One-shot energy drinks show bullish growth

One-shot drinks are winning over consumers because they deliver a clear single benefit – an energy payload – without consumers having to drink a 250ml or 500ml beverage, writes report author, Julian Mellentin.

“The proposition behind energy shots is simple: From a concentrated potion of caffeine, vitamins and amino acids, consumers get the functional ‘bang’ that they receive from an energy drink but without having to consume a drink that tastes relatively unappealing – or consume nearly as much liquid,” Mellentin says.

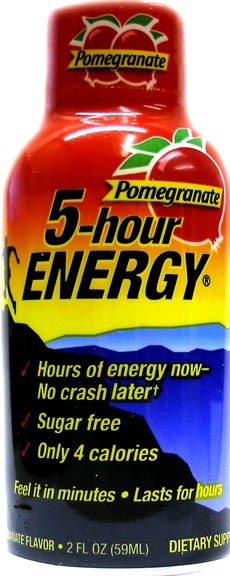

“With many energy-shot products, they also can avoid sugar, meaning that they can sidestep the ‘sugar crash’ that follows consumption of many energy drinks.”

Indeed the leading US brand – 5-Hour Energy – in television advertising promises, “hours of energy now, no crash later.”

Me-too

Most one-shot energy drinks come in an 80ml format and have been launched by smaller niche players creating a situation where the likes of Red Bull, PepsiCo and Coca-Cola and even Red Bull are having to play the “me-too” game.

The most advanced western market – the US – has surged to $500m in five years according to estimates made before the recent entry of the beverage giants.

“The recent entry of Red Bull, with Red Bull Energy Shot and Red Bull Sugarfree Shot, indicates the appeal of the new category,” says Mellentin, adding that opportunities existed in “virgin territory” such asAustralia, parts of South America and the Middle East.

Mellentin says opportunities exist for new brands to become dominant in these countries and many parts of Europe before the likes of Red Bull and Coca-Cola moved into the sector with all their marketing and distribution muscle.

“America’s energy shots boom looks poised to cross the Atlantic – starting in the UK, which appears to be spearheading development of the category in Europe. In recent months, the UK has seen the launch of two new energy shot products, and more will almost certainly follow suit.”

Red Bull, with US sales of about $700m after eight years and a 65 percent share of the energy drinks market, launched one-shot energy drinks in June.

Living Essentials, owner of the 5-Hour Energy brand in the US, differentiated itself by self-consciously not marketing toward the 14-25-year-old males that are the core target for Red Bull and all other ‘regular’ energy drinks. It blatantly stated it would not target, “14-year-old skate punks”.

5-Hour Energy notched sales of about $170m for the year ended February, 2009, according to Nielsen stats.

Uber-premiums

Mellentin noted premiums that can top 400 percent over regular energy drink formats that are themselves premium-priced over other regular carbonated beverages.

“The packaging format conceals the extent of the price premium – and the cost per unit appears to be value-for-money for many consumers,” he writes.

“Such products could never and should never be sold in 1-litre packs, because this would then make the extent of the premium very visible and cause consumers to question the value-for-money equation.”

Energy shots are also defined by their low-calorie status – a key factor in attracting diet-conscious older consumers and women of all ages. Other pros of the format include the fact the mini-size makes the product suitable for impulse, check-out retail positioning.