The Coca-Cola and Pepsi brands have taken the no. 1 and no. 2 spots again of Euromonitor’s report, Top 100 Megabrands: How the World's Fast-Moving Brands Remain at the Top. But even as the category leaders, traditional soda has struggled to attract and retain customers in recent years.

“While several major brands have maintained their ranking for some time, the balance across the list is shifting. People’s attitudes to health and premiumisation are evolving and brands that cannot meet new realities have lost out,” Euromonitor said.

“Changes in how people research and shop online are having a profound impact. Also, the importance of different regions of the world has changed for many of these megabrands, raising the question of where companies should focus their resources most effectively.”

Caffeine-forward brands stay hot

The most significant region for fast-moving consumer goods (FMCG) brands is Asia Pacific, where retail sales value is highest. Energy drinks like Red Bull, which took the no. 6 spot, have traditionally done well in North America and Asia--its retail sales have risen strongly in China and the US since 2014.

But despite rising up from the no. 9 spot in 2014, Red Bull is facing flat sales in Asia Pacific thanks to strong competition. According to Euromonitor, consumers in the region traditionally see energy drinks as functional, non-premium offerings and are more responsive to lower price points, including private label.

Nescafe came in at no. 3 on the list, up from no. 4 in 2014. It’s the leading hot drinks brand worldwide and also sees most of its sales from the Asia Pacific region, with key markets in China, Japan and Thailand.

Japan’s busy consumer lifestyle drives the popularity of Nescafe’s instant coffee. But it faces competition from pod machines in its second-best market western Europe, including from parent company Nestle’s own machine, Nespresso.

Coke or Pepsi?

North America generates the most sales for no. 2 Pepsi with about $4bn in 2017. But its retail sales fell in North America, Latin America and Asia Pacific while sales rose in the Middle East and Africa.

As traditional soda, it’s facing the same challenges with sugar consumption that other brands are. The consumer turn against sugar has had a significant impact on these megabrands with more challenging years expected.

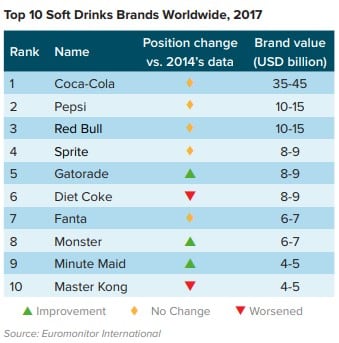

Even with the sugar pushback, Coca-Cola achieved global brand sales of about $35-$45bn in 2017 to maintain its no. 1 spot. This far outpaces the other top beverage brands as Pepsi, Nescafe and Red Bull all had about $10-$15bn in sales each.

Latin America is Coke’s standout market, accounting for 40% of sales. Mexico’s passage of a sugar tax in 2014 had a significant impact on its sales, which have fallen by more than a fifth in the Latin American region since then.

To combat this, Coca-Cola is attempting to rebrand itself as a “total beverage company” with more emphasis on tea, coffee, juice, plant-based beverages and bottled water. It made a high-profile acquisition of Costa Coffee in the UK for a major coffee platform, and it’s been collecting smaller tea and water brands for several years.

Megabrands of the future

According to Euromonitor, megabrands made up 14% of all FMCG sales worldwide in 2017. Most sales were driven by packaged food, soft drinks and beauty and personal care brands.

“The most significant area of growth is bottled water. Many consumers now seek it in preference to high sugar carbonates, juice or diet / low-sugar variants that are seen as more artificial, through the presence of sweeteners, for example,” Euromonitor said.

“As a fragmented, commoditised and often localised product, bottled water brands are not threatening the soft drinks megabrand rankings.”

But still, consumers are turning to low-calorie and low-sugar flavored drinks like La Croix, Spindrift and bubly, and expanding their preferences to emerging categories like kombucha.

Beverage megabrands are also learning to navigate the world of e-commerce to their advantage. Evolving purchase models like subscriptions or one-button purchases can increase consumer loyalty and “allow potential disruptors to flourish (as they do not necessarily need shelf space).”

Euromonitor’s full top ten ranking is: Coca-Cola, Pepsi, Nescafe, Lays, L’Oreal Paris, Red Bull, Pampers, Tide/Ariel, Nivea and Huggies.