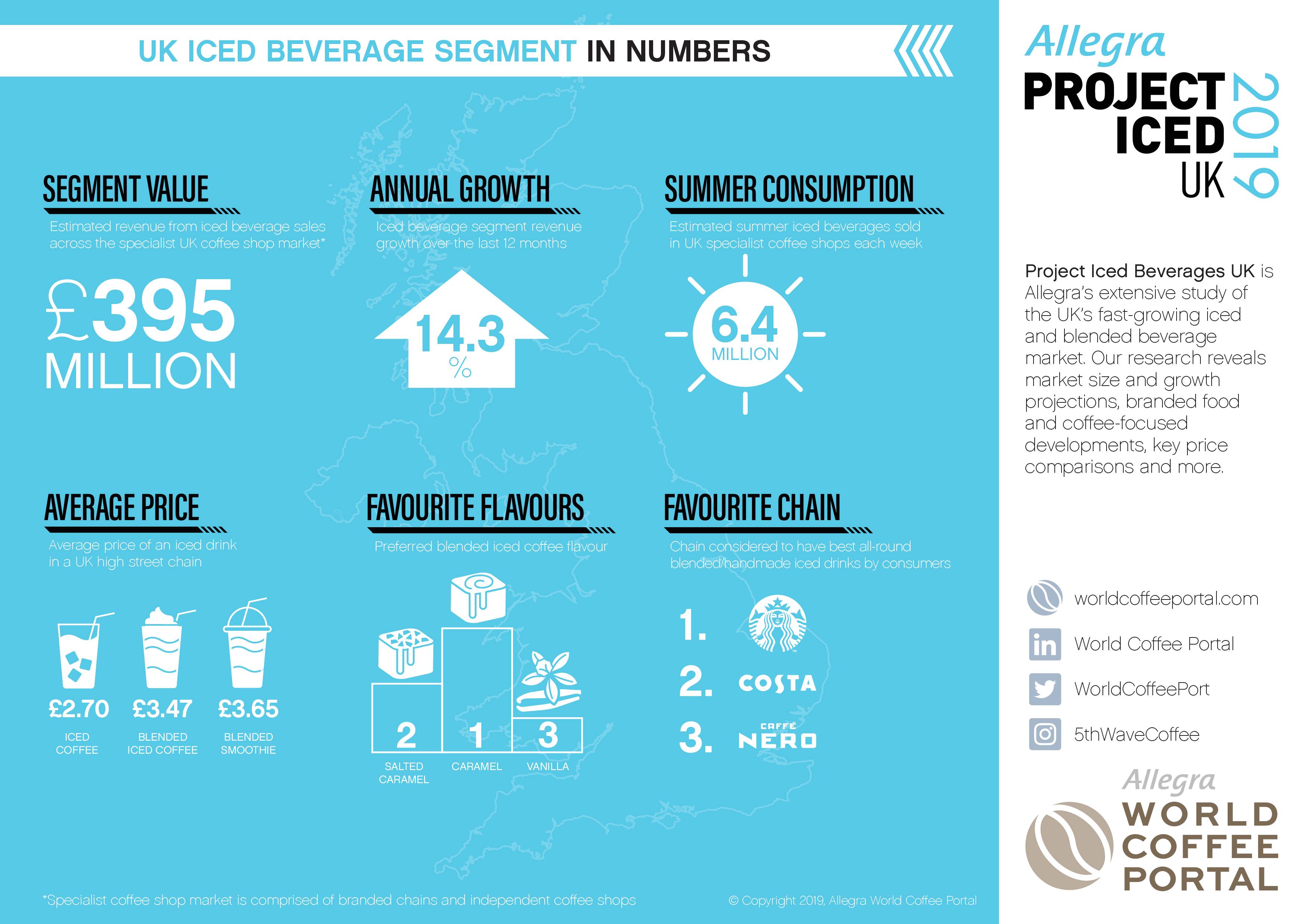

In a series of consumer surveys, industry consultations and field and data research, the Allegra World Coffee Portal (WCP) penned the report Project Iced UK 2019. The team determined that iced drink sales grew to £395m in 2018, up 14.3% from 2017.

This category represents 5.8% of the UK specialist coffee shop segment, which generates £6.8bn in annual revenue. WCP expects iced coffee drinks in the UK to build on its ‘strong market momentum,’ forecasting £449m in sales for 2019.

More than 170 million iced beverages are estimated to be sold in UK cafés every year, mostly dominated in the summer months. This is lead by consumers under the age of 30, 45% of which also shared that they purchase one every week.

However, price is a concern for shoppers as just 24% of UK consumers agreed that iced beverages are a good value for money, and independent cafés and roasters are facing tough retail challenges.

A future of RTD and cold brew

Ready-to-drink varieties have appealed to health-conscious UK shoppers, as they typically contain less sugar and fewer calories than blended, hand-crafted drinks in-store. About 50% of survey participants reported to WCP that they would purchase iced beverages more often if they were healthier.

Jeffrey Young, founder and CEO of Allegra, said “Iced beverages continue to represent a growing opportunity for the UK coffee market to innovate, access younger consumers and broaden the appeal of coffee venues.”

“While more work is needed to widen seasonal demand, a robust and diverse iced beverage offer is essential for operators wishing to remain firmly on the pulse of UK coffee market development.”

Cold brew, blended smoothies, freak shakes and other ‘Instagram-able’ drinks should be continued to be marketed toward young consumers, WCP said, to encourage year-round consumption of iced beverages.

The report stated that 45% of industry leaders consider cold brew as the most significant product opportunity in the iced beverage segment, even though cold brew sales are still a small portion of hot coffee.

Handmade iced drinks came in second for product opportunity at 42%, and just 10% of leaders believe nitro cold brew will have widespread availability and commercial potential in the UK.

Facing a saturated market

Even with competition from big brands and high street shops, there is a sustained consumer demand for high-quality roasted coffee in the UK, with the ‘café roastery experience.’ WCP said that 44% of industry leaders anticipate independent cafés as the biggest growth channel for wholesale distribution, followed by workplaces and contract catering.

Small-batch, single origin coffee is expected to grow in popularity over the next year, particularly with less familiar varieties from Rwanda, Myanmar and China. Sustainability initiatives are important, with 88% of roasters and 60% of consumers willing to pay more for ethically sourced coffee.

Competition from other roasters is perceived as the biggest current market challenge, with 49% of those surveyed saying there is an oversupply of roasters compared to consumer demand. Some roasters are resorting to mergers and acquisitions to stay competitive.

A tough retail climate in the UK is worsening, largely due to political uncertainty and rising labor and property costs. But the more than 7,000 independent UK cafés grew 4% over the last year, according to WCP, and 80% of the surveyed café leaders reported a positive sales performance.

“There’s no doubt independent coffee shops face an uphill struggle compared to scaled competitors, particularly in today’s highly challenging retail environment. But those independent cafés defined by razor-sharp menu quality and seamless, highly personalised hospitality face a very bright future indeed,” Young said.