Asia-Pacific spirits sector to grow by over $100bn by 2022

The APAC spirits sector is projected to have a CAGR of 5.4% from USD $398.2bn in 2017 to USD $517.2bn in 2022, according to new research from GlobalData.

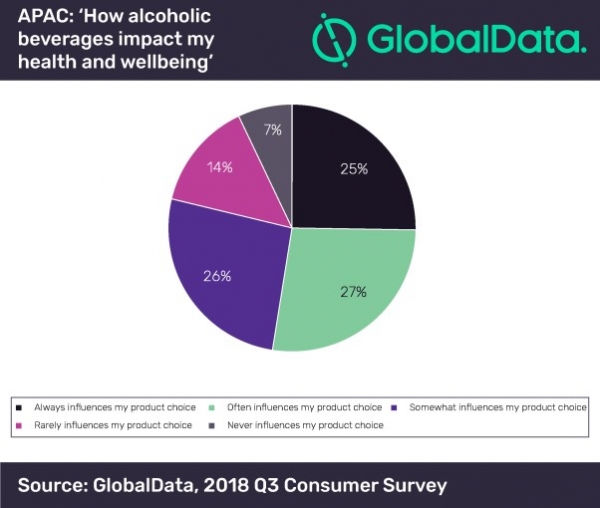

Rising health awareness, increasing use of social media and growing demand for better quality spirits as factors that are shaping the APAC spirits market: and GlobalData suggests “manufacturers should introduce spirits with indulgent flavor blends that offer health benefits to capitalize on the emerging trends.”

Consumers are looking for spirits that are lower in alcohol than in the past, for example; as well as focusing on quality rather than quantity with premium, authentic products.

Specialty spirits

The category most likely for fast growth in region are specialty spirits, keeping on trend with health-consciousness in young people. Specialty spirits held the largest share of total value sales at 79% in 2017, followed by whiskey at 12.6%.

The country markets with the highest growth potential are Australia, Hong Kong, China and New Zealand. More women drinking in the category are expected to shape its outlook in the next few years.

Trading off quantity for quality

Parag Talesara, consumer analyst at GlobalData, said “Consumers are making informed, health-driven choices and are willing to spend more on alcoholic products marketed with claims such as ‘low alcohol’, ‘made using traditional equipment’ or ‘brewed following traditional techniques’.

"They perceive these products to be of better quality, healthier and safer than mass-produced products.”

There is no great brand monopoly in the APAC spirits sector, with the top five brands - Jinro, Red Star Er Gau Tou, Niu Lan Shan, Ruang Khao, and Officers Choice - all accounting for just 10% value share in 2017.

The six key distribution channels for APAC spirits are hypermarkets and supermarkets, convenience stores, food and drinks specialists, e-retailers, vending machines, on-trade and other general retailers.

“Consumers in APAC - especially in Australia and New Zealand - are willing to trade-off quantity for quality and are seeking spirits made in small batches: perceiving them to be of better quality," said Talesara.

"Manufacturers, therefore, must focus on targeting quality-focused consumers and use native botanicals, herbs, and spices to offer an authentic consumption experience.

“Demand for spirits in the region will continue to rise due to thriving bar culture. Low alcohol spirits will remain drinkers’ favorite category when compared to other spirit types: prompting distilleries to introduce spirits with low alcohol content.”