'A MIXED YEAR AND A TOUGHER ONE THAN WE ANTICIPATED AT THE START': CFO DEIRDRE MAHLAN

NORTH AMERICA: Wealthier consumers reap recovery benefits

“Consumers of average and below incomes are still under pressure, and as a consequence, total spirits market growth has slowed, driven by standard and value price points,” Ivan Menezes.

Nonetheless, Diageo’s CEO said North America – the firm’s biggest and most profitable region – continued to deliver top-line growth and higher margins (up 300 basis points in two years).

US spirits and wines grew 5% and Canada 1%, but Diageo Guinness USA fell 7% – tequila rose 34%, but vodka fell 1% and Smirnoff 2% in the States.

Despite weakness at the lower end of the North American spirits market, Menezes said Diageo had been more cautious on pricing, its reserve brands delivered.

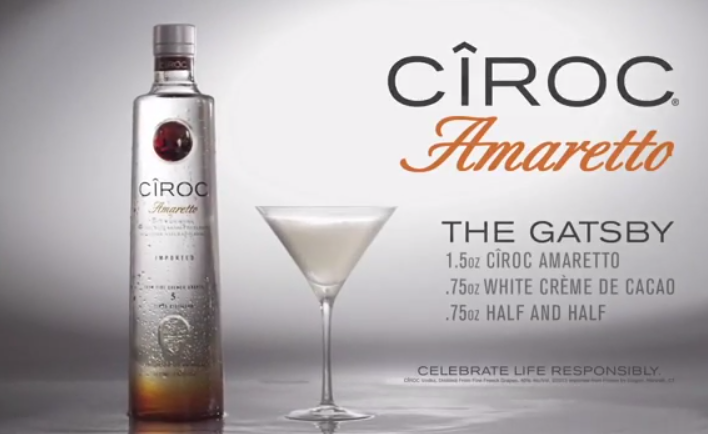

Johnnie Walker, Bulleit and Ciroc Amaretto all grew double-digit, he added, “as wealthier consumers have benefited most from the economic recovery”.

Touching on social and demographic change in North America, Menezes cited data showing that spirits share of the total beverage alcohol (TBA) market rose significantly in the 10 years to 2013.

In 2003 beer accounted for 58% share of throat, wine 14% and spirits 28%; today the figures are 53%, 15% and 32% respectively.

The number of young spirits drinkers has also risen steeply – within the 21-24 demographic, spirits commanded a 43% share of TBA servings in 2013 versus 35% in 2005. (GFK/MRI Doublebase Study).

Finally, data comparing 2005-2013 shows the popularity of spirits among Hispanic LDA (Legal Drinking Age) and TBA drinkers – with spirits share of TBA purchases among this group up from 30% to 36%.

Summing up this data, Menezes said: “Our business in North America is the engine of our growth and I have spoken before about the demographic and social change that underpins that.

“But it bears repeating. The number of legal purchasing age consumers is increasing and society is becoming more multi-cultural. Both drive a continued shift to spirits," he added.