The latest figures from Wine Australia show that the average value of bottled wine grew by 10% to a record $6.20 AUD per litre FOB in 2018.

In addition, the value of exports above $10 per litre ($7.12 USD) reached a new record in 2018, growing 22% to $895m ($638m USD).

‘Strong growth’ across categories

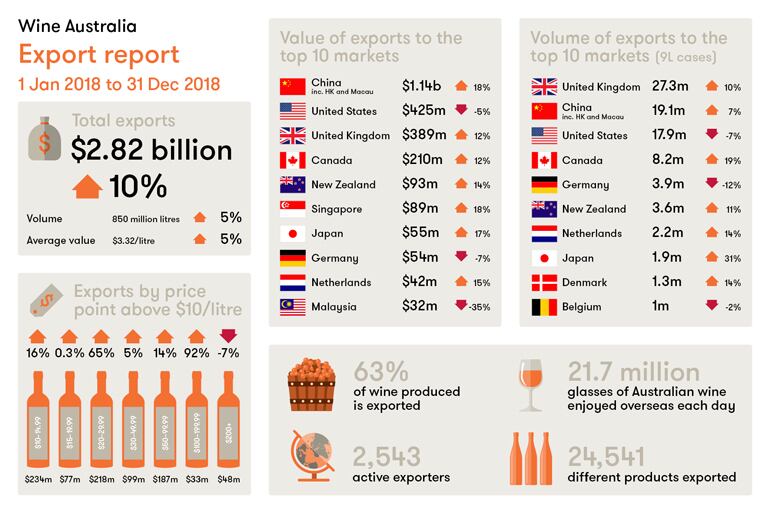

Total Australian wine exports grew in 2018, with an increase of 10% in value to $2.82bn ($2bn USD) free on board (FOB) and 5% in volume to 850 million litres (94 million 9-litre case equivalents), according to figures for the year ending December 31, 2018.

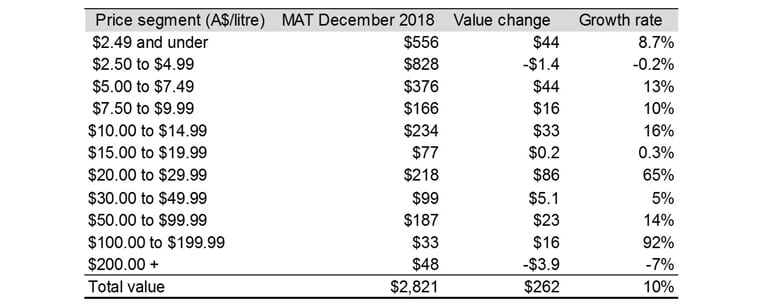

In particular, wine exports in the $20-$29.99 AUD segment grew 65%, while wine in the $100-$199.99 AUD segment grew 92%. Meanwhile, wine exports in the $10-$14.99 AUD category grew 16%.

Bottled wine shipments increased by 7% in value to $2.24bn ($1.6bn) but decreased in volume by 3% to 361 million litres (equivalent to 40 million 9-litre cases). The average value of bottled wine grew by 10% to a record $6.20 per litre FOB.

Unpackaged wine also enjoyed ‘outstanding growth’, reaching record levels in value (up 27% to $560m) and volume (up 12% to 480 million litres or 53 million 9-litre case equivalents). The average value of unpackaged wine continued to grow, increasing by 14% to $1.17 per litre.

Another record was the value of exports above $10 per litre, which grew by 22% to $895 million. The value of exports above $10 per litre FOB now surpasses the value of exports in the $2.50–4.99 AUD per litre segment, which is historically the largest segment of exports.

Export destinations

The US, China and the UK are the top trio of destinations for Australian wine (China tops the chart in value terms, followed by the US and UK; while in volume terms the UK is the largest market followed by China and the US).

Exports to China - one of the most exciting markets for Australian wine exporters - continue to grow: up 18% in value to $1.14bn AUD and up 7% in volume.

Canada is the fourth largest market in both value and volume terms. Other key markets for Australian wine exports include New Zealand, Singapore, Japan and the Netherlands.

Regionally, the Middle East showed the biggest growth as a destination for Australian wines, although a small market comparatively: growing 36% to $33m in 2018. Exports to Northeast Asia grew by 19% to $1.23bn; exports to Europe grew by 7% to $615m; Southeast Asia grew by 3% to $171m; and exports to the Oceania region grew by 12% to $105m.

Exports to North America are starting to level out after 12 months of decline, posting 0.1% decline to $636m in 2018.

Red wine continues to be the most popular wine style exported from Australia by a long way, with its value increasing by 12% to $2.14bn in 2018. The value of white wine exports also grew, however - up 10% to $607m.