which positively contributed to the segment’s overall performance.”

Developing markets (Croatia, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia) saw volumes remain broadly stable, up 0.8%. Volume growth excluding Poland – where a new sugar tax has been implemented – was 4.4%.

The emerging markets division (Armenia, Belarus, Bosnia and Herzegovina, Bulgaria, Egypt, Moldova, Montenegro, Nigeria, North Macedonia, Romania, Russia, Serbia and Ukraine) saw volume growth of 18.6%.

Zoran Bogdanovic, CEO of Coca-Cola HBC AG, said: “The business has delivered a very strong recovery in 2021, with all key metrics above pre-pandemic levels, the result of consistent and disciplined focus on our strategic priorities over the last few years.

“We finished the year with strong revenue growth, our highest ever EBIT margin and free cash flow while continuing to gain share. This performance demonstrates the strength of our 24/7 brand portfolio, revenue growth management capabilities and execution excellence in our markets.

“We are encouraged by the momentum we see in the business. We expect 2022 to be a year of strong sales supported by ongoing volume momentum, pricing actions and beneficial category mix. While mindful of inflationary headwinds and other risks, our track record and continuous focus on efficiencies give me confidence in delivering another year of EBIT growth.”