In this edition of the FNA Deep Dive, we take a look at the LNA category, and see if there is any possibility that this will ever catch up with – or even overtake – the alcohol industry.

The LNA industry in the Asia Pacific region has so far mainly been driven by increasing consumer health awareness coupled with growing demand in majority Muslim regions such as Indonesia and Malaysia.

Factors including industrialisation, rising health awareness, coupled with large customer bases in China, India, Thailand, Indonesia, Malaysia are expected to further drive APAC market growth.

Data from Global Market Insights indicates that the Asia Pacific low-to-no alcohol beverage market is estimated to grow more than 7% during the period of 2019 to 2025. The global market was at USD20bn in 2018 and is anticipated to reach USD 30 billion by 2025.

Importantly, non-alcoholic beer is expected to account for over 80% of the total market share as it continues to grow, and this prediction can be further strengthened by the involvement of big beverage firms traditionally known for alcoholic beers such as Heineken, AB InBev and Kirin in the market.

That said, most of these firms are adamant that their low-to-no alcoholic options are meant to ‘complement’ existing beers which are alcoholic, and do not expect the current alcoholic beer market to be affected by the rise of this new sector.

“Non-alcoholic beer is meant to complement rather than replace beer, [allowing] anyone who wants to have a beer [to] enjoy one during any occasion [at] any time of the day,” Heineken APAC Brand Development and Communications Director Maud Meijboom - van Wel told FoodNavigator-Asia.

“It is for those moments in life when [the consumer wants] a great beer but just doesn’t fancy the alcohol [or] the effects of alcohol.”

Heineken’s zero-alcohol option, the Heineken 0.0 is made with normal beer ingredients (water, malted barley, hop extract) and brewed with the firm’s unique A-yeast, but the alcohol is removed ‘gently’ in a ‘natural process’.

“We then gently remove the alcohol with vacuum distillation and blend the brew with natural flavourings,” added Meijboom - van Wel.

Within the APAC region, Heineken 0.0 has already been launched in eight countries: Australia, New Zealand, New Caledonia, Thailand, Malaysia, Singapore, French Polynesia and India

Director and Founder of LNA beer firm Nirvana Brewery Becky Kean concurred that it is unlikely that it will ever take over alcohol’s spot in consumers’ hearts, but she told us that as choices increased, LNA would likely take some market share away from traditional alcoholic beers.

“I don’t think that low-to-no-alcoholic beverages will ever replace alcohol, but I do think it will take up a big percentage of the market,” she said.

“Eventually it will become the norm as an additional option for people to choose: Sometimes you have an alcoholic beer, sometimes a non-alcoholic beer. It won’t be a niche in the future, just another style of beer.

“Having more choices in the category will let people see it as a more viable option [as this has been] one of the things that has held the category back recently. When there are more options, people will just keep buying these to try, and this is what will lead to the growth of the category.”

Nirvana Brewery has one of the widest ranges of LNA beers in the industry so far, with six different variants (as opposed to just one or two by bigger firms) in its portfolio, ranging from lager to pale ale to stout and more.

“A lot of the growth in the alcohol-free lot of the growth in alcohol-free [beer] is coming more from countries where health and well-being is a focus, [for example] in Japan, as opposed to countries where alcohol consumption is restricted,” added Kean.

Japan as a major market

Japan is one of the most popular markets for LNA beers, with not only foreign firms like Nirvana Brewery looking to enter the fray, but also big local beer companies creating their own non-alcoholic versions of beer, such as Kirin and Asahi.

Here, the major driving factor for the market is very clearly health and wellness concerns, according to Kirin Holdings Corporate Communications spokeswoman Ataka Takashima.

“We aim to meet the current non-alcoholic beer user's health needs. The drink is targeted to men and women over 20 years old who care about belly fat,” she told us.

A Kirin Brewery survey reported that about 70% of adults were concerned about belly fat, and Takashima added that the consumption of non-alcoholic beverages has been on the rise in Asia, with Japan in the lead.

“The habit of consuming non-alcohol beer has not become habit among consumers yet, [but] non-alcoholic beer constitutes an estimated 5% of all liquor in the Japanese market,” she said.

