That is according to a new report by Rabobank into China’s craft beer market at a time when the traditional beer market has matured considerably and is now much more developed than in countries in Southeast Asia.

With annual consumption above the global average at 36 litres per capita, the beer market has witnessed a significant increase in both value and profitability, though much depends on regional differences. The well-developed eastern provinces consume much more beer than the emerging west, though it has reached a ceiling with stagnant volume growth.

Today, beer production in Beijing is lower than it was in 2006, whereas in Qinghai it is still growing and has risen by 180% over the last ten years, the Dutch agricultural bank found.

Following a global trend towards premiumisation, mainstream beer in China has gone through a difficult time over the past five years, while super-premium beer volumes have grown by 160% and now account for 4% of the volume and 18% of the profit pool.

As one of the segments in the super-premium category, craft beer volume is generally assumed to be considerably less than 1% of overall Chinese consumption. Yet now it is showing strong growth momentum.

Craft is performing exceptionally well in Shanghai, Beijing and Guangzhou, Rabobank found, noting that Chinese millennial consumers have similar purchase considerations as their peers in other countries, leading to strong potential.

“That will be great opportunities for imported craft beer, domestic craft beer that uses foreign ingredients and domestic craft beer from local ingredients.” said Francois Sonneville, a Rabobank senior food analyst.

“Yet challenges always go with opportunities. There are a few negative factors restraining the further development of craft beer in China, including consumers’ unfamiliarity towards the product, relatively high costs of transportation, distribution and imported ingredients, logistic issues of cold chain and brewing capacity shortage.”

Nonetheless, Rabobank expects that imported craft will benefit from improvements in logistics. For Chinese craft brands, the outlook might be even better as contract brewers solve quality issues and invest in more modern local capacity.

More stories from China…

Taiwan issues new labelling regulations for fish, chocolate and herb

Taiwan has introduced new regulations to govern the labelling of several foods in a bid to improve food safety and protect consumers' rights, the Food and Drug Administration said.

The new measures cover labelling of cod, chocolate and semen coicis, a traditional herb, after they came in force on January 1.

The regulations, which are part of the Act Governing Food Safety and Sanitation, stipulate that only fish classified as Gadiformes should be labelled as cod, whereas other species, even if they are close to the Gadiformes order, should not be.

This follows cases of sea bass and Greenland halibut being labeled and sold to Taiwan consumers as cod.

The FDA also said that products labelled as dark sweet chocolate must contain at least 35% cocoa solids, while those labelled as milk chocolate must contain at least 25% cocoa solids. Otherwise, the product cannot be called chocolate, the FDA said.

New labelling regulations cover Semen Coicis, which the FDA said had been misrepresented, with food companies allegedly selling pearl barley under the guise of the similar looking traditional herbal ingredient.

Violators will be subject to fines of NT$30,000-4m (US$930-125,000).

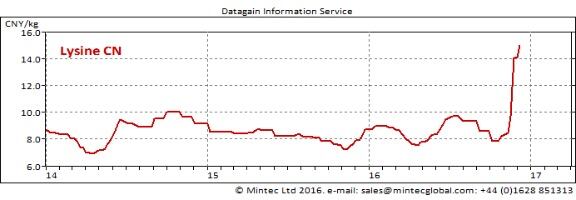

Lysine prices increase on supply disruptions

Prices of lysine, a major protein used in feed compounds, rose 78% month on month at the start of December in China, due to a shortage in supplies and an increase in demand.

According to commodities analyst Mintec, supplies to major Chinese markets have been limited by stricter transport regulations starting in November, limiting the truck carriage size.

This delayed lysine deliveries through November, leaving stocks in major trading regions scarce. Snowy weather conditions in the northeast regions of China have also disrupted transportation.

On the demand side, an increase in the number of pigs in China this year has fuelled feed consumption. This has caused demand for lysine to strengthen, adding further upward pressure to prices.