As volumes of carbonated soft drinks, milk and juice continued to fall, Americans’ consumption of bottled water surged 7.9% in 2015 (by volume), while dollar sales rose 8.9% over the same period.

Michael Bellas, BMC chairman and CEO, added: “Americans increased their annual consumption by more than 11 gallons, from 25.4 gallons per person in 2005 to 36.5 gallons a decade later. During the same period, per capita consumption of carbonated soft drinks dropped by 12.4 gallons. Per capita consumption of other major beverage categories, like milk and fruit beverages, also fell.”

He added: “While some consumers have turned away from regular, full-calorie sodas in favor of their diet versions, many others transitioned to bottled water instead.”

According to the IBWA, approximately 73% of the growth in bottled water consumption among consumers since 1998 has come from people switching from carbonated soft drinks, juices, and milk to bottled water.

While the industry has attracted some negative PR over its sustainability credentials, the IBWA argues that the environmental footprint of bottled water is the lowest of any packaged beverage (click HERE).

Per-capita consumption of bottled water rose 7.1% in 2015, with every person in America drinking an average of 36.5 gallons of bottled water last year, according to the International Bottled Water Association (IBWA).

Tap water clearly has a lower carbon footprint than the bottled variety, acknowledges the IBWA, but it’s not the case that millions of consumers are ‘trading up’ from tap to bottled water, it says, as most of the growth in bottled water is coming from consumers switching from other packaged soft drinks (that have a higher environmental footprint).

Similarly, banning bottled water – but not other packaged beverages - from national parks and other locations on sustainability grounds does not prompt most visitors to use drinking fountains or bring tap water from home as an alternative, says the IBWA. “Where other packaged beverages are available, most consumers will choose soda or another sugary drink [instead].”

Which segments in bottled water are growing most strongly?

“Regular, lower priced bottled water is growing at 5%, total premium is growing at 20%, and the higher alkaline sub category at almost 60%...quarter in and quarter out. That equates to 9% growth across the total category.

"This is good for the industry, the premium bottled water category, our higher alkaline sub category, and specifically for AQUAhydrate.”

Hal Kravitz, CEO, AQUAHydrate

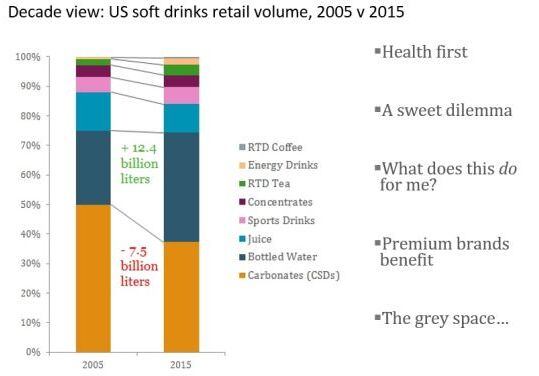

The above chart from Euromonitor International highlights just how much volume the carbonated soft drinks category has lost over the past 10 years, although juice has also lost ground. So what are consumers drinking instead? Bottled water (easily the biggest winner), energy drinks, ready-to-drink coffee and tea, and sports drinks, said senior beverages analyst Howard Telford during our Feb 2016 beverage innovation summit.