ANALYST BELIEVES DEPRESSED MARKET MAY FORCE FURTHER CLOSURES

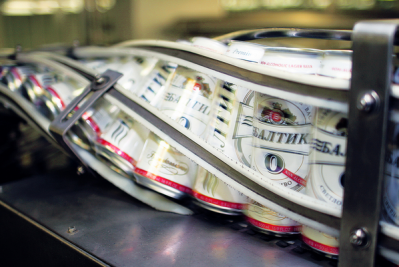

Carlsberg closes two Russian breweries as Baltika attacks 'unbalanced' taxes and regulation

The group says the decision has been made as a result of the declining Russia beer market and the macro economic situation, while subsidiary Baltika Breweries attacks the "unbalanced taxation and regulation of the industry" in the country.

The closures at breweries in Chelyabinsk (Baltika-Chelyabinsk) and Krasnoyarsk (Baltika-Pikra) with affect 560 staff. Carlsberg says sales and distribution chains will remain in the two cities, but beer will be sourced from its other breweries.

The company initially suspended production temporarily at Chelyabinsk in September 2014. Asked if the decision to close breweries was a sign that Carlsberg did not expect the Russian market to improve in the near future, a spokesperson told this website that the closures were necessary to ensure the company's "long-term competitiveness".

They added that the remaining eight Russian breweries are all functioning and there are no plans for any further closures at this time.

Asked what he thought of Baltika's surprisingly strong rhetoric, in attacking Russia's 'unbalanced' tax and regulatory environment, one analyst who covers the company told BeverageDaily.com: "It is a dangerous move, as they’ve had a strategy of flying below the radar for a number of years now, always weighing their words in Russia since they knew they’d be watched as an industry leader there."

"But Carlsberg is in an industry that shrunk for a number of years, and are really struggling to deliver a sound business in Russia – a lot of that’s down to taxation issues, with the government trying to fill out budget deficits with easy money from the multinational beer industry," he added.

Stresses and strains... in the world's fourth-largest beer market

A statement from Baltika Breweries attacked legislative restrictions and tax regulation of the beer industry in Russia as "among the most disproportionate in the world", adding that this has resulted in an "inevitable market decline".

It quotes Rosstat data which says that, in the period 2008-2014, the beer market in the country dropped by more than 30%.

“This negative dynamics can be changed only by predictable regulation of the industry in Russia,” the company said.

It says 10 large breweries belonging to other market players have closed in recent years.

Quizzed on how significant he thought the brewery closures were, given Carlsberg's well-known over-capacity in Russia, the analyst told us that they should provide some relief in terms of delivering better results for fiscal year (FY) 2014.

"But again we’re looking at a very difficult market in Russia this year. Also, the closure of two breweries will of course help but that will not be enough the counter all the negative effects hitting them this year," he said.

"The closures are a culmination of years of bad results in Russia, with the market down year-on-year for maybe five years now," the analyst added.

"If there’s no light at the end of tunnel, that the market won’t be better in 2016 or 2017, they might actually find it necessary to close even more breweries, since their capacity is still large and they still have room for uptake in the market," he said.

Carlsberg's shrinking profit pool: Brewer needs traction in Russia

The Russian beer market is the fourth-largest in the world, and Carlsberg’s subsidiary Baltika Breweries has a 39% market share, according to current data on its website.

While Russia accounts for a significant chunk of Carlsberg’s group profit pool, in August last year the company warned it was considering brewery closures due to fragile consumer confidence affected by the Ukraine crisis.

"Now we're probably talking 20-25% of their profit pool in Russia due to the currency valuation there hitting their earnings pretty hard. It’s bad news, but it’s good for Carlsberg that their business is more balanced – so they can weigh out the Eastern European negatives elsewhere in the world," the analyst said.

"But it’s very tough for Carlsberg to deliver decent results without Eastern Europe and particularly Russia gaining some traction again," he added.

"In the short term that seems very tough for them, so they have to turn over every stone in that business in the search of a more efficient way to drive the organization, because they’re going to be under a lot of pressure in the coming 12 months."

All eyes on February 18 - Carlsberg's full-year results

Carlsberg's sales in Russia have been dented by regulations on selling beer (such as the ban on street stalls and kiosks from January 2013) and government incentives to reduce drinking were acknowledged as other factors for the beer downturn by the company today.

Danish brewer Carlsberg became the controlling shareholder of Baltika Breweries in 2008, increasing its shareholding to 100% in 2012.

The multinational says the closures, including related restructuring, will result in a pre-tax, non-cash write-down of approximately DKK 0.7bn ($0.11bn). This amount is to be included in special items for 2014 and will not have an impact on 2014 operating profit or adjusted net result.

Carlsberg will release its FY2014 results on February 18.

*Article updated 2/2/15. Additional reporting, Ben Bouckley