That 40% growth will come despite bans and restrictions in some countries due to health concerns about caffeine, taurine and other stimulants and how they are consumed in some situations like by young people mixing them with spirits in bars and night clubs.

At about €12.4bn the US was by far the biggest market in 2015 followed by the Asia-Pacific at €10.1bn and western Europe at €7.3bn. Latin America was worth €3.8bn, the Middle East and Africa €1.8bn, eastern Europe €1.5bn.

All regions are forecast for strong growth until 2020, with China showing the most spectacular surge as it doubles from a €6bn market now to be worth €12.4bn in 2020. That’s close to half of the world’s forecasted energy drink sector growth and, if continued, would see China overtake the US as the world’s biggest energy drink market in about 2025.

Explaining the success of the category, Howard Telford, senior beverages analyst at Euromonitor International said: “There is an expectation in the market today that soft drinks we consume also satisfy a need for energy, for enhanced hydration, for nutrition, for relaxation etc.”

Telford said ever more numerous older consumers were buying into the category in ever greater numbers. “Energy drinks and the wider world of functional beverages are interested in reaching older consumers and we’re seeing new, different flavours as one way to bring new consumers into the category.”

With that addition, the youthful core remains. “The rise of energy drinks over the past decade has come from the ability of the category to successfully meet that functional demand for energy, and through the targeted way that leading energy brands – Red Bull and Monster – have positioned themselves as lifestyle beverages for Millennials.”

Going forward Telford predicted “the continued success of the category is going to be contingent on how well it adjusts to other products –water, juice, tea – entering their territory through enhanced, functional launches.”

“The explosion of new flavour launches that we’ve seen over the past two years suggests that the category needs to adjust to retain existing consumers and expand appeal beyond its core consumer.”

Regulatory reverberations

In China as in the US and almost everywhere the threat of regulatory clamp downs shadows the sector and actions have already been taken in Baltic EU nations Latvia and Lithuania where sales have been banned to under-18s and marketing restrictions put in place. In Baltic neighbour Estonia, the government Institute for Health Development instigated a campaign warning of potential health problems associated with energy drinks like heart problems.

Just today a Danish member of the European Parliament (MEP) tabled a motion to veto European Commission-approved caffeine-based health claims that could appear on energy drink and other products very soon.

“Other countries such as the Netherlands and UK have introduced warning labels on energy drinks advising they are not suitable for pregnant women and children under 16 years old,” said Canadean beverage analyst Chris Strong.

Energy giants: Global market share breakdown in 2015

In latin America Uruguay has banned the import of energy drinks due to raised caffeine levels and in some countries they are susceptible to higher taxation.

Category blurring, growing, mixing

Category blurring is being driven by start-ups and other players.

“The market found innovation inspiration in categories with a more wholesome image, such as fruit juice, RTD tea, bottled water and dairy drinks. Combining an energy function with these drink sectors resonates with consumers all around the world,” Mintel noted in a recent report.

Telford at Euromonitor agreed: “Products like [Pepsi-owned] Mountain Dew Kickstart are creating new occasions and expanding the flavour options for energy drinks consumers. Even a growth category like cold brew coffee can be viewed as having a functional appeal similar to energy drinks.”

Bars and nightclubs where energy drinks were mixed with spirits like vodka remained an important consumption occasion for the category, but sales had grown in other channels.

“In general, retail sales have grown faster than on-trade volume. Bars/pubs/clubs may be a channel where we see more innovation in the future – Monster introduced a new can size to UK on premise earlier this year. There may be room, through flavours and larger sizes, for energy and functional beverages to compete as both mixers (where they are established) and also as stand-alone soft drinks on-trade. “

Impulse single-serve occasions in convenience stores, petrol station forecourts and independent small groceries remained a much larger trade channel than take-home, multipack occasions, he said, “despite attempts to growth this segment.”

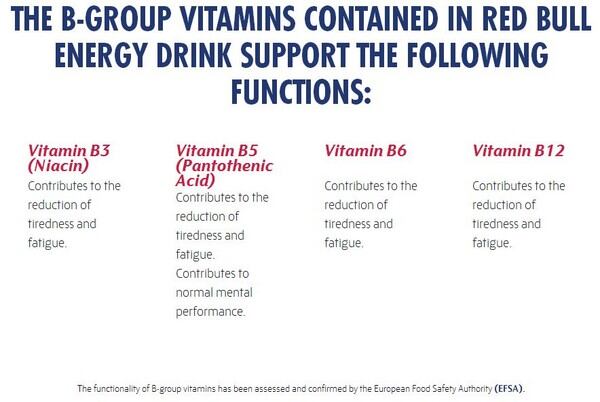

A slew of EU-approved fatigue fighting vitamin B claims did not hurt the sector, as would likely soon-to-be-approved caffeine claims, but Telford observed “I don’t think this has a substantial ongoing impact on consumer perception or sales of the category.”