“It has increased by 320% for the past 10 years with a 3% CAGR growth over the last three years, and we expect this trend to continue.”

Kirin launched its non-alcoholic beer (Kirin Karada Free) which also obtained a Food with Function Claim (FFC) label for its fat-reducing properties in 2019.

Asahi also launched its own non-alcoholic version, the Asahi Dry Zero, earlier this year with a focus on using sustainable renewable energy for production.

Health and wellness

Diving deeper into the health and wellness benefits that LNA beers are expected to confer, its low calorie count and reduced sugar levels are also a big consumer draw.

A bottle of Heineken 0.0 is just 69 calories, whereas Nirvana Brewery’s various options are no more than 66 calories – and claim to contain extra nutrient benefits as well.

“A lot of the times if you’re not drinking alcohol the options would be lemonade, juice, or other sugary drinks [but] an alcohol-free beer is actually one of the healthiest options you can get after water,” Kean said.

“The sugar is very low, the calories are very low, and there are actually quite a few vitamins that occur from the yeast reactions, such as Vitamin B12 and even folic acid in quite high amounts.”

Kirin Karada Free takes the benefits a step further, with the company claiming that the consumption of this can give a ‘fat-reducing effect’

Brewing controversy

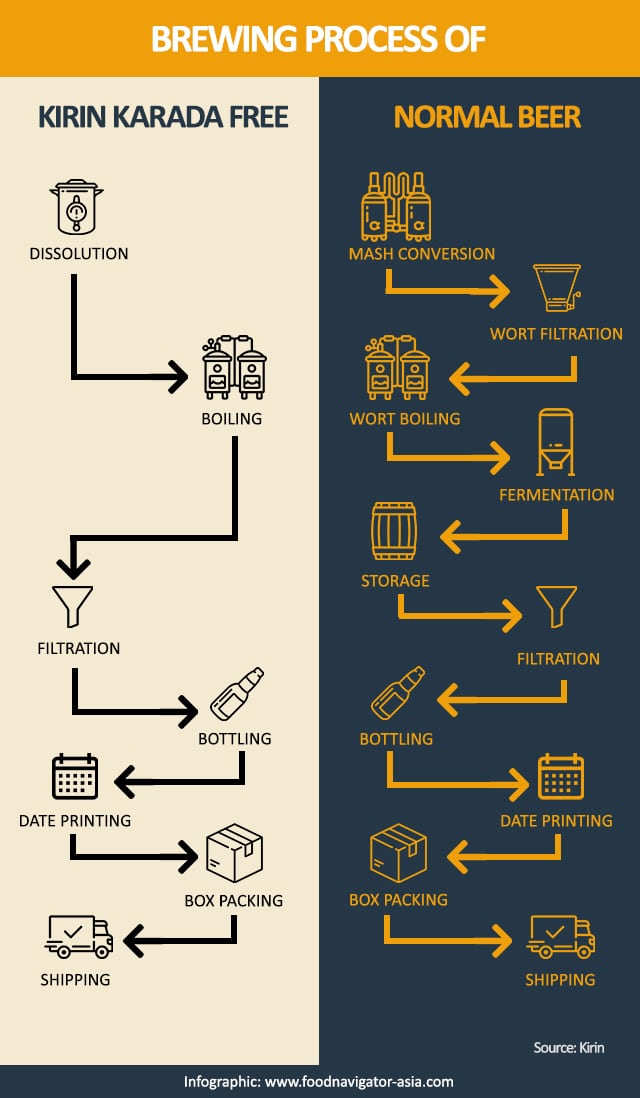

When it comes to the LNA beer production process, the various firms all have their own unique take.

Most non-alcoholic beers are fermented and the alcohol is removed after with various techniques, like Heineken 0.0, but some firms have said that the alcohol removal process can affect flavour, hence opt to prevent alcohol formation from the very beginning.

“The main benefit to producing it this way is that you’re maintaining all the flavour, especially the fresh flavour that you get in the hops, the delicate compounds from the malt and the yeast,” said Kean.

“[Those] sorts of flavours can easily be damaged if you’re boiling a beer to remove the alcohol. Boiling also tends to produce a weird off-flavour which generally tastes a bit strange or artificial.”

