The research firm’s report Cider, UK – January 2013, highlights UK cider volume sales up slightly to 884m liters in 2012, while value sales surged to £2.69bn, driven principally by demand for cider among the under 35s.

Mintel predicts that tax and inflationary pressures will slow volume growth from 2013-2017, but that these factors will drive faster value growth, with a 38% uplift to £3.7bn in value sales possible by 2017.

Discussing the success of Stella Artois Cidre – which has built a 6% value share in just two years in the world’s largest cider market – behind Bulmers (Heineken) 7%, Magners (C&C) 8%, Strongbow (Heineken) 24% – Mintel senior drinks analyst Chris Wisson explained AB InBev’s success.

“They’ve got big advertising support, the distribution is there. When they launched Cidre, people really didn’t think it was going to work, that Stella wasn’t a natural fit for cider. The fact that it has worked so well shows that (A) it’s a good product, and (B) it’s brought a lot of beer drinkers into the cider category," Wisson said.

Stella Artois brand security

People talked about ‘Stella man’, Wisson said, the stereotypical UK male Stella Artois drinker who previously wouldn’t drink cider. “Because he’s got the security of the Stella brand in the category, he’s now trying cider as well,” Wisson said.

“It was a great launch. They [AB InBev] did it just at the right time. Now they’ve just launched a pear cider as well, which is a logical next step, since pear is very popular as well.”

Other major brewers were following AB InBev’s lead, Wisson said, with Carling (Molson Coors) recently announcing the launch of their own cider, while Carlsberg had “dipped their toe into the market” with Somersby.

UK taxation on cider was much more favorable to producers than it was for beer, Wisson explained. “No doubt that was an encouraging factor for Stella when it launched the cider, lowering the risk somewhat, knowing they could make much more favorable margins than they could on their lager in the UK.”

Talking of other recent large-scale launches, Wisson said: “Somersby is not very clearly branded as a Carlsberg product, but it’s not been as spectacular as Stella Cidre. That’s to be expected, because Stella was first to market.”

Carling’s product, out next month, was clearly labeled with its eponymous brand name, Wisson said. “They’re relying on the quality of their brand name to attract more people over.”

‘Cool, fashionable Kopparberg’

The other major UK success story in 2012 (£60m), Swedish brand Kopparberg (6% value share, £60m sales, picture left) started gaining traction in 2008, Wisson explained, via a very different approach to Stella Cidre.

“They’ve really gone for the under-35s market, and they’ve done a great job of making it quite a cool, fashionable brand for younger people to be seen with. Surveys show it’s the coolest brand with students.

“It’s not a massive advertiser, but it’s quietly gone about its business, appealing to the younger drinker with quite accessible flavor profiles. They’ve gradually built momentum, focusing on the on-trade first, now they’re one of the big guys in the off trade as well.”

Brands such as Kopparberg were tapping fruit-flavored cider demand, Wisson said (beyond the core demand for traditional apple and pear ciders), among younger drinkers. “Much like Stella, that’s drawn new people into the market. 10 years ago apple cider was considered a bit stuffy old man in style. Now it’s much more vibrant.”

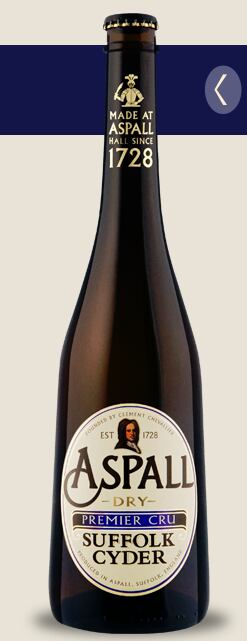

On the one hand, brands such as 7% ABV Aspall Premier Cru (left) stressed their terroir qualities, and were positioned almost as competitors to wine, Wissall said, but there was also space for “accessible fun brands that are perhaps not so connosseurial or premium, and are more accessible than region-specific brands”.