£62m UK brand set for Stateside rollout

Apple of AB InBev’s eye: Stella Cidre set for US launch

Discussing Anheuser-Busch InBev’s Q1 2013 results in last Tuesday’s earning call – volume fell 4.1% year-over-year in organic terms, revenue fell 1.5% to $9.169bn, net profit rose 23% to $2.051bn – Brito said the firm’s US innovation pipeline was strong, refering to success for Bud Light Platinum and flavored RTD beer Lime-A-Rita.

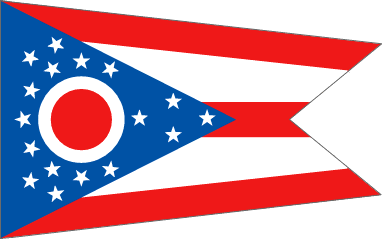

AB InBev was already seeing great results from Straw-Ber-Rita, “which is on track to be event larger than Lime-A-Rita”, Brito said, while Stella Artois Cidre (pictured) would arrive “in the next few weeks” alongside new Budweiser ‘bow tie’ cans in 8 packs.

Large US brewers cherish hard cider hope

In late February, Mintel senior drinks analyst Chris Wisson hailed the UK success of Stella Artois Cidre, which built a £62m brand (a 6% value share) of the world’s largest cider market in two years.

Many analysts see cider as an ‘escape route’ for large US brewers faced with flat volumes in mature markets – one that could start from a premium position in the States but also offer affordability and scalability – alongside new craft beer brands or launching beer-based RTDs.

Kicking-off the call, Brito said said that in Q1 AB InBev was hit in the US by a tough weather comparable and macroeconomic factors – payroll tax hikes, higher gasoline prices, delays in tax refunds – that put pressure on consumer income.

However, AB InBev’s overall market share fell by around 50 basis points (0.5%), a loss Brito attributed to the brewer’s sub-premium brands (an AB InBev spokeswoman told BeverageDaily.com these were Busch, Natural/Natural Light, Rolling Rock) and the firm’s strategy of narrowing the price gap between these and its premium brands.

North American margin expansion ‘hasn’t happened’ – Analyst

But while he praised AB InBev’s management for building up “huge credibility with investors and analysts over the years”, Liberum Capital analyst Pablo Zuanic noted the firm’s lackluster US showing.

“You have been talking about North American EBITDA margin expansion for a few quarters already. It hasn’t happened,” Zuanic said.

He added: “In fact, we’ve seen declines for four quarters in a row, so sorry to put you on the spot, but you need to be a little more clear and specific about how and when we can begin to see EBITDA margin expansion in the US and whether that really a target.”

Brito replied that since AB InBev came into being, it had grown US margins from 28% to 40%, but that the firm had never promised margin expansion every quarter and every year, but was “trying to build innovation that will be important for our future”.

“You have to remember that when we got into this business, there was the Bud Light…but other than that…the pipeline was a little empty,” he said.

AB InBev had since filled this pipeline, de Brito said, adding that “as important as margin pool enhancement is building for the future…so we can have margin expansion as we go forward”.