Watch the video below to find out more.

Kirin does it differently as well, opting to still boil their product, but without any fermentation taking place due to it not using malt as an ingredient in the first place.

“[The] beverage is not fermented, it is not made from malt and contains zero alcohol. Its entire brewing process consist of just dissolution, boiling, filtration, and bottling,” said Takashima.

Non-alcoholic wine

Although beer takes up 80% of the LNA beverage market, the remaining 20% is still a significant portion, comprising other types of LNA beverages such as wines and liquors.

One example of a company in this sector is Israel-based Wine Water, which manufactures non-alcoholic wine grape infused water under its O.Vine brand.

It produces both still and sparkling red and white wine-infused waters, which are made from upcycled fruit residue from the traditional winemaking process, reusing polyphenol-rich skins and seeds from the remains of wine grape varieties, including Merlot, Syrah, Petit Verdot, and Cabernet.

According to Anat Levi, CEO of Wine Water, the O.Vine infused water beverages are zero alcohol, clean-label, contain no preservatives, no added colours, and no sulphites.

“Normally between 15% to 25% of the harvest is lost (during wine-making). The product itself is based on waste recycling. Its key idea is to reuse the waste after the wine making process,” Levi told us.

“[Our] wine grape skin and seeds infusion is made of grapes harvested in green friendly growing vineyards, and most of them are sustainable certified [so] we follow specific principles in the vineyards to gain this certification.”

Also recently having launched in Asia with Japan as its first focus, O.Vine hopes to appeal to millennials, younger Gen X consumers from 30 to 55 years old as well as mature females who like drinking wine but are seeking healthy alternatives with no alcohol, lower calories and sugar.

“Alcohol consumption is very limited in the Middle East, mostly due to the Muslim restriction for alcohol [so] a distinct soft drink positioning is key to exploiting demand in these Muslim-majority markets,” Levi added.

Similar to Heineken and Nirvana, Wine Water emphasised that their non-alcoholic wine was not meant as a substitute regular wine either.

Challenges

Despite the rapid growth of LNA beverages in the region, various teething and regulatory issues have already reared their heads.

One of these was in Thailand, where alcohol sales and consumption are particularly strictly governed.

The local Alcohol Control Committee announced last year that it would be forming a working team into a ‘legal loophole’ that beer companies were ‘taking advantage of’ when it comes to the marketing of LNA beverages.

“If it’s advertised as an alcohol-free malt beverage, there’s no problem, but if it’s advertised as an alcohol-free beer, we have to examine the intention and whether the advertising is breaking any law,” Office of Alcohol Control Committee Director Dr Nipon Chinanowet said.

The other obstacle the industry ran into was of a religious nature, occurring in Malaysia later in the year when a minister commented that: “Using an alcohol brand name without the alcohol is very confusing because the process of manufacturing the beverage, including distillation, falls under the system of producing alcoholic products.”

"We know that [these drinks] are made by alcohol companies, so even if it is said to not contain alcohol, this can cause confusion and make Muslims think that they can consume it.”

Heineken 0.0 was not named specifically, but the company issued a statement clarifying that: “All Heineken 0.0 products are only available at the non-halal zone of supermarkets and convenience stores, with clear signage indicating that the product is strictly for non-Muslims, aged 21 and above only.”

Future of LNA

That said, the trend does not not anywhere close to dying down anywhere worldwide, so much so that an industry event dedicated just to low-to-no alcoholic beverages dubbed Low2NoBev is set to be held by William Reed, the publisher of FoodNavigator-Asia, in London this June.

In the APAC region, the future of the industry also continues to look bright, particularly in Japan.

With the upcoming Tokyo Olympics and Paralympics Games, Takashima said Kirin predicts sales of its non-alcoholic beers to increase.

“We expected that non-alcoholic beer will also increase in consumption due to the high affinity between sports and alcoholic beverages,” she said.

Although the impact of the recent coronavirus outbreak on the Olympics is yet to be seen, she added that the Japanese liquor tax will be reformed in October this year, and this would have an impact on present beer consumers who may eventually move to non-alcoholic beers.