More than 23,000 Australian craft beer drinkers from across the country took part in online craft beer retailer Beer Cartel’s annual survey, which is now in its fourth year.

“Craft beer is the only segment of the Australian beer market which is in continuous growth, with overall consumption of beer and alcohol in decline,” says Beer Cartel. “Most craft beer drinkers are positive about the direction craft beer is heading and are excited by the opportunity to try different beers.”

Key changes in the category over the last year have been a shift towards cans and an increase in online purchases, notes the survey.

Core ranges the most important

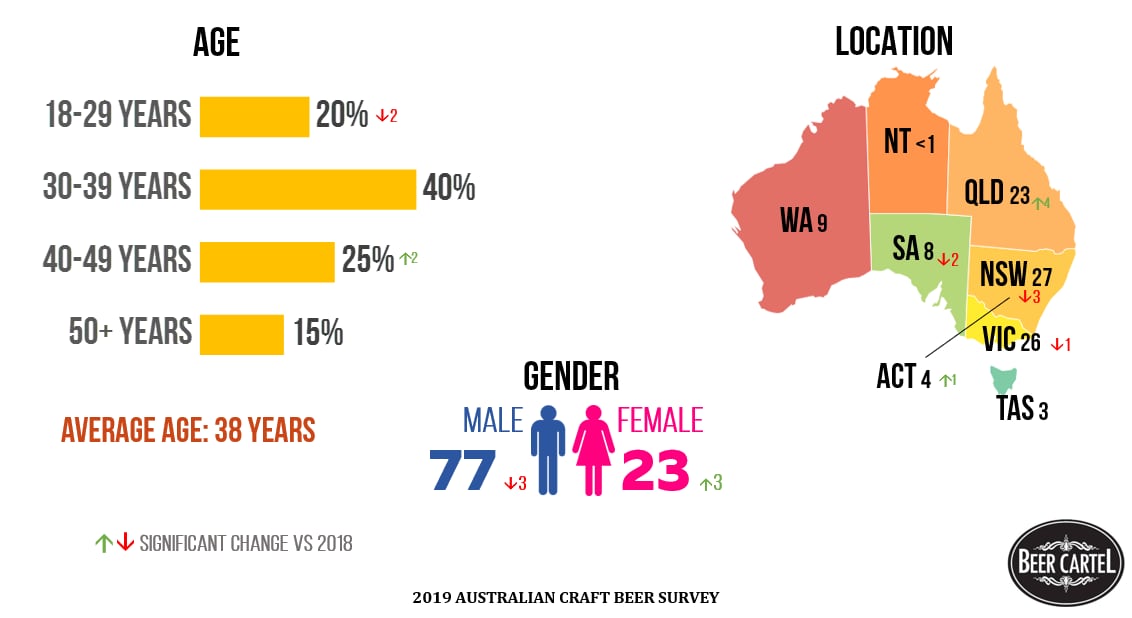

The average Australian craft drinker is aged 38; has been interested in the category for 8 years; and spends $56 a week on beer. The number of female craft drinkers has grown: but still only accounts for 23% of consumers, with 77% of drinkers being male.

Pale Ale /XPA is the most popular beer style; followed closely by India Pale Ale / double IPA.

Core range beers account for the majority of purchases. While past research indicated a large proportion of consumers are regularly drinking beers they’re never previously tried, the frequency of purchase of core range beers compared to new or limited release beers overall is much higher.

Drinkers use a wide range of sources to find advice on beers to buy. Friends & family (49%) are the most common source cited, alongside the brewery venue and brewery staff.

In the past year there has been growth in online beer purchases. According to the survey, 30% of craft beer drinkers purchase beer online at least every six months or more often, compared to 22% in 2018.

Do consumers care about craft?

In May 2018 the Australian Independent Brewers Association (IBA) released their Independence Seal to help consumers identify independent breweries. Awareness of the seal is growing: in 2018 a third of craft beer consumers knew about the seal: this year awareness has grown to 41%.

Nine percent of craft beer consumers said they would only buy beer with the seal; while 59% said it had a medium to large impact on their beer purchases.

For the vast majority of craft beer drinkers (78%), the term 'Independent Beer' is understood to mean beer that it is made by an independent brewery.

Other respondents linked the term ‘independent’ to being Australian-made, supporting small businesses, or being a higher-quality product.

As with other developed beer markets, large multinational brewers are snapping up Australian craft brands (Carlton & United Breweries with 4 Pines and Pirate Life; and Lion with Little Creatures; for example).

In the survey, 89% of drinkers said they were big supporters of independent craft beer.

But there remains a large minority (40%) who say they are happy to buy good craft beer irrespective of ownership (34% of respondents, in contrast, do believe that ownership is important).

Australia's best craft brewery, according to the survey, is Gold Coast brewery Balter Brewing Company.

Beer cans vs beer bottles

Consumer preference for cans has overtaken bottles for the first time in Australia. Overall preference for cans has grown 8 percentage points to 38%, while preference for bottles has decreased significantly to 27%.

“This reflects the changing landscape of vessels in Australia where the majority of craft brewers now sell beer in cans,” notes Beer Cartel.

However, 35% of craft drinkers said they did not have any preference what their beer was packaged in.

For most craft beer drinkers, four or six packs are the most common packaging format purchased.

The full survey results can be found here.