Update: SABMiller rejects proposal

UPDATED: SABMiller has rejected the proposal this afternoon

It is the third proposal the brewing giant has made: in a statement this morning it confirmed that two prior written proposals had been made in private and rejected by SABMiller.

The first offered £38 per share in cash, and the second £40 per share. The revised proposal offers £42.15 per share in cash, with a partial share alternative available for around 41% of SABMiller shares.

AB InBev says it is ‘disappointed’ that the prior proposals were rejected; but believes the new offer will be ‘highly attractive and an extremely compelling opportunity’ for SABMiller shareholders.

AB InBev adds that the proposal represents a premium of around 44% to SABMiller’s closing share price before speculation of an approach from AB InBev was renewed (the shares were priced at £29.34 on 14 September).

But a statement from SABMiller this morning has responded with less enthusiasm. It confirmed that its board met on Monday and rejected the second proposal of £40 per share. It also concluded that, in the event of a £42 per share proposal, it would reject such an offer as it ‘still very substantially undervalues SABMiller.’

The board will now meet to discuss the third proposal of £42.15 per share.

“The all-cash offer within the new proposal announced today [£42.15 per share on October 7] is only £0.15 higher than the £42 proposal considered and rejected on 5 October 2015. The Board will, of course, meet formally to consider the £42.15 proposal as soon as practicable and a further announcement will be made thereafter,” said SABMiller.

Jan du Plessis, chairman, SABMiller, said “AB InBev needs SABMiller but has made opportunistic and highly conditional proposals,” adding that AB InBev is still undervaluing the company.

‘A truly global brewer’

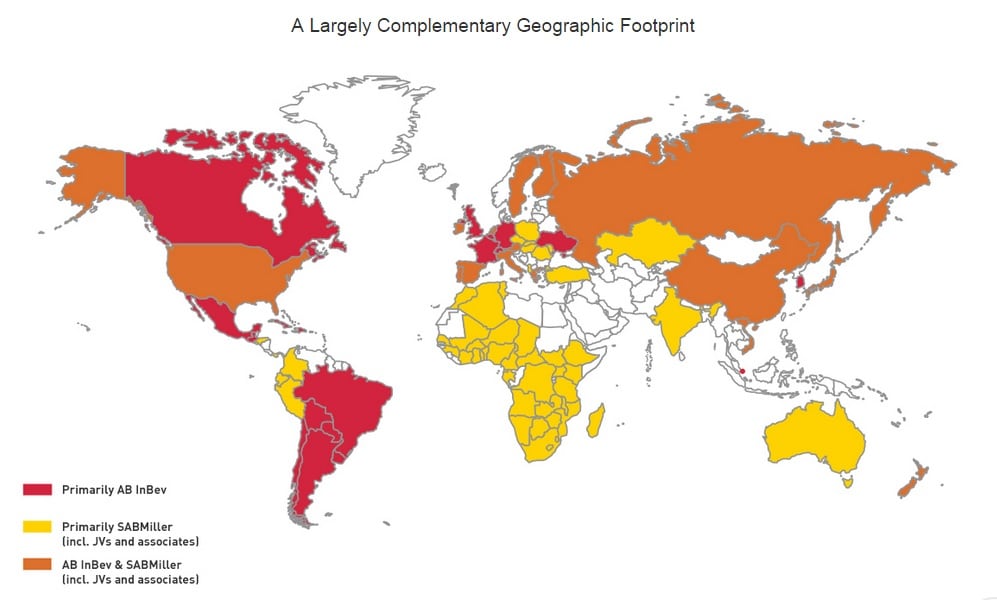

The combined group would be present in most major beer markets, and in particular the emerging regions where strong growth is predicted.

The combined mega-brewer would generate revenues of $64bn and EBITDA $24bn.

Carlos Brito, CEO, AB InBev, said: “Our footprints are largely complementary, and where we have geographic overlap we will be proactive in addressing any regulatory issues. The combined company would have strong growth prospects in key emerging regions such as Asia, Central and Latin America, and of course Africa.”

The US and China in particular could be regions where regulatory or contractual considerations arise: these would be dealt with promptly following discussions with SABMiller and business partners, he continued.

AB InBev holds a strong position in North and South America, as well as the UK and some of Europe. Meanwhile, an important part of SABMiller’s footprint is Africa, where it has been present since the 19th century. For AB InBev this is a key region for the future with ‘hugely attractive markets:’ GDPs are on the rise, there is a growing middle class, and increased economic opportunities.

“We are very excited about the prospects of making a major investment in Africa, a continent that we believe has great growth prospects,” continued Brito.

“SABMiller’s South African heritage and its commitment to the African continent has been a key driver of its success, and we intend to sustain this, to support the future growth of the business.”

Big brewing deals

If AB In Bev’s $103.6bn offer for SABMiller goes ahead, it will be the biggest deal in brewing history. AB InBev and SAB Miller are the two biggest brewers: a combined force would control 30% of global beer volumes.

In 2008, InBev bought Anheuser-Busch for $52bn. This turned it into the world’s largest beer maker.

AB InBev boasts brands including Budweiser, Corona, Stella Artois, Beck’s, Leffe, and Hoegaarden and Skol.

Beer and soft drink business SABMiller owns brands including Peroni, Grolsch and Foster’s.

The combined mega-brewer would own 18 of the world’s 40 most popular beer brands (by volume). A largely complementary distribution network would boost the combined brand portfolios, says AB InBev.

“For consumers, this is about choice, more choice in more regions of the world,” said Brito. “Our joint portfolio of global and local brands would provide more choices for beer drinkers in new and existing markets around the world. Consumers would have more opportunities to taste a wide range of beers, ranging from specialty and craft beers to local champions and global flagship brands.

“We also see significant opportunity in bringing together our innovation capabilities to introduce exciting new products that suit the tastes of consumers around the globe.”

A global management team would draw on the combined skills from the two companies, Brito suggested, adding that many of SABMiller’s most senior executives would have a role in the combined